Blockchain

Contemplating the requirements of 2022 and all that has occurred within the crypto house, layer 1 (“L1s”) can nonetheless be mentioned to have had a really attention-grabbing and eventful 12 months. Many notable occasions have taken place within the L1 house over 2022.

From Ethereum’s transition from proof-of-work to proof-of-stake in September, to the implosion of the Terra ecosystem in Could. New layer 1 had been introduced, with Aptos launching its mainnet and Sui anticipated early to take action subsequent 12 months.

Notable incumbent, BNB Chain and main layer-2 (“L2”) resolution, Polygon, gained market share within the vacuum left by Terra, whereas Solana had a tougher 12 months, being one of many layer 1 extra impacted by the latest FTX saga. The 12 months was rife with materials occasions in arguably an important sub-sector inside crypto.

What has occurred?

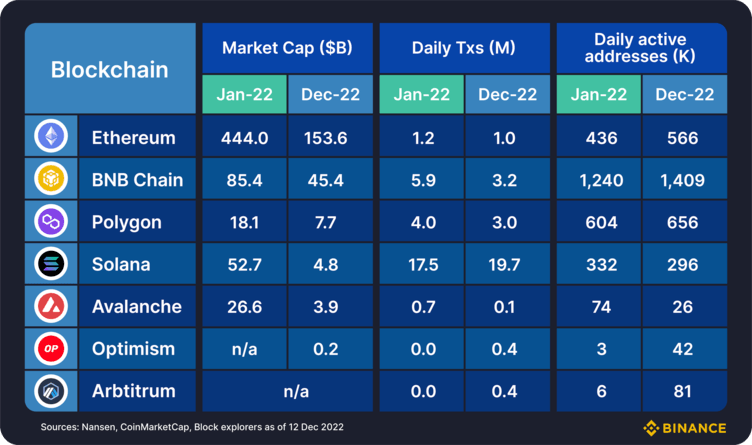

L1 / L2 market cap and day by day on-chain metrics throughout 2022

Key Observations

- Market cap is, in fact, decrease for a large number of causes that we’re not going to dedicate this piece to. Nevertheless, we must always very clearly word that market cap doesn’t essentially correlate to crucial on-chain metrics when it comes to day by day transactions and energetic addresses. As we are able to see, BNB Chain and Solana excel right here, whereas Ethereum, regardless of the better market cap, is evidently decrease when it comes to day by day exercise.

- Ethereum: The Merge! Since this matter has been coated advert nauseum by everybody and their cat, somewhat than repeating, we needed to speak about its influence. Knowledge reveals that since finishing the transition to proof-of-stake in mid-September, $ETH provide progress is massively down (from 3.58%/y to 0.005%/y). In actual fact, together with its burn mechanism, $ETH spent nearly all of November as a deflationary asset and at the moment sits very near that degree.

- BNB Chain: a commendable 12 months for BNB Chain, with market cap down solely ~45% YTD, fairly a bit higher off than main rivals Ethereum (-64% YTD) and Solana (-90% YTD). BNB Chain was one of many main L1s serving to onboard builders displaced by the Terra and FTX scandals. Day by day exercise metrics stay extraordinarily excessive, with the launch of BNB Liquid Staking and zkBNB being notable highlights. Innovation and partnerships within the NFT house are additionally persevering with in full swing, with OpenSea just lately saying assist for BNB Chain NFTs on its platform.

- Solana / Avalanche: 2022 was difficult for the traditional “alt-L1” commerce of 2021. Solana noticed some robust traction of their NFT ecosystem, with progress in collections, volumes and marketplaces. Avalanche noticed optimistic headlines on the again of their Subnets, which provided scalability for decentralized purposes (“dApps”), notably within the gaming house. Nevertheless, each alt-L1s have suffered from poor publicity (for Solana this got here by way of the FTX scandal, whereas for Avalanche this was a product of some not-so-flattering information that obtained leaked just a few months in the past). Solana has additionally continued to undergo from common outages, calling into query the reliability of the community.

- Layer 2s: Whereas L2s are technically one step faraway from the L1, any dialogue on L1s is incomplete with out a minimum of commenting on the rising scaling market. Polygon is the undoubtable chief right here, with its quite a few options throughout the board. It has been a robust 12 months for Polygon, with their enterprise growth persevering with to shine (Starbucks NFTs, Reddit NFTs, Instagram/Meta NFTs to call just some latest headlines that Polygon has been behind). Extra pure-play L2s, Arbitrum and Optimism have additionally carried out strongly over the previous 12 months and continued to extend exercise / take market share from a number of the smaller alt-L1s. The OP token’s launch was a notable second for Optimism earlier this 12 months, whereas Arbitrum continued to deal with their core product choices with their launches of Arbitrum Nitro and Arbitrum Nova.

Expectations for 2023

Now that we’ve got obtained some concept of how the key L1s have moved by means of the 12 months and a few of their notable occasions, what concerning the coming 12 months? What are our tentative expectations?

Layer 1 (notably a number of the smaller alt-L1s) will really feel the stress of L2s

- One of many main narratives of the 12 months was so-called “L222” referring to 2022 being the breakout 12 months for L2s. Did we see this? L2 whole worth locked (“TVL”) figures present that there was a rise of 118% (in ETH phrases) because the begin of the 12 months. So, in a means, sure. It definitely has been the largest 12 months that L2s have had to this point. Nevertheless, in absolute phrases, whole TVL locked in L2s is simply round US$4.5B. Once we evaluate to whole DeFi TVL in Ethereum (round US$25B), and whole crypto market cap sitting close to US$900B, we are able to contextualize how far L2s nonetheless should climb.

- Take into account additionally the truth that, as proven in Determine 1, each Arbitrum and Optimism exceed Avalanche when it comes to day by day on-chain exercise. Add to this the growing deployment of alt-L1s dApps on L2s e.g. Dealer Joe of Avalanche just lately introduced their deployment on Arbitrum, and it will likely be attention-grabbing to observe what occurs with a number of the smaller alt-L1s. There was an concept that has been mentioned amongst many within the crypto house that the key L1s will merely grow to be settlement layers, whereas execution and exercise occurs on the L2s. Whereas we’re seeing a little bit little bit of this already, 2023 may very nicely be the 12 months that we see this occur on a a lot bigger scale.

New L1s may survive if they really carry one thing new to the desk

- Take into account probably the most well-known new entrants within the L1 house, Aptos (who went to mainnet in This fall of this 12 months) and Sui (who’re anticipated to launch in early 2023). Each of those L1s carry varied new improvements with them, together with the Transfer programming language. Given the background of this language and all that it guarantees, alongside the potential will increase in transaction pace with each L1s, there’s a potential for some true innovation. It must be price maintaining an in depth eye on whether or not both or each of those L1s are capable of make the most of their new applied sciences to carry a few step change within the crypto market.