- New information and evaluation urged that the bear market would possibly maintain for some time

- Bitcoin metrics and market indicators additionally painted a bearish image for BTC

The brand new 12 months was not as promising because the Bitcoin [BTC] group anticipated. This was as a result of the king coin didn’t handle to register positive factors by way of its value.

Based on CoinMarketCap, BTC’s value declined by greater than 1.5% within the final seven days. Moreover, on the time of writing, it was buying and selling at $16,654.85 with a market capitalization of over $320 billion.

Grizzly, an creator and analyst at CryptoQuant, revealed that buyers might have to attend a bit of longer to witness a value pump.

Are your BTC holdings flashing inexperienced? Test the Revenue Calculator

Persistence is the important thing!

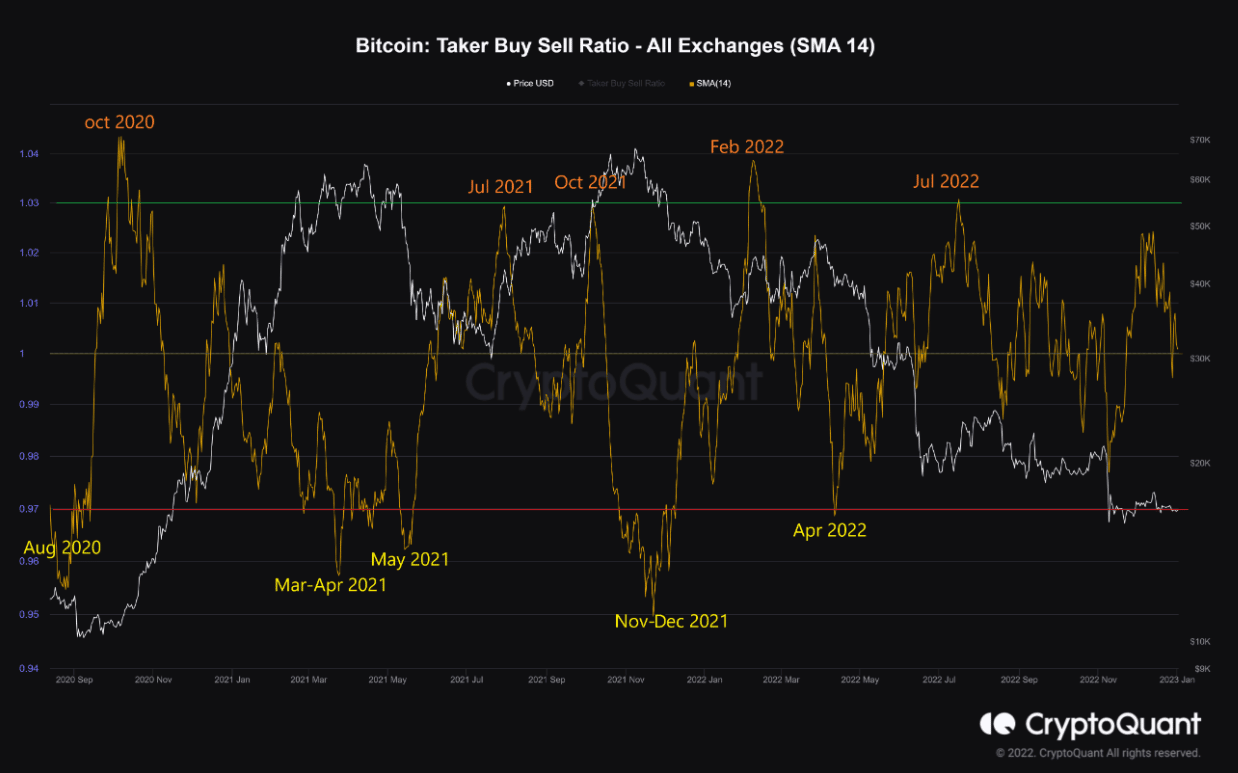

The evaluation talked concerning the Taker Purchase/Promote ratio, which is a metric used to look at the prevailing sentiments on the derivatives market. As per the evaluation, the index was bouncing round 1, and in contrast to earlier patterns, there was no clear path to those swings, since August 2022.

Subsequently, it’s troublesome to level out during which path BTC is headed, which reduces the possibilities of an unprecedented surge within the brief time period.

Supply: CryptoQuant

Glassnode’s data additionally revealed fairly just a few notable metrics, corresponding to BTC’s provide in revenue (7d MA) reaching a 1-month low of 9,497,168.998 BTC. This, nonetheless, didn’t look good for BTC.

Moreover, in line with CryptoQuant’s data, BTC’s trade reserve was rising. This was a bearish sign because it indicated greater promoting stress.

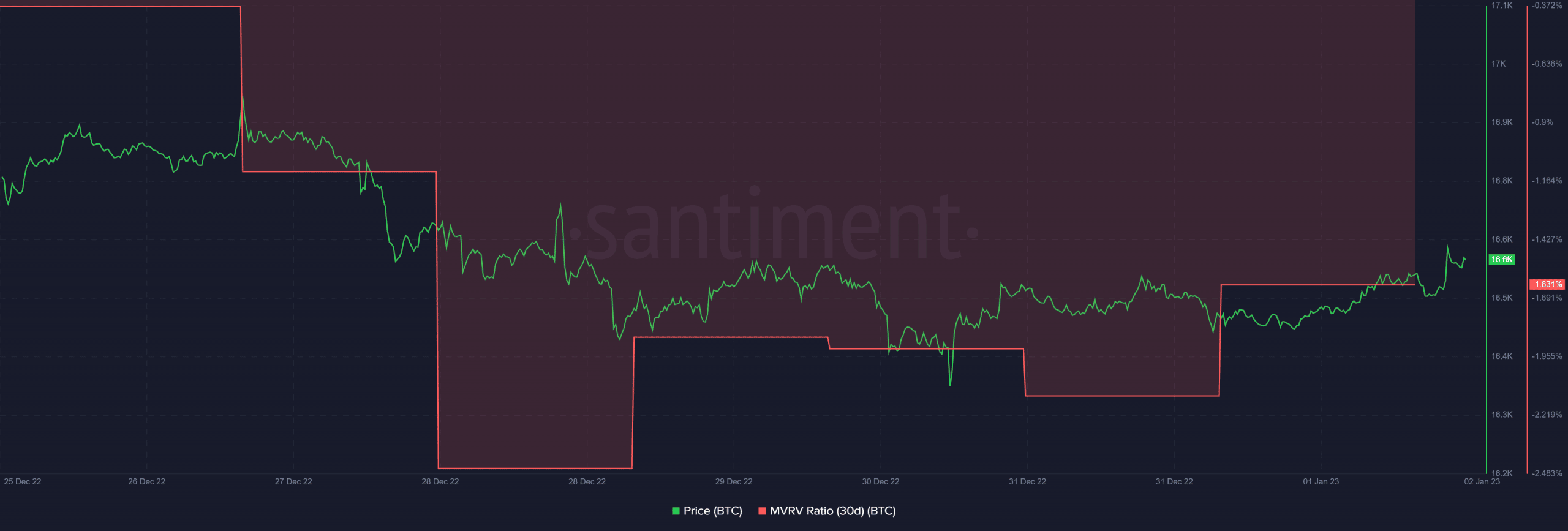

BTC’s aSOPR additional indicated that extra buyers have been promoting at a loss, which was by and enormous a adverse sign. Moreover, this may be a sign of a market backside. Nonetheless, BTC’s Market Worth to Realized Worth (MVRV) Ratio registered a slight uptick, giving buyers some hope.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Predictions 2023-24

The bears are laborious to beat

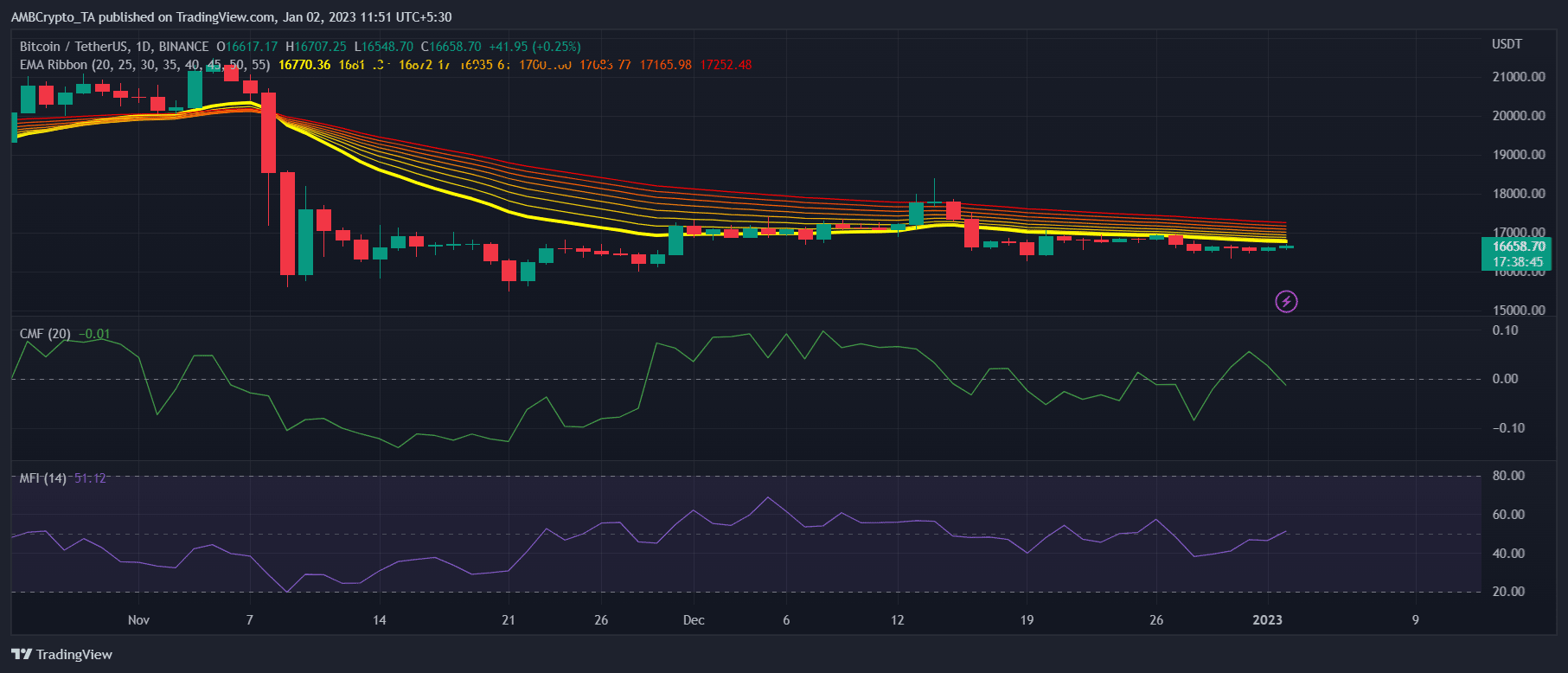

Most market indicators favored a bearish outlook for BTC as they urged sellers’ benefit. As an example, in line with the Exponential Transferring Common (EMA) Ribbon, the 20-day EMA was resting beneath the 55-day EMA, proving a bearish edge.

The Chaikin Cash Stream (CMF) registered a pointy decline, additional decreasing the possibilities of a value pump. The Cash Stream Index (MFI), then again, supplied much-needed aid by rising barely.

Supply: TradingView