- Santiment analyst Clementllk opined that CAKE’s value was approaching a superb shopping for alternative.

- An evaluation of the altcoin on a day by day chart revealed rising accumulation.

In a 7 January report by Santiment, pseudonymous analyst Clementllk, in an evaluation of PancakeSwap’s CAKE token, revealed that the altcoin reached a technical value sample. This sample traditionally indicated a excessive success charge for getting alternatives.

What number of CAKEs are you able to get for $1?

Clementllk assessed CAKE’s motion on a value chart and located that the native token of the main decentralized finance protocol (DeFi) on BNB Chain was forming a shark sample. Based on Clementllk, if CAKE hits the worth mark of $3.45, the sample might be efficiently triggered.

It will thus create a superb shopping for alternative for traders.

Supply: Santiment

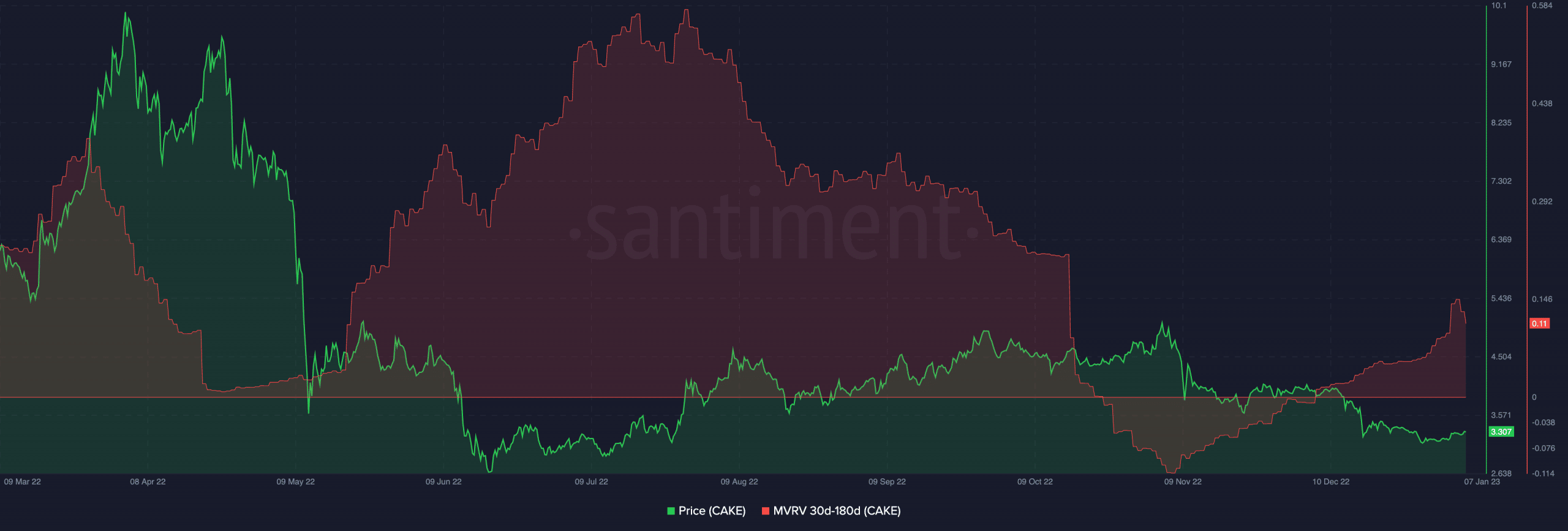

Additional, the analyst assessed CAKE’s Market Worth to Realized Worth (MVRV) ratio utilizing two formulation, together with the {(MVRV 90d / 30d)-1} and (MVRV 30d-MVRV180d). Whereas the primary formulation returned a destructive MVRV ratio, the latter returned a optimistic worth.

Clementllk opined that this could possibly be a “potential shopping for alternative” for the traders seeking to ape in on the altcoin. As of this writing, CAKE’s (MVRV30d-MVRV180d) remained optimistic at 0.11, knowledge from Santiment revealed.

Supply: Santiment

What ought to CAKE holders count on?

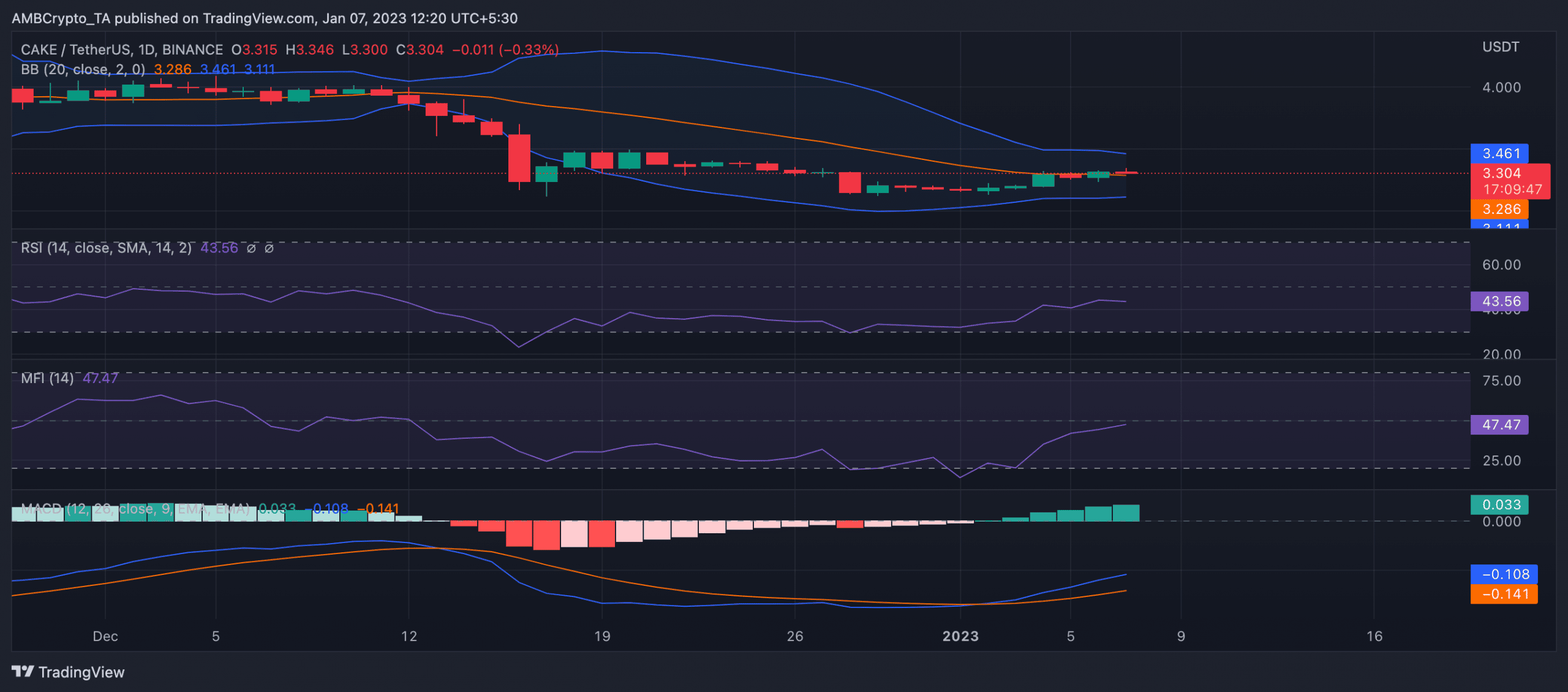

CAKE commenced the 2023 buying and selling 12 months with a brand new bull cycle, a value motion evaluation on a day by day chart revealed. A have a look at the place of the Transferring Common Convergence Divergence (MACD) line relative to the sign line confirmed this.

On 2 January, the MACD line intersected the sign line in an uptrend. That is usually thought of a bullish signal, indicating {that a} new uptrend is starting. This was validated by CAKE’s value rising by 4% till press time.

For the reason that new bull cycle started, CAKE has change into more and more much less risky. A have a look at the alt’s Bollinger Bands (BB) revealed this.

Learn PancakeSwap’s [CAKE] Value Prediction 2023-24

The gap between an asset’s BB bands (higher and decrease bands) can be utilized to gauge market volatility. When the space between the bands is broad, it might point out that the market is very risky. Conversely, when the space between the bands is slim, it might counsel that the market is much less risky.

On a day by day chart, for CAKE, the space between the 2 bands has narrowed progressively because the 12 months started.

Though nonetheless positioned under their respective impartial zones at press time, CAKE’s Relative Energy Index (RSI) and its Cash Movement Index (MFI) have been on an uptrend because the starting of the brand new bull cycle. This indicated that purchasing exercise has since grown.

Nonetheless, with CAKE’s value in between the higher and decrease bands of its BB, this indicated that the market was in a state of consolidation or indecision.

When the worth is in the course of the bands, it might imply that the market is ready for a catalyst or new data to come back out earlier than making a transfer.

It might additionally point out that there’s an equal variety of consumers and sellers out there, and neither facet is ready to achieve the higher hand, ensuing within the asset’s value remaining comparatively steady.

Supply: TradingView