NFT

Blur, a NFT market, has seen its buying and selling volumes and complete sell-side liquidity skyrocket since conducting an airdrop on Feb. 14, 2023. The explanation for the spike might be the beginning of season 2 airdrops, the place 10% of BLUR token’s complete provide will probably be distributed to sure customers primarily based on their exercise. The workforce allotted 12% towards an early person airdrop within the first season that ran from {the marketplace}’s gated launch in March 2022 to February 2023.

Blur buying and selling volumes (in ETH). Supply: Dune

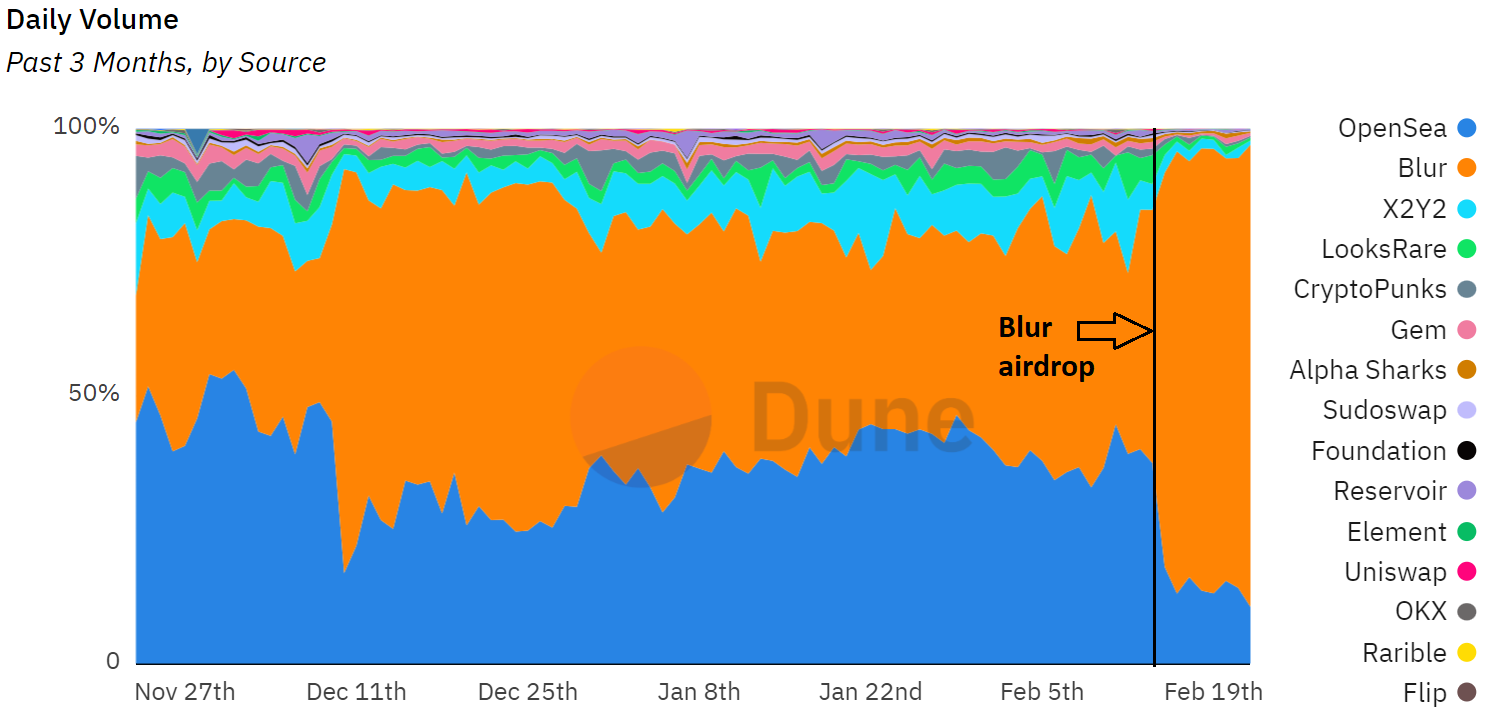

Blur has made a big dent in OpenSea’s place because the main market. Analytics from knowledge scientist Hildobby exhibits that Blur is consuming into the market share of OpenSea and different aggregators like X2Y2. Blur’s incentive program and superior NFT buying and selling options are inflicting customers to shift from OpenSea to Blur.

The share of NFT marketplaces by buying and selling quantity. Supply: Dune

OpenSea feels the warmth

Following Blur’s instance, OpenSea discontinued its market price of two.5% per sale. The truth that OpenSea LLC was prepared to let go a big chunk of its earnings—near round $336.8 million for one 12 months—means that Blur’s progress threatens it.

The 2 NFT giants additionally just lately locked horns on the vital problem just lately of creator royalties. By limiting the power to earn full creator royalties on each platforms, creators have to decide on between Blur and OpenSea to listing collections.

Pacman, the founding father of Blur, advised Cointelegraph on Feb. 23 that OpenSea began the spat first. They have been pressured to retaliate with restrictive options like restricted royalties on Blur if a group can be listed on OpenSea as nicely. Nevertheless, ideally, he would need each creators to have the ability to earn their royalties on each platforms with out having to decide on. It seems that Pacman needs OpenSea to succumb to the competitors and as a substitute of combating Blur, it ought to accommodate the aggregator progressively.

Blur has additionally incentivized creators and customers via the Blur token. It was additionally a method to compensate for the earnings creators would have made in missed royalties on the platform when it didn’t assist them earlier. NFT merchants, however, obtain token rewards for including liquidity to the platform by itemizing NFTs. To date, the plan has labored efficiently, as Blur’s liquidity has skyrocketed after the token launch.

Blur has additionally earned the repute of a “market for professional merchants” because of its modern options for knowledgeable NFT merchants like sweep optimization, near-instant replace of mixture value, filtering primarily based on rarity rating and gasoline optimization.

Blur’s success is contingent on governance and upgrades

There are two paths that the BLUR token can take from right here, both keep a non-yielding token with governance- options like Uniswap (UNI) or shift to allocate worth accrual strategies to token holders.

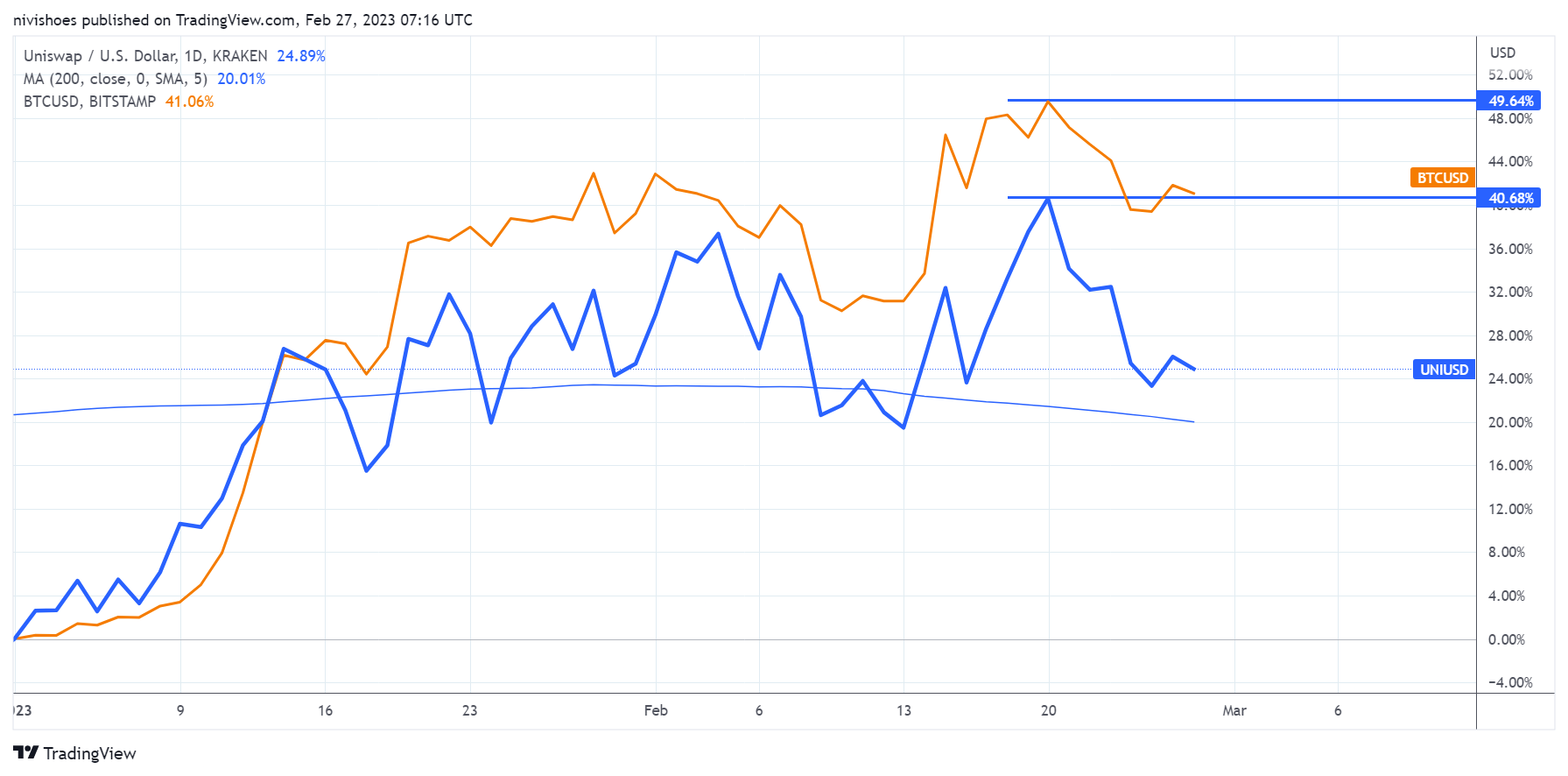

In its present state, BLUR token is just like UNI, which places it at an obstacle as a result of the market has moved on to ideas of actual yields (for instance, GMX and SUSHI) or different modern worth accrual strategies (like Curve’s voting escrow mannequin) that encourage shopping for.

UNI token’s underperformance relative to Bitcoin within the current January to February 2023 crypto rally is a testomony to the truth that the market is discounting non-yielding tokens. UNI rose by 40% in 2023 to the highest towards Bitcoin’s 50% rise.

BTC/USD and UNI/USD value motion. Supply: TradingView

Since its inception, Blur has charged zero charges on its platform. Pacman additionally mentioned the potential worth accrual to BLUR holders by flipping the “price change” and directing rewards towards holders.

Staking can be a broadly carried out characteristic that protocols use to discourage promoting by offering inflationary rewards. Whereas this technique helps retain buyers to some extent, with out actual yields would seemingly do extra hurt in the long term via inflation.

Blur’s token efficiency will probably be extremely contingent on the selections voted on by the BlueDAO. Till then, Blur’s progress within the NFT market will seemingly affect BLUR’s value as a result of buyers could not need to quit the chance of publicity to the area of interest market chief. Nevertheless, the general trajectory might stay on the draw back, just like what DYDX skilled in 2022.

DYDX value chart. Supply: CoinGecko

The decentralized derivatives change is near implementing important adjustments to its platform, together with improved worth accrual to DYDX holders. Nevertheless, whereas the dYdX workforce is working towards its V4 launch, platforms like GMX and Features Community are benefiting from the Ethereum layer-2 liquidity and LP-focused rewards and incentives.

Since Feb. 14. airdrop, the BLUR’s promoting strain has subsided significantly. Dune knowledge scientist PandaJackson42’s Blur analytics web page exhibits that 76.7% of the BLUR airdrop receivers bought their tokens.

This means that promoting strain from airdrop receivers ought to finish quickly. Nevertheless, the token’s vesting schedule dangers dilution from investor and workforce token unlocks beginning in June 2023 and the distribution of Season 2 rewards someday later this 12 months.

BLUR token launch schedule. Supply: Blur Basis

Blur is well-positioned to seize an enormous market upside, particularly contemplating OpenSea’s final increase in January 2022 valued the corporate at $13.3 billion. The totally diluted market capitalization of Blur is at the moment 5 occasions much less at $2.7 billion. The challenge can generate important shopping for demand for its token by bettering the worth accrual.

The views, ideas and opinions expressed listed below are the authors’ alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.