- Numerous addresses have been accumulating BTC, thus, indicating broad-based curiosity

- Miner outflow witnessed a rise, thus indicating rising promote stress

Primarily based on information from Santiment, addresses of varied sizes have been accumulating Bitcoin [BTC] over the previous few weeks. This accumulation might have performed a task within the current BTC rally.

The buildup additionally indicated that not solely whales however sharks and retail traders have been additionally becoming a member of the BTC purchase social gathering. This wide selection of addresses accumulating Bitcoin signified a broad-based curiosity within the kingcoin, and a robust indication of a bull market.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

📈 A definitive rationalization on why #crypto costs have bounced:

🦈10-100 $BTC wallets added 105,600 #Bitcoin in previous 10 weeks

🐋100-1,000 $BTC wallets added 67,000 #Bitcoin in previous 8 weeks

🐳1,000-10,000 $BTC wallets added 37,100 #Bitcoin in previous 10 dayshttps://t.co/sGLqJLxGVD pic.twitter.com/kpQimOXmeO— Santiment (@santimentfeed) January 14, 2023

Hash-ing it out

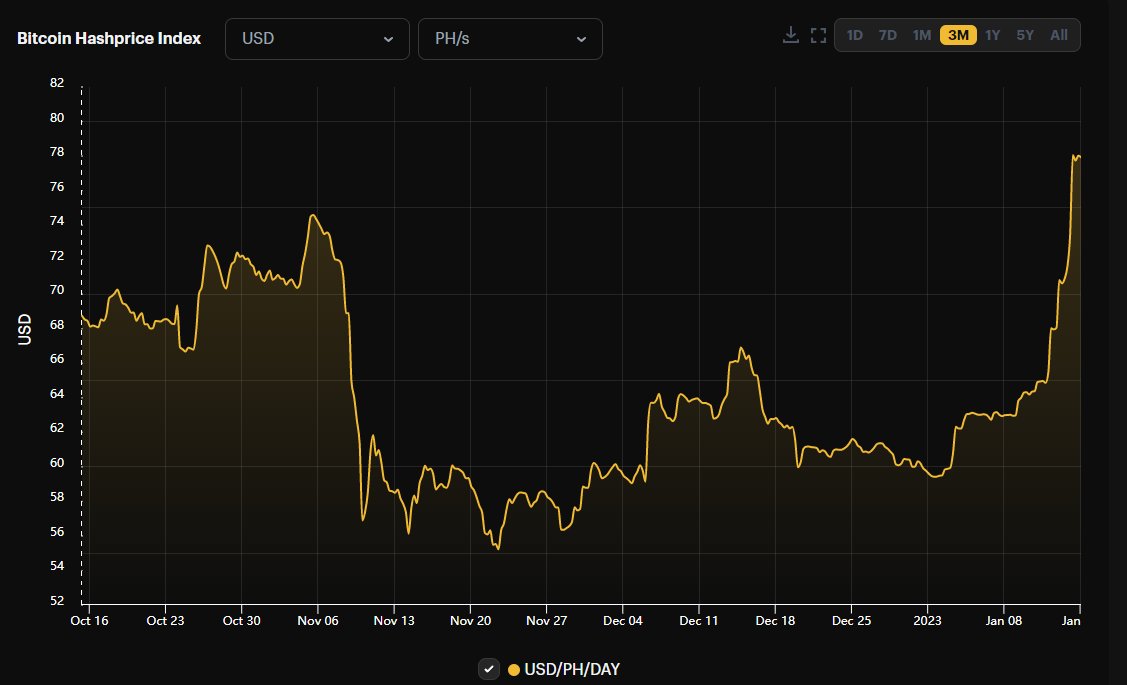

Moreover, hash costs additionally witnessed a rise that would have an effect on Bitcoin miners. Hash price is a measure of the ability of the miner’s computational effort, and excessive hash charges might be a sign of miners’ confidence within the long-term worth of Bitcoin.

As hash costs improve, extra miners are keen to hitch the community, and this may result in a rise within the safety of the community. The next hash price additionally implies that extra miners are keen to compete for block rewards, which might result in extra mining issue, making it more durable to mine Bitcoin.

Supply: Hashrateindex

Nevertheless, miner outflow was additionally growing, in accordance with Glassnode. The miner’s outflow quantity (7d MA) additionally reached a one-month excessive of 88.111 BTC.

Miner outflow refers back to the switch of mined Bitcoin from the miner’s pockets to a different pockets. This indicated that miners have been promoting their BTC as an alternative of holding onto it which could possibly be a bearish signal.

HODLers dilemma

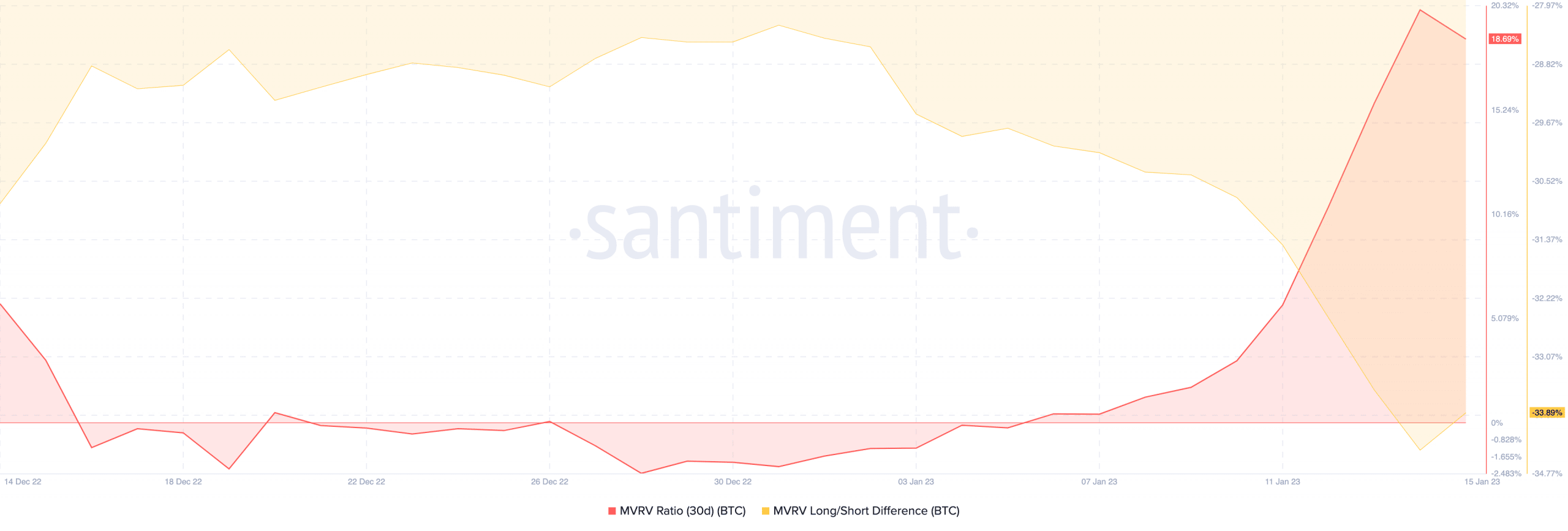

Nevertheless, there have been different bearish indicators current out there as properly. In line with Glassnode, the variety of addresses in losses decreased. Coupled with that the MVRV ratio for Bitcoin elevated. The rising MVRV ratio indicated that if nearly all of the addresses promote their positions, they might be doing so at a revenue.

What number of are 1,10,100 BTCs price at this time

Many short-term traders have been noticed to be worthwhile over the past week as was evidenced by the declining lengthy/quick distinction. This might probably result in larger promoting stress for Bitcoin.

Supply: Santiment

One other bearish indicator was the rising funding price for Bitcoin. In line with maartunn on CryptoQuant, funding charges for Bitcoin hit a 14-month excessive. Funding charges are the quantity paid by merchants in a protracted place to merchants who’re in a brief place.

In earlier events the place funding charges have been as excessive as they have been on 15 January, Bitcoin had a pullback. This could possibly be a trigger for concern for merchants because it means that there could also be a excessive stage of leverage out there. This coud result in a extra violent value transfer if sentiment adjustments.

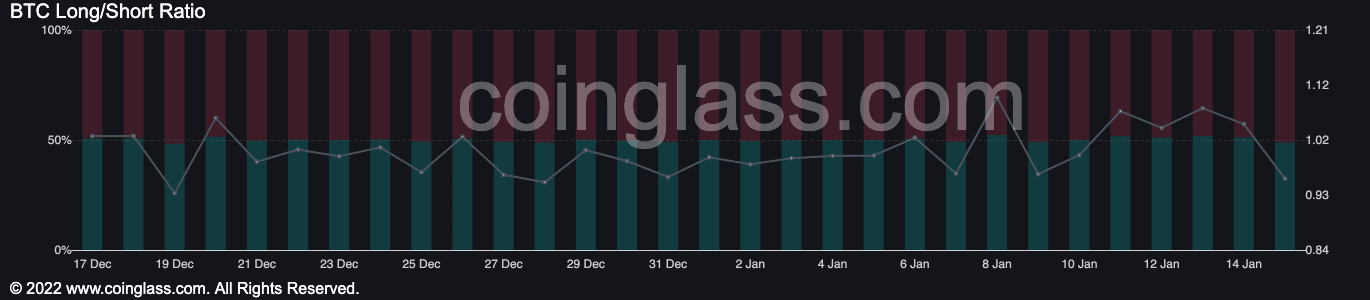

Lastly, merchants sentiment was slowly getting unfavourable as properly. In line with coinglass, the proportion of quick positions being taken on Bitcoin was 51.02% at press time.

Supply: coinglass

It’s but to be decided whether or not the merchants shorting BTC will become appropriate. At press time, the worth of Bitcoin was $20,730.97 and it fell by 1.23% within the final 24 hours.