- Bitcoin miners added over 3,000 BTC to their reserves

- An analyst predicted a drop in worth as a result of RSI and Open Curiosity stance

For many of 2022, Bitcoin [BTC] miners’ actions revolved round promoting as their operations grew to become much less worthwhile. Nonetheless, because the king coin celebrated its 14th 12 months, some miners modified the previous years’ norm.

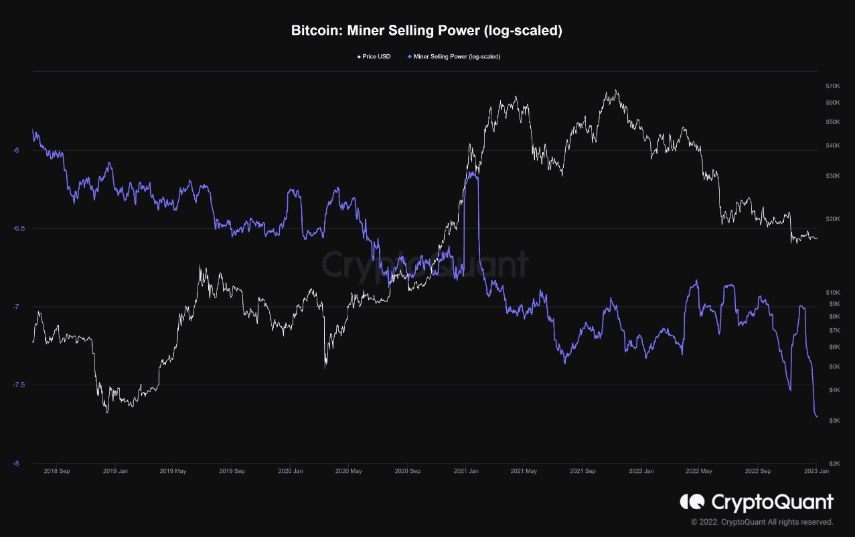

In keeping with IT Tech, a CryptoQuant analyst, miners added 3,499 BTC to the reserves. The rise implied signal to start the 12 months because it lowered promoting strain. CryptoQuant’s information confirmed the impact as miners’ selling power considerably dropped.

Supply: CryptoQuant

A 0.13x drop in worth if BTC falls to Binance Coin’s market cap?

It’s an in-house play for Bitcoin

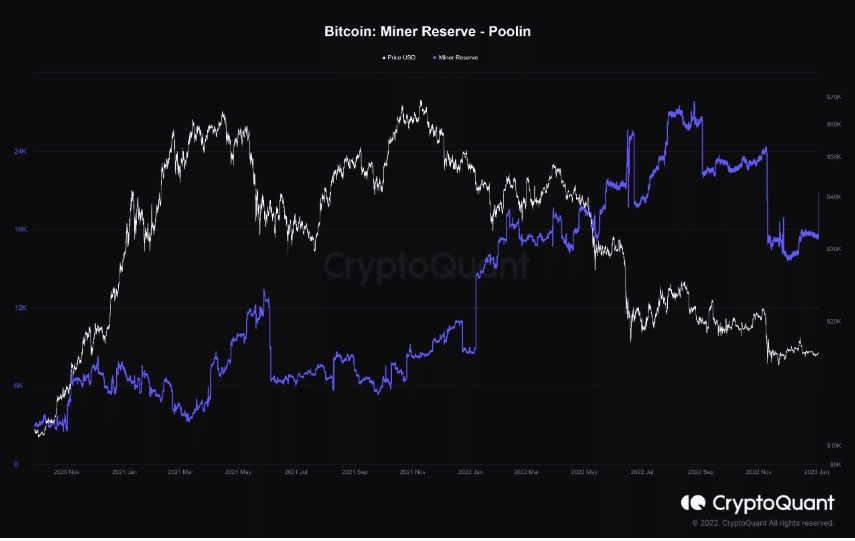

Moreover, IT Tech pointed out that the transactions following the addition had been inside performs between miners. Noting that the switch was to ‘Poolin’ miners, the analyst acknowledged,

“+3526 $BTC was added precisely on the identical time when reserves elevated. So it’s a excessive chance that there was motion between miner’s wallets.”

The validity of his opinion was established by the standing of the Poolin miner pockets. At press time, information from community-based analytics platforms revealed {that a} spike in Bitcoin reserves on the tackle.

Supply: CryptoQuant

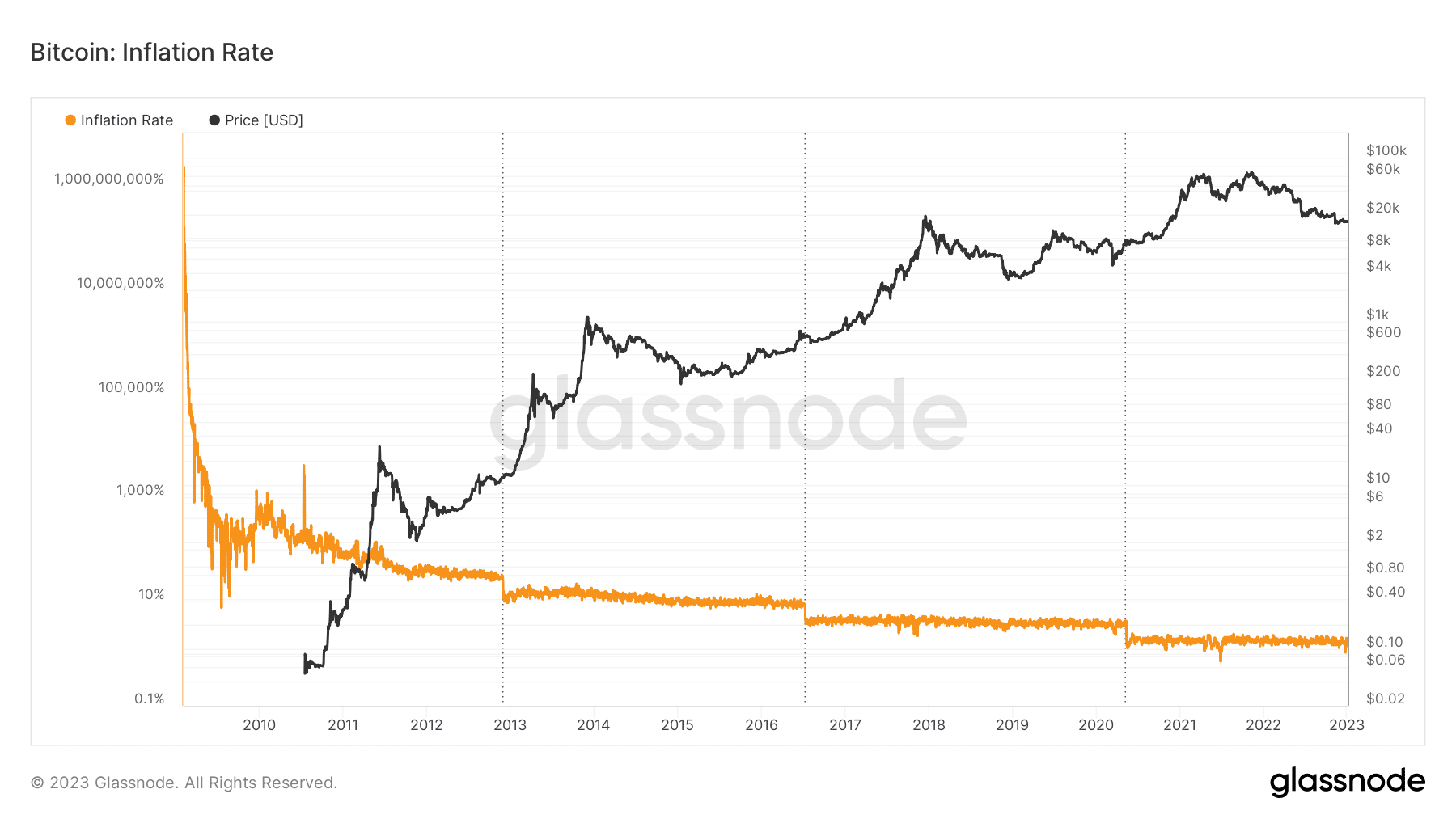

However, the change in stance didn’t routinely produce a constructive outlook for Bitcoin. In keeping with Glassnode, BTC issuance remained extraordinarily low at 556.25. The issuance could be termed as the whole quantity of latest cash minted on the Bitcoin community.

Therefore, the static situation implied {that a} spike in reserves added no worth in miners’ pursuit of including to the present provide. This additionally spreads to the inflation rate. This metric represented the share of latest cash divided by the present provide. A lower in each metrics meant a excessive case of inactivity amongst miners.

Supply: Glassnode

Assist will not be on the best way

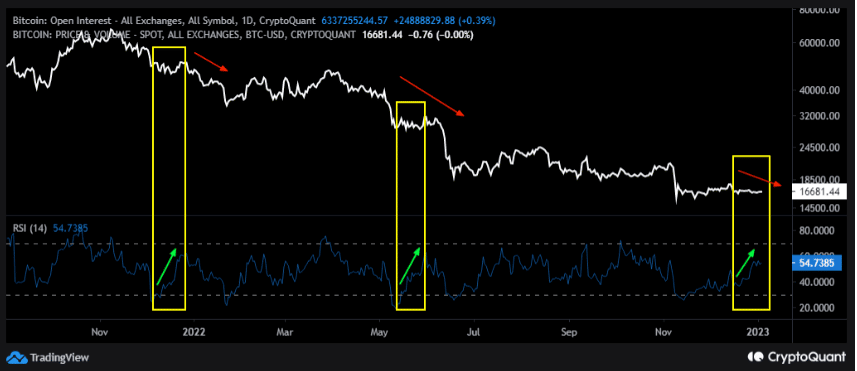

One other analyst on the platform, BaroVirtual, posted that BTC’s potential within the brief time period was undoubtedly bearish. In his publication, the analyst referred to the pattern exhibited by the Relative Energy Index (RSI).

Are your BTC holdings flashing inexperienced? Verify the Revenue Calculator

In upholding his viewpoint, BaroVirtual cited the BTC historic pattern the place the worth dropped as a result of RSI rising state. Based mostly on the chart supplied, it was an analogous case across the finish of 2021. The identical additionally occurred between Might and June 2022.

Supply: CryptoQuant

Moreover the RSI motion, the Open Curiosity (OI) was additionally at a spot the place bearish divergence was the subsequent transfer traditionally. The analyst stated,

“When the value of Bitcoin decreases or is sideways inside a downtrend, and the RSI, quite the opposite, rises, this creates a traditional hidden bearish divergence sample, which led to a bearish correction within the earlier two (2) instances.”