- Bitcoin can not escape its correlation from conventional markets

- Brief-term sentiment was caught in between declining optimism and growing gloom

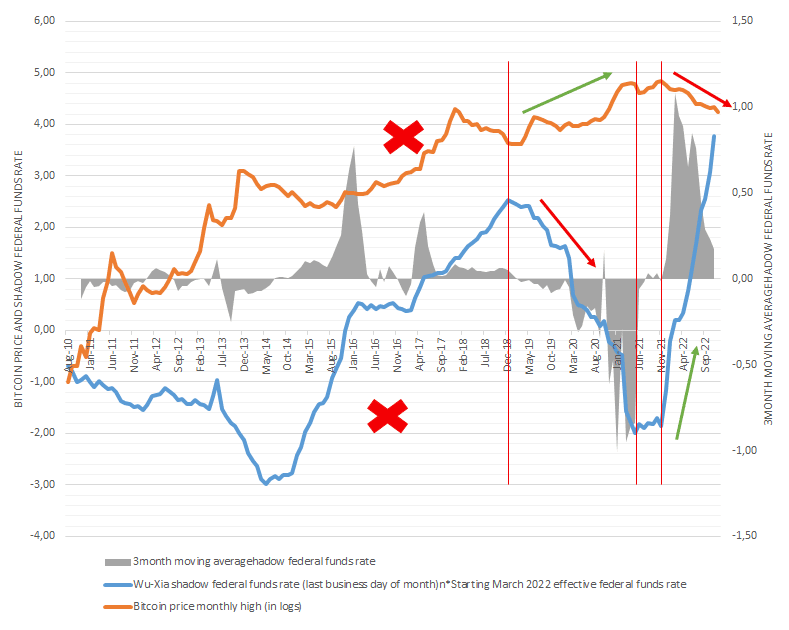

Bitcoin [BTC] has had an affinity with financial coverage because the introduction of the brand new market cycle, in response to Quantum Economics knowledgeable and on-chain analyst Jan Wüstenfeld. In his 4 December CryptoQuant publication, Wüstenfeld opined that BTC’s damaging sentiment, accompanied by declining financial prospects, was no random incidence.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

In response to him, BTC and the standard market weren’t aligned earlier than the present bear market. Nonetheless, the very fact extra establishments had been now concerned with the coin meant that it was inevitable to flee the correlation. On the identical time, the federal funds price hike additionally performed its half.

Supply: CryptoQuant

It’s no extra in retail management

The analyst additionally opined that the market was subsequently liberated from sole retail traders’ management. Whereas justifying his viewpoint, Wüstenfeld mentioned,

“Now we have seen extra widespread adoption of Bitcoin during the last years. Futures markets being launched, institutional curiosity rising and many others. So naturally, Bitcoin has grow to be extra related to the standard monetary markets and isn’t solely pushed by retail investing anymore.”

After all, Bitcoin had correlated with the inventory market in some unspecified time in the future. In actual fact, the king coin had, in some circumstances, reacted to the US inflation experiences as nicely. Nonetheless, the analyst’s projection was rooted in a long-term connection.

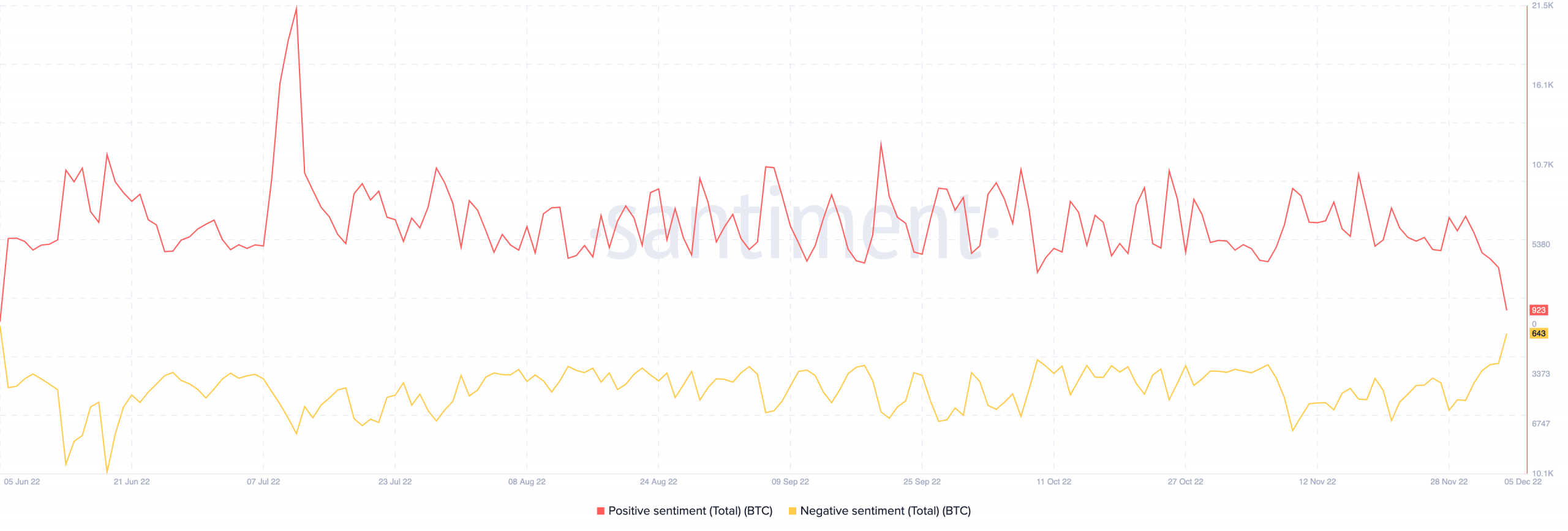

Regardless of the religion that Bitcoin would stay related for lengthy, on-chain knowledge confirmed that the present bias was damaging. In response to Santiment, the optimistic sentiment outweighed the damaging, at 923 and 643, respectively.

Nonetheless, the chart confirmed that damaging sentiment was on the rise, whereas optimistic sentiment declined. Therefore, there was an opportunity that short-term bullish expectations differed from the day’s order.

Supply: Santiment

As well as, traders’ latest motion was much less more likely to set off a major response from BTC. This was as a result of situation of the trade knowledge within the now-ended week.

In response to Glassnode, there was a detailed name between trade influx and outflow. The on-chain monitoring platform reported the outflow to be $3.3 billion, whereas the influx was $3.2 billion.

🚨 Weekly On-Chain Change Movement 🚨#Bitcoin $BTC

➡️ $3.2B in

⬅️ $3.3B out

📉 Internet circulate: -$162.3M#Ethereum $ETH

➡️ $2.4B in

⬅️ $2.5B out

📉 Internet circulate: -$76.7M#Tether (ERC20) $USDT

➡️ $3.9B in

⬅️ $3.7B out

📈 Internet circulate: +$201.9Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) December 5, 2022

With a comparatively minimal distinction, it meant that Bitcoin didn’t expertise huge promoting stress. Equally, shopping for momentum didn’t considerably outpace trade-offs. So, it’s no shock that the king coin solely recorded a 1.77% enhance within the final 24 hours.

Bitcoin is right here for a very long time

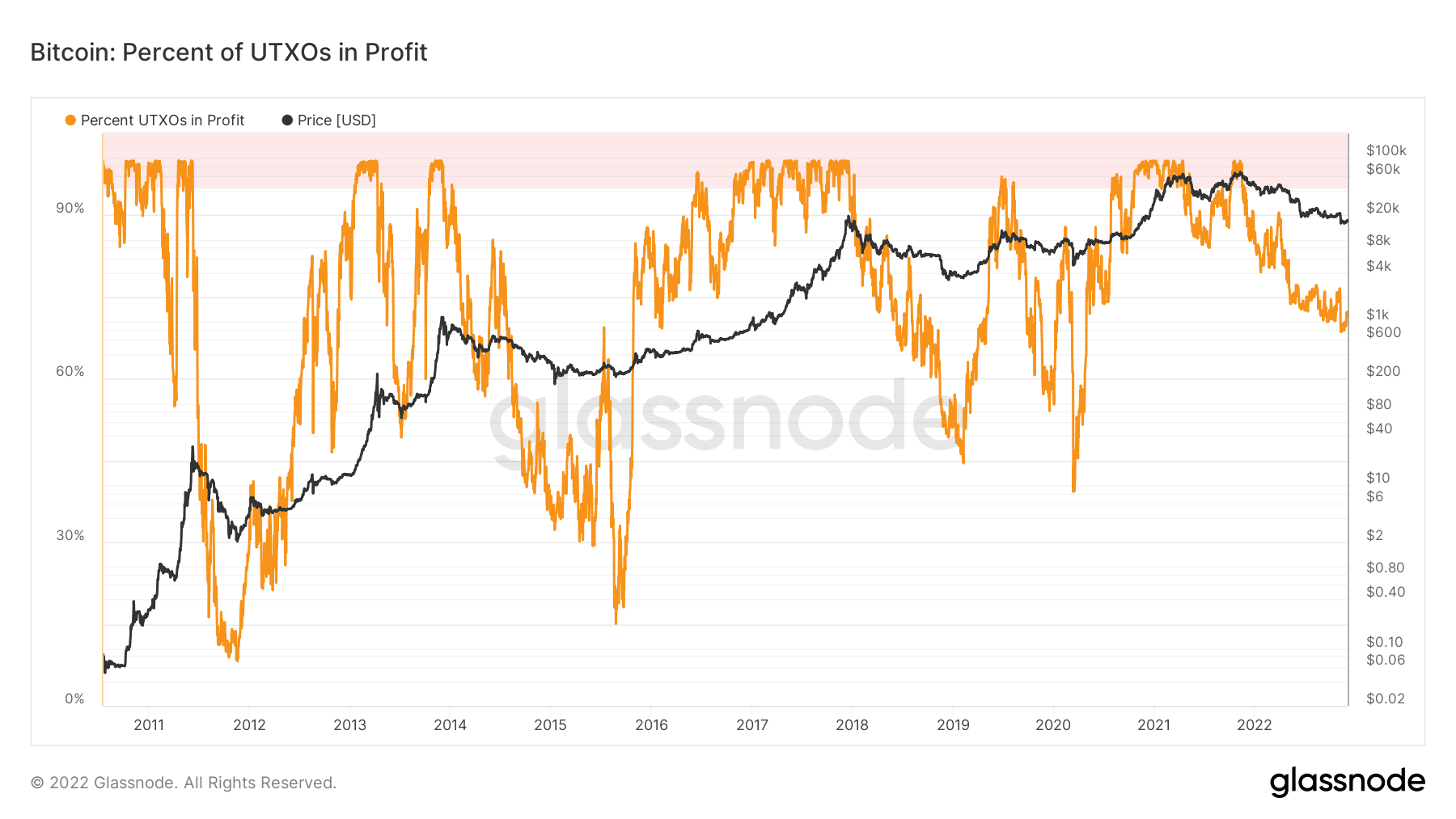

On additional outlook, Glassnode’s knowledge showed {that a} good proportion of long-term holders had been nonetheless in revenue. This was as a result of revelations made by the Unspent Transaction Outputs (UTXO). At press time, the UTXOs proportion in revenue was 69.94%. However, it didn’t nullify that more moderen traders had their property plunge in worth.

Supply: Glassnode