A number one crypto analytics agency says that key indicators are signaling Bitcoin (BTC) is on the verge of a bearish flip after an prolonged rally.

In a brand new weblog put up, Santiment says 5 indicators are flashing bearish for Bitcoin though the king crypto is making strikes nearer to the $30,000 worth degree.

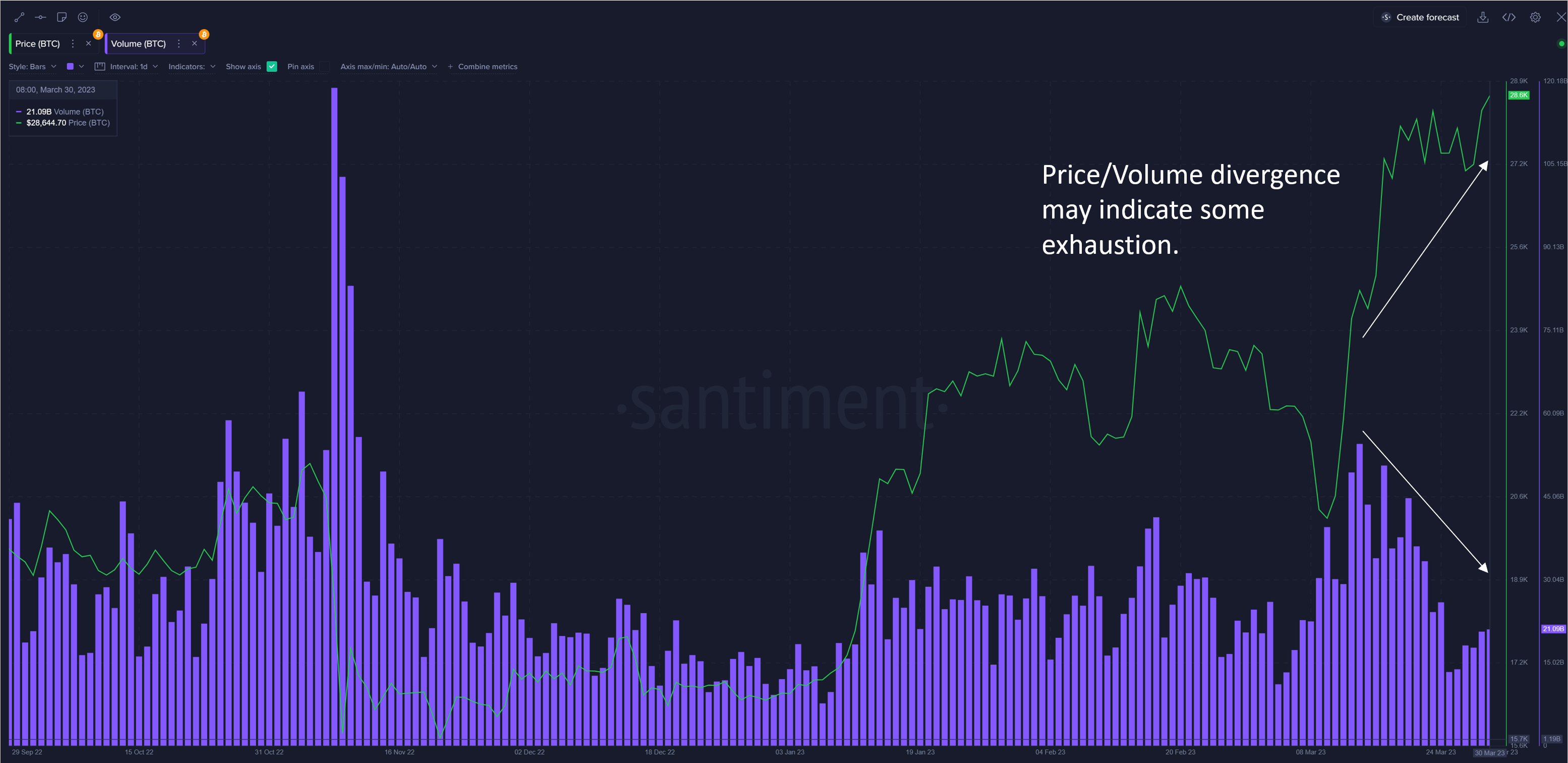

In keeping with Santiment, the buying and selling quantity is cooling off.

“The latest rally noticed fairly first rate buying and selling quantity coming in at the beginning, which is a wholesome signal. Nonetheless, issues began to decelerate somewhat as we inch greater. Now we’re observing a divergence in Value and Quantity, which normally isn’t a superb factor as it’s signaling that there’s exhaustion within the worth motion.”

Subsequent, Sentiment says that the Social Quantity and Social Dominance indicator is at a excessive degree, which traditionally signifies the highest of a worth rally has arrived.

“BTC’s Social Quantity and Social Dominance are at its highest degree in a yr, indicating that the group is getting considerably excited. This normally precedes a neighborhood prime.”

In keeping with Santiment, the third bearish indicator is that long-term holders of Bitcoin are beginning to grow to be lively once more.

“Since mid-March, we noticed two such spikes, between 2,800 and three,000 BTC which can be fairly long-term (5 years) being activated. May or not it’s as a result of crypto crackdown or CTFC [Commodity Futures Trading Commission] vs. Binance case? Whichever the case, looks as if some whale might be feeling somewhat jittery about every part that’s occurring.”

The second to final indicator signaling bearishness is the exercise of Wrapped Bitcoin (WBTC) borrowing on lending and borrowing decentralized finance (DeFi) protocol Aave (AAVE), in line with the analytics agency.

“Presently, we’re seeing cautious borrowing of WBTC at this worth vary, nothing too insane but however seems to be like of us have began to brief.”

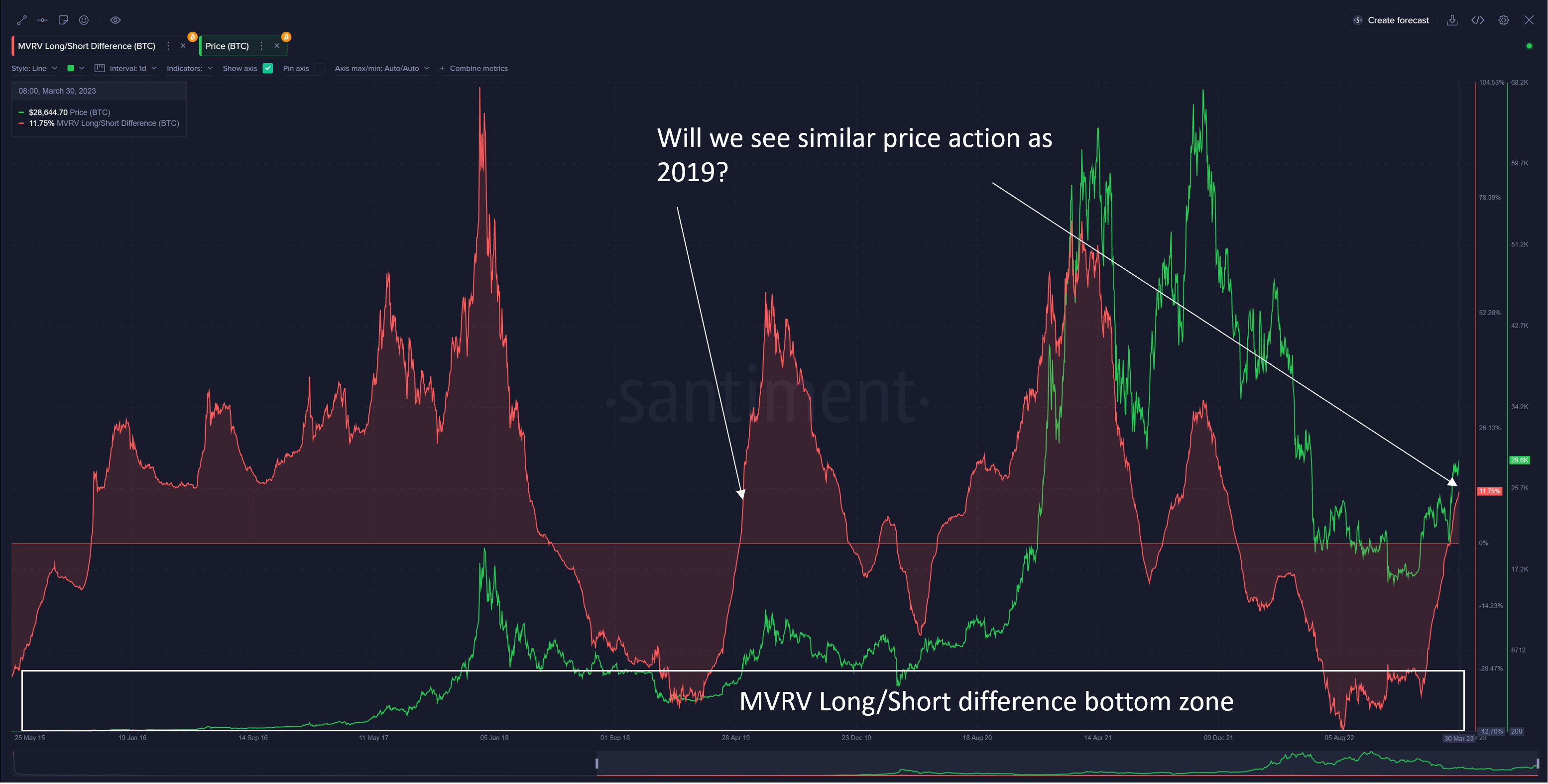

Lastly, Santiment says Bitcoin’s market-value-to-realized-value (MVRV) ratio, which seeks to seize market bottoms and tops primarily based on the common profitability of all Bitcoin holders, is indicating that the Bitcoin rally could quickly come to an finish.

In keeping with Santiment, the MVRV ratio could also be forming the same sample seen in 2019.

“If historical past is to repeat, then, we’d simply see a pointy spike marking a neighborhood prime and a dreadful bleed out like 2019. Granted, macro situations as we speak are very very completely different from that of 2019. It nonetheless stays to be seen how BTC goes to navigate by the chaos.”

Bitcoin is buying and selling for $28,035 at time of writing.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney