- On-chain knowledge revealed that BTC whales are uncertain whether or not BTC’s latest rally marked the graduation of a brand new bull cycle.

- Regardless of the latest value bounce, institutional traders keep away from BTC accumulation.

New knowledge from on-chain metrics has revealed that regardless of a 23% enhance within the value of Bitcoin (BTC) previously week, giant traders and institutional gamers stay cautious, viewing the sudden value bounce as a short lived reduction rally.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

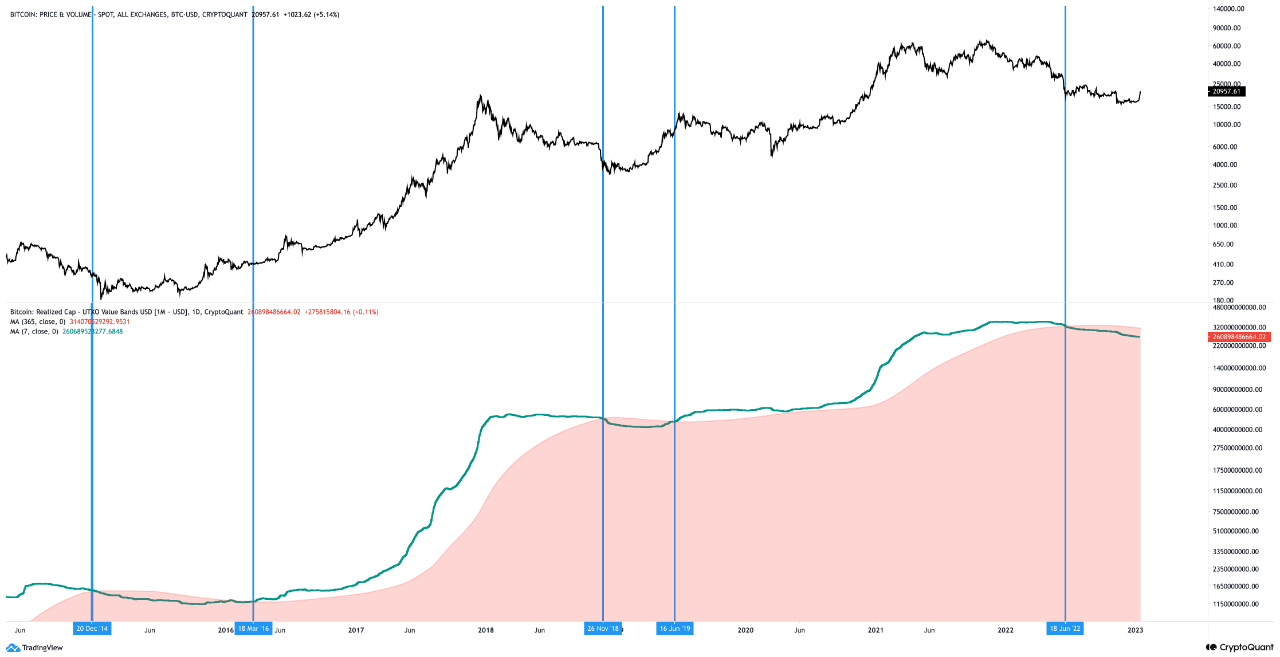

CryptoQuant analyst Woominkyu assessed the exercise of BTC wallets holding over $1 million in Unspent Transaction Output (UTXO) and in contrast it to earlier market developments to find out if the latest enhance in BTC’s value marked the start of a brand new bull run or was only a mere non permanent reduction rally.

In keeping with Woominkyu, the info urged that:

“A reduction rally is very anticipated till the 7 easy shifting common (SMA) reaches the 356 SMA, and an actual bull market may start when the 7 SMA breaks above the 356 SMA.”

Confirming that whales remained resilient regardless of the constant decline in BTC’s worth within the final 12 months, Woominkyu mentioned:

“As all the time, the whales appear to be extra affected person than particular person traders, and the present scenario shouldn’t be completely different from the earlier cycles. The whales will hold accumulating BTC sufficiently and disappear on the finish of the upcoming bull market once more.”

Supply: CryptoQuant

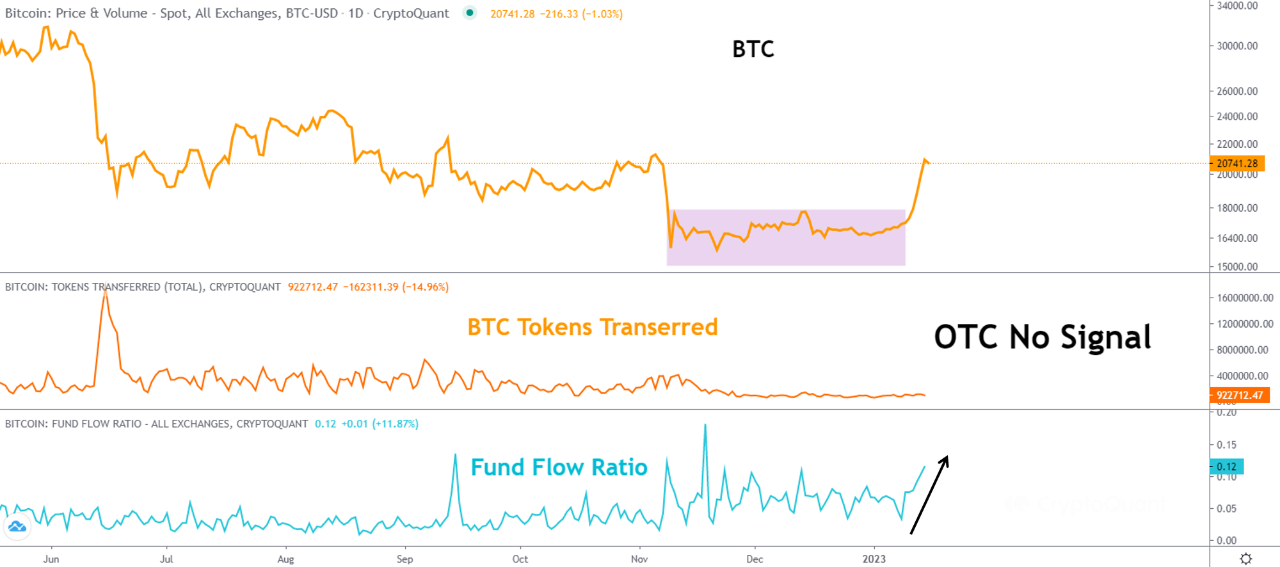

One other CryptoQuant analyst MAC_D, thought-about BTC’s Fund Quantity index, Fund Holdings index, and Over-The-Counter transactions and opined that “it was laborious to say that there was a shopping for development by institutional traders.”

What number of are 1,10,100 BTCs value right now?

In keeping with MAC_D, regardless of the bounce in value to the $21,000 area within the final week, BTC’s Fund Quantity Index remained low as “the extent of transaction quantity is insignificant.”

Supply: CryptoQuant

A have a look at BTC’s Fund Holdings index revealed that “establishments’ BTC holdings are fairly lowering,” MAC_D discovered. At press time, this stood at 690,000, per knowledge from CryptoQuant.

Supply: CryptoQuant

Additional, as for BTC’s Over-The-Counter transactions, MAC_D famous “no uncommon transactions” regardless of the value rally within the final week.

Supply: CryptoQuant

In keeping with MACD_D:

“Normally, on the backside, institutional traders need to purchase quietly by way of OTC buying and selling. Nonetheless, this buying and selling was merely actively traded solely on the change, and no uncommon transactions occurred on the onchain.”

These observations on-chain led the analyst to conclude that:

“Trying on the above three contents, I don’t suppose the present rise means an actual uptrend transition. I feel that is the results of shopping for sentiment, which was suppressed when the U.S. CPI index was lately launched. The present institutional traders have remained calm and simply watching. OTC buying and selling might be brisk once they count on a full-fledged uptrend flip.”