- BTC was in a slight upward momentum.

- The king coin may escape beneath $16,442.38.

- A escape above the 23.6% Fib degree of $16,766.50 will invalidate the bias.

Bitcoin (BTC) has been caught within the $16.92K – $16.45K vary for over 10 days. The sideways construction of BTC has stalled your entire crypto market, with restricted volatility and quantity – a double nightmare for merchants.

At press time, BTC was buying and selling at $16,587. Nevertheless, the value may fall even decrease primarily based on technical indicators and on-chain metrics.

Learn BTC value prediction 2023-24

The assist at $16442.38: will it maintain?

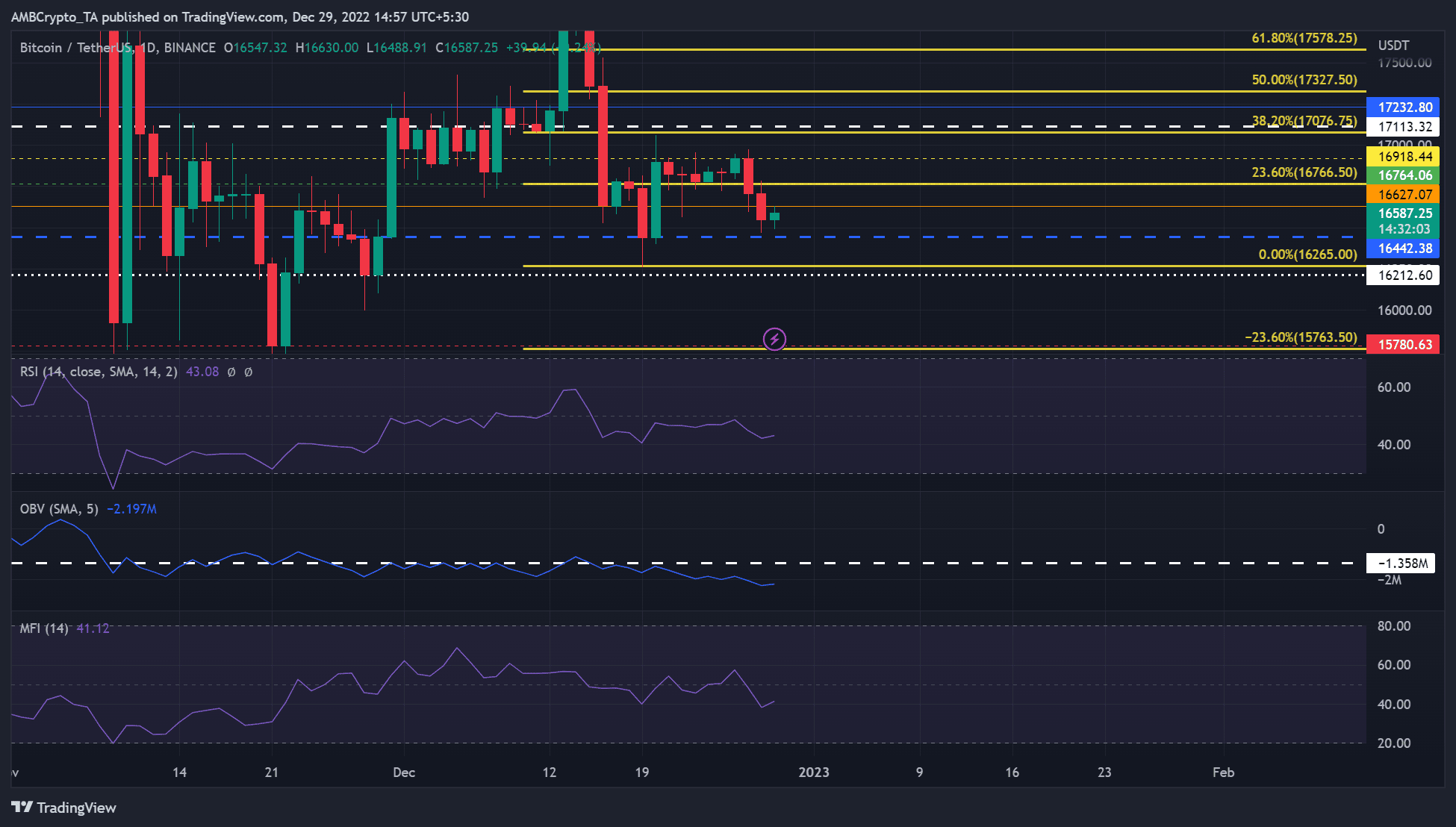

Supply: BTC/USDT on TradingView

BTC rallied after the FOMC assembly and reached a excessive of $18.4K, up about 9%. After that, the value correction cleared all of the features and dropped decrease.

Because the $18.4K excessive, there have not too long ago been 4 main value pullbacks. The primary one settled at $16,627.07 and confronted a value rejection on the 23.6% Fib degree, which initiated the second part of the correction.

The second correction settled at $16,442.38, however the try and get well was rejected at $16,918.44. This degree has since grow to be a bearish order block and influenced the third part of correction, which settled on the 23.6% Fib degree.

At press time, the fourth part of value correction had damaged beneath the 23.6% Fib degree and will additionally break beneath $16,442.38, a earlier assist degree.

The On-Steadiness Quantity (OBV) was destructive, indicating that the asset was bought greater than it was purchased, suggesting excessive promoting stress. As well as, the Relative Power Index (RSI) has moved away from its imply and declined, indicating that purchasing stress eased.

Subsequently, BTC may break beneath $16,442.38 and retest $16765, offering short-sale targets.

Nevertheless, a break above the 23.6% Fib degree of $16,766.50 would invalidate the above bias. This may enable the bulls to focus on the bearish order block at $16,918.44. Nevertheless, the bulls want to beat the impediment at $16627.07 to advance.

Lengthy-term BTC holders suffered extra losses as whale transactions dropped

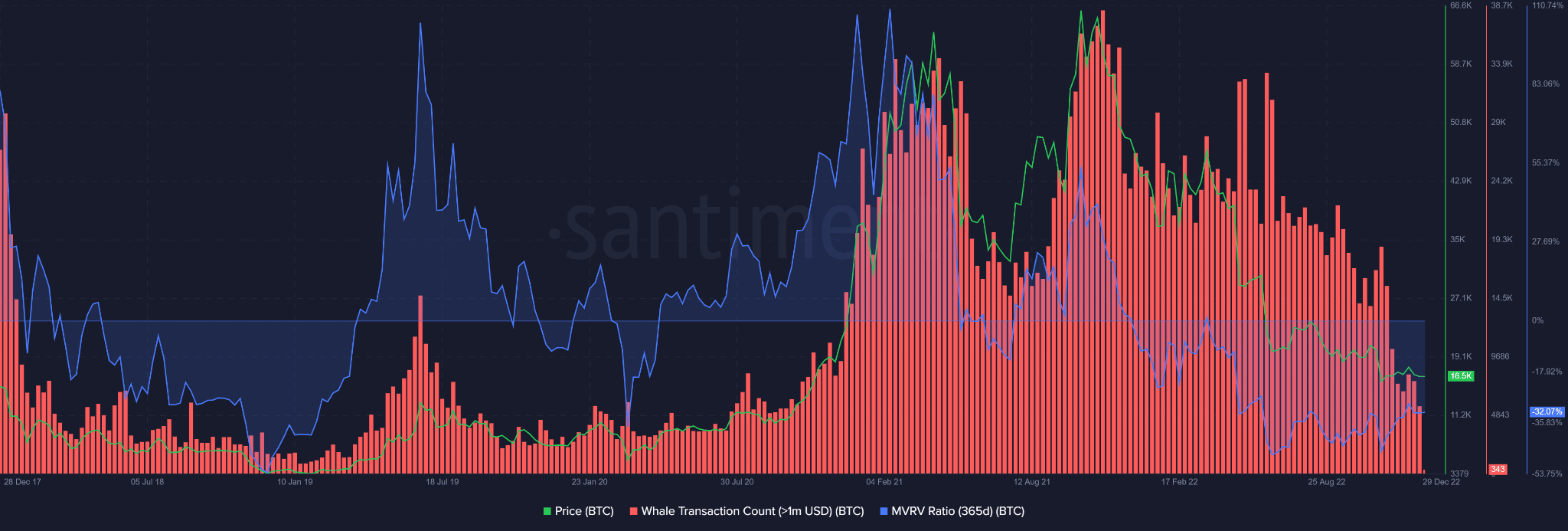

Supply: Santiment

In keeping with Santiment knowledge, the variety of BTC whale transactions was at its lowest degree, virtually as little as in December 2020. Such a metric makes it troublesome for BTC costs to rise, as whale actions immediately have an effect on value developments. Subsequently, BTC holders may begin 2023 on a much less glad notice.

Moreover, long-term holders of BTC have suffered losses all year long, as evidenced by the 365-day MVRV, which was deep in destructive territory all year long. On the time of going to press, long-term holders had been experiencing losses of over 30%.

Are your BTC holdings flashing inexperienced? Test the Revenue Calculator

An extra decline in whale transactions may imply extra losses for the HODLers. Nevertheless, a rise within the variety of whale transactions may reverse costs.

It’s value noting that the best variety of whale transactions in December occurred round 13 December, the day of the FOMC announcement. If the pattern repeats, we may see the following leap in whale transactions throughout the subsequent FOMC assembly in late January 2023 (January 31/February 1).