- Provide on centralized exchanges stays depleted regardless of a rise in Bitcoin community exercise.

- Bulls may must preserve a cool head as 30-day SMA addresses had not finalized surpassing the 365-day SMA.

The dishonesty of FTX, accompanied by the havoc skilled in 2022, led many Bitcoin [BTC] holders to modify to self-custody. Nevertheless, different unaffected exchanges have been fast to reply within the bid to achieve again traders’ belief. Led by Binance [BNB], exchanges with hundreds of thousands of customers adopted by way of with the Proof-of-Reserves (PoR) system.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Will alternate provide ever return to regular?

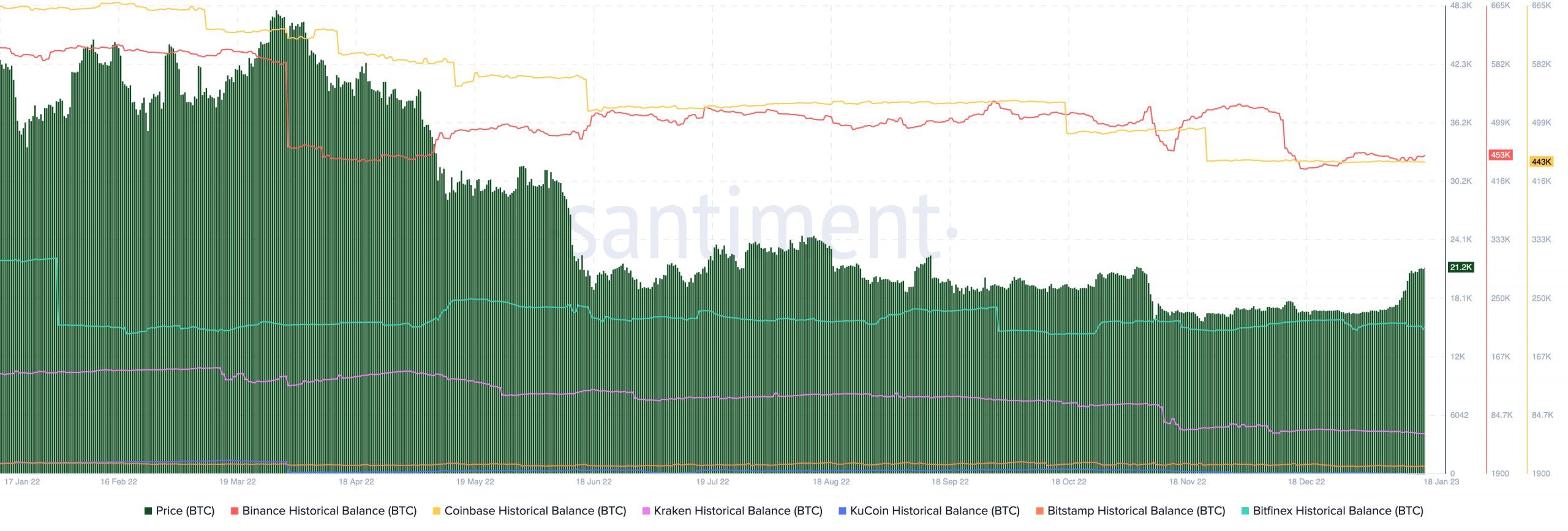

Regardless of makes an attempt, the motion has did not yield important outcomes. In accordance with an 18 January Santiment update, BTC’s provide within the final 12 months dropped from 11.85% to six.65%. This information was coined from the supply activities of the highest six exchanges, with Kraken being probably the most affected.

Supply: Santiment

The metric situation signifies that holders of the king coin had not exited their place on the protection of their property being in their very own fingers. However with BTC placing up an extraordinary efficiency within the final two weeks, shouldn’t exchanges get extra provide?

Nevertheless, lots of elements may very well be at play apart from the crash of the Sam Bankman- Fried (SBF)-led alternate. Just lately, Gemini has had its personal share of troubles. Though in numerous circumstances, the points plaguing Gemini even have the tendency to negatively have an effect on its customers. Therefore, this was one other legitimate purpose for BTC holders to miss non-custodial platforms.

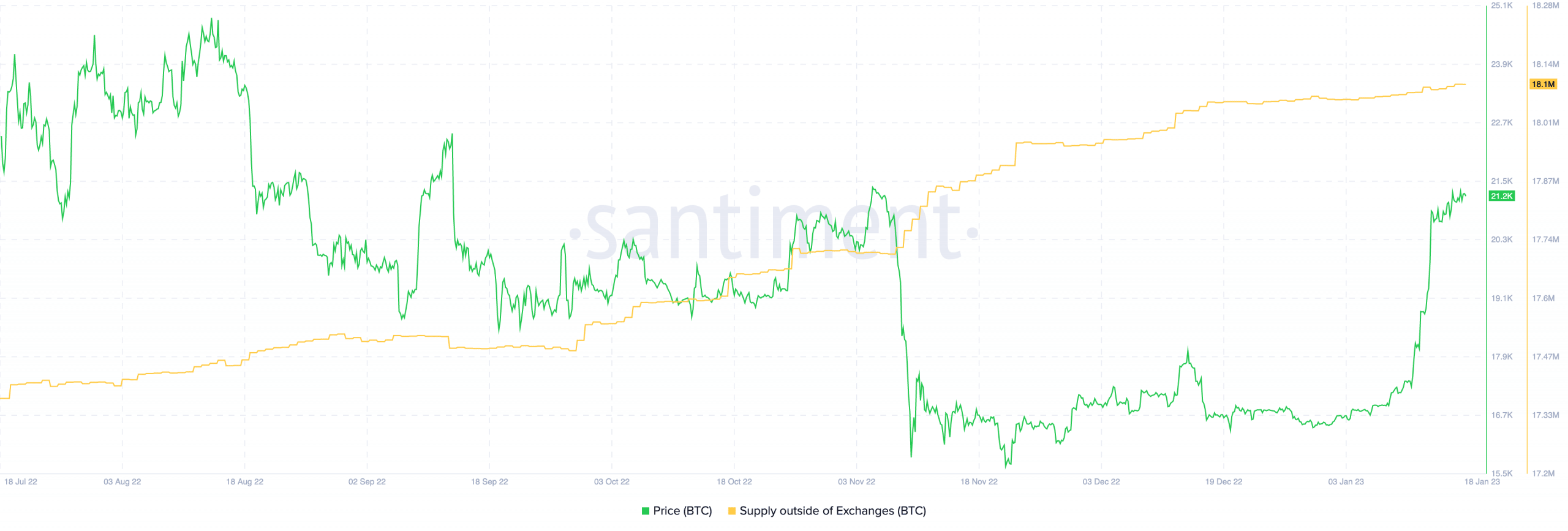

On gauging the availability exterior of exchanges, Santiment revealed that it has been on a continuous enhance. On the time of writing, it was 18.1 million, as BTC traded at $21,200.

Supply: Santiment

BTC is again, however it may very well be higher

Moreso, BTC’s pattern helped change the fortunes of some traders affected by the 2022 drawdown. This was as a result of Bitcoin was again above the realized worth. Therefore, this ensured that the common BTC holder had their property above the reds.

#Bitcoin is now buying and selling again above the Realized Value, indicating that the common $BTC holder is now again within the inexperienced.

The 2022-23 bear cycle has to date spent 179-days buying and selling beneath it, making it the second longest thus far.

Learn full evaluation right here: https://t.co/uYkwG8wT5C pic.twitter.com/26emkMQUj1

— _Checkɱate 🔑⚡🌋☢️🛢️ (@_Checkmatey_) January 16, 2023

Life like or not, right here’s BTC’s market cap in ETH’s phrases

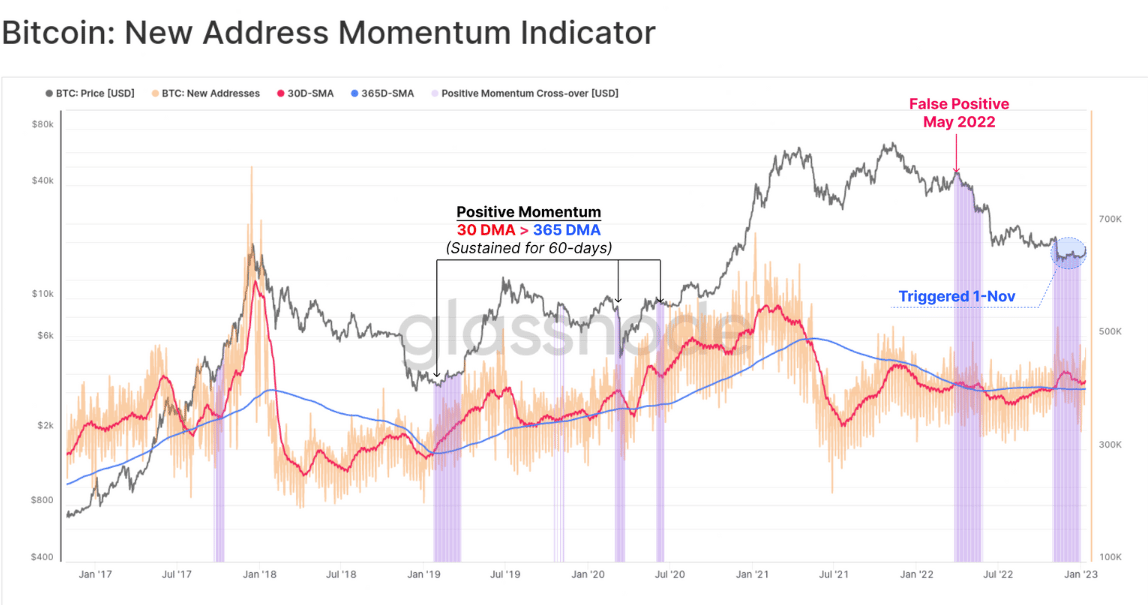

As well as, it would nonetheless be tough for the BTC uptick to contribute to a rise in alternate provide. This assertion was on account of Glassnode’s report exhibiting that it was not but a full-blown bull market. As an alternative, the potential for exiting the reds was in progress.

In accordance with the report, the 30-day SMA of recent addresses has solely surpassed the 365-day SMA for a month. To substantiate the bullish trait, the previous will need to have outpaced the latter by a minimal of 60 days. However since that was not the case, the upturn had an opportunity of being a false transfer. Nevertheless, the 30-day sustenance signaled a push in community development and exercise.

Supply: Glassnode