Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation

- Bitcoin sees hefty outflows from exchanges to counsel an accumulation part

- A revisit to the month-long vary lows may current merchants with a possibility

Tether Dominance has slowly elevated all through 2022. This meant that over the yr, the stablecoin occupied increasingly of all the crypto sphere’s market capitalization. This metric’s good points since June highlighted how traders fled from holding crypto to staying in fiat.

Bitcoin itself has been in a downtrend from the $67k mark final yr. This downtrend wasn’t about to finish simply but.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Hypothesis that Bitcoin neared its backside within the markets was seen throughout social media. Others felt the sins of FTX may see all the trade bleed for years. December noticed Bitcoin precariously perched atop $17k, nevertheless it may very well be time for one more transfer downward.

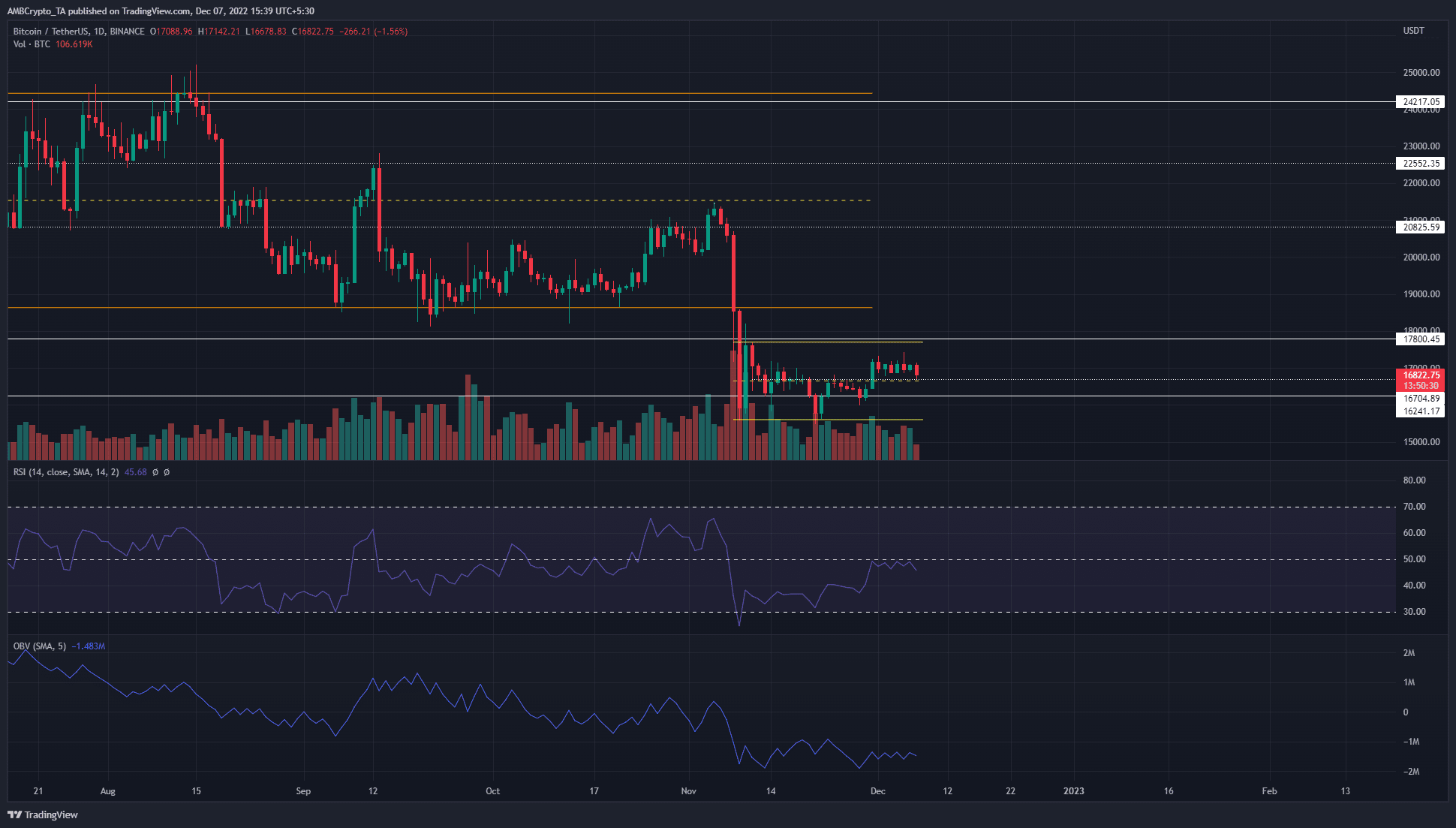

Bitcoin reveals bearish momentum on the each day chart with assist at $15.6k

Supply: BTC/USDT on TradingView

Over the previous month, BTC traded inside a spread (yellow) from $15.6k to $17.7k. The mid-point lay at $16.6k and has served as an essential degree previously month. At press time, the Relative Energy Index (RSI) was under impartial 50 whereas the On-Steadiness Quantity (OBV) didn’t possess any pattern just lately. Since August, the OBV has been in a downtrend and confirmed vital promoting quantity.

From a technical standpoint, BTC has a bullish market construction. It has risen above the earlier decrease excessive at $16.6k, and retested the identical as assist. But, that doesn’t point out consumers will be .

The mid-range worth was a spot the place decrease timeframe merchants can look to bid. For higher probabilities of success, risk-averse merchants can look forward to a transfer to the vary lows earlier than shopping for. They will additionally search for a sweep into $15.2k-$15.4k space and a reclaim of $15.6k, to commerce a swing failure sample.

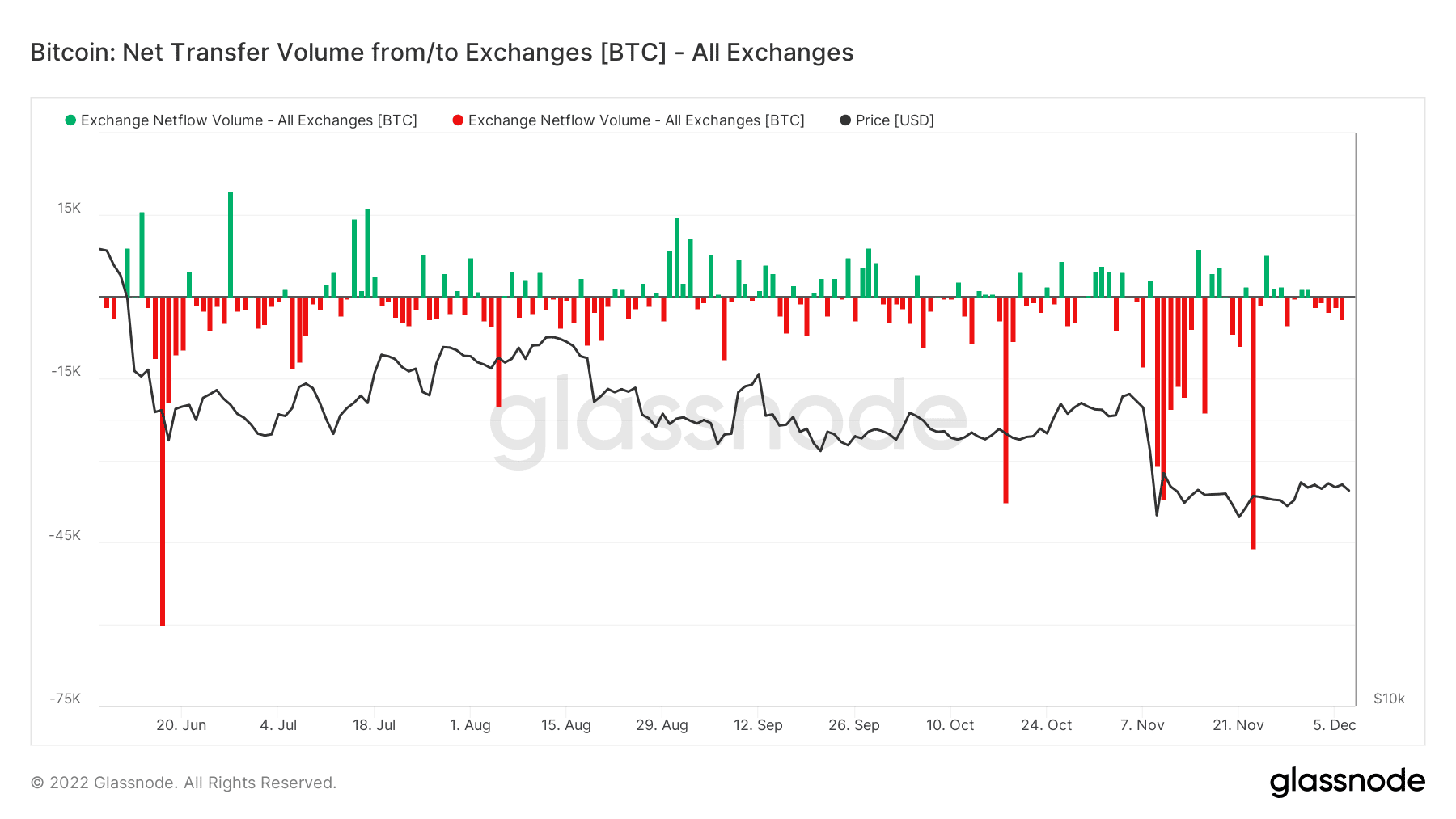

The current bloodshed noticed traders load up on Bitcoin, may a rally begin quickly?

Supply: Glassnode

Glassnode knowledge confirmed that Bitcoin leaving exchanges has been a dominant pattern since November. This instructed that traders moved their BTC out of exchanges and sure into chilly storage. It may be a response to the FTX crash, nevertheless it is also a sign that consumers noticed these costs as profitable.

This knowledge by itself doesn’t assist the thought of a rally. One other drop beneath $15.6k remained a risk. But, regardless of all of the worry out there Bitcoin has been capable of maintain on to the $16k space. Derivatives merchants anticipating additional losses on Bitcoin have gotten their palms scalded.

Merchants can follow the aforementioned vary, whereas traders should train endurance. Bitcoin may be near discovering a backside when it comes to worth, nevertheless it may very well be very removed from discovering a backside when it comes to time.