- The $15,000 worth mark may very well be a superb worth backside for BTC

- The SOPR 30MA confirmed {that a} backside formation may be on BTC’s horizon

An additional decline to the $15,000 worth vary may mark the value backside for main coin, Bitcoin [BTC], CryptoQuant analyst Nakju opined in a report.

In response to Nakju, many merchants usually use BTC’s Coin Days Destroyed (CDD) metric to evaluate the actions of long-held cash on the BTC community. These merchants additionally interpret the identical as a promote sign.

Are your BTC holdings flashing inexperienced? Verify the Revenue Calculator

Nevertheless, Nakju opined that the CDD metric may additionally signify volatility relatively than simply be used to evaluate the correct time to promote. Taking a cue from the historic efficiency of BTC’s CDD, it has acted as a precursor to each huge worth plunges and important worth rises.

Supply: CryptoQuant

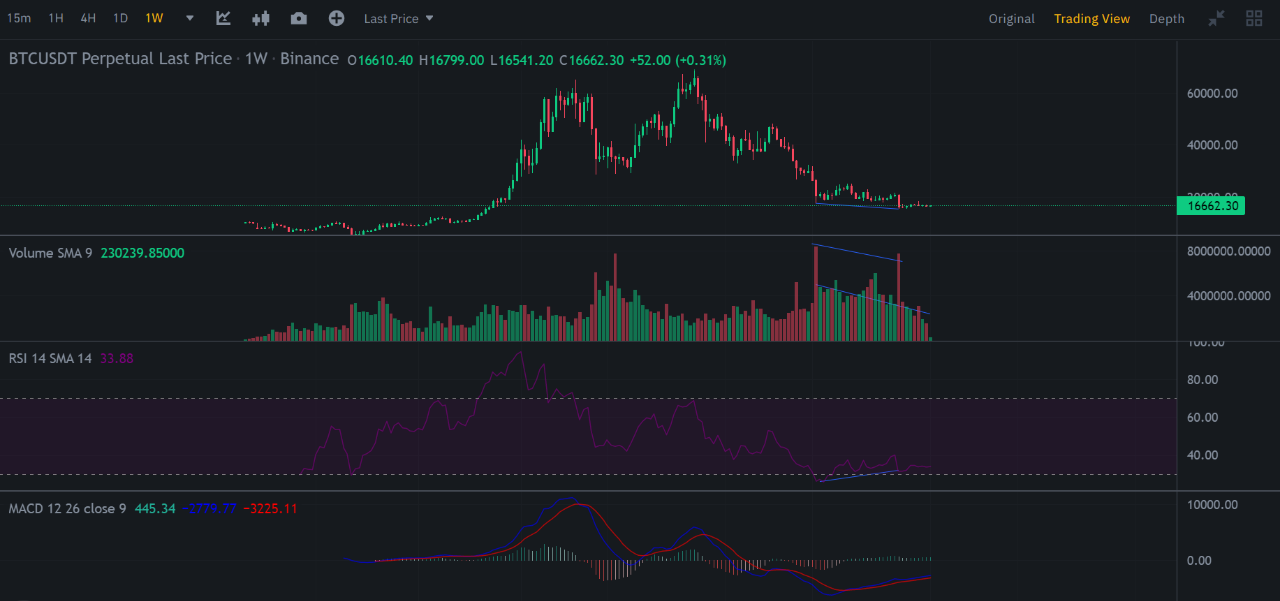

Moreover, as per Nakju, if BTC’s worth plummets to $15,000, it may play in favor of traders. He believed that the value vary may very well be as a superb instance of when BTC would usually log an everyday bullish divergence marked by a interval of low buying and selling quantity and an oversold Relative Energy Index (RSI).

In response to Nakju, development reversals “of any asset happens when the quantity of transactions is small.” Therefore, the $15,000 worth mark may be a worth backside to be adopted by a long-term rally in BTC’s worth.

Supply: CryptoQuant

One other CryptoQuant analyst Onchain Edge, discovered that the present worth of the king coin’s SOPR MA30 was 0.54. This was whereas assessing BTC’s Spent Output Revenue Ratio (SOPR) on a 30-day shifting common.

In response to the analyst, the present SOPR stage acted as a bear market backside indicator in earlier bear cycles in 2012, 2014, and 2018. Moreover, Onchain Edge beneficial utilizing greenback value averaging (DCA) and setting accumulation targets as BTC gears as much as contact the bear market’s backside.

He additionally suggested BTC traders to stay bullish in 2023.

Supply: CryptoQuant

Day merchants will not be dilly-dallying

As of this writing, BTC traded at $16,733.07 per knowledge from CoinMarketCap. An evaluation of the king coin’s efficiency on a four-hour chart revealed elevated accumulation by day merchants.

As of this writing, the Relative Energy Index (RSI) was in an uptrend at 60.88. Equally, the Cash Circulate Index (MFI) was seated above the 50-neutral mark at 68.33. This indicated elevated BTC purchases by day merchants.

Likewise, the dynamic line (inexperienced) of BTC’s Chaikin Cash Circulate (CMF) was pegged above the middle line at 0.22. A CMF worth above the zero line is an indication of energy out there.

Supply: TradingView

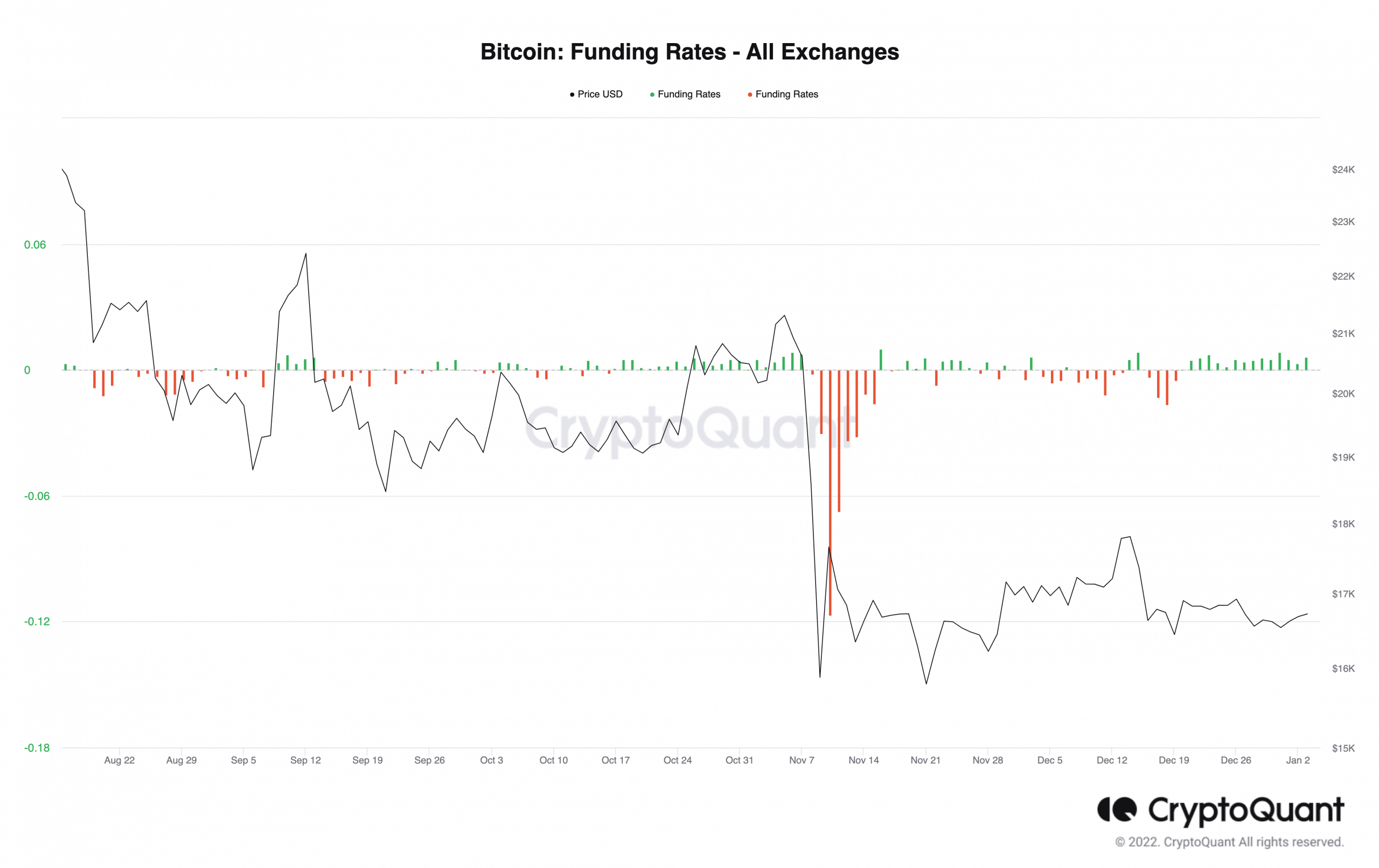

Lastly, BTC’s funding charges on the time of writing have been optimistic and have been so since 21 December 2022, knowledge from CryptoQuant revealed. This meant that long-position merchants have since dominated the market, betting in favor of an upward rally in BTC’s worth.

Supply: CryptoQuant

Arabic

Arabic Chinese (Simplified)

Chinese (Simplified) Dutch

Dutch English

English French

French German

German Italian

Italian Portuguese

Portuguese Russian

Russian Spanish

Spanish