- Bitcoin shorts improve because the bearish circumstances intensify.

- Whales drive the present value motion however a pivot might set off shorts liquidations.

Bitcoin and the altcoin market are going by way of essentially the most bearish week of 2023 to date. A state of affairs that has resulted within the liquidation of lengthy positions as costs crashed. Many derivatives merchants have consequently shifted to brief positions however there’s an unexpected threat.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin’s bearish efficiency to date this week has enticed many merchants to execute brief positions to make the most of the falling costs.

However herein lies a possible threat of liquidations in case whales begin shopping for up BTC, triggering a bullish pivot. Whales usually make the most of such conditions as a result of the liquidations lengthen the directional transfer, permitting them to learn.

4/ Bearish:

– Jobs added >= 224k

– Unemployment fee <= 3.4%Bullish:

– Jobs added < 224k

– Unemployment fee > 3.4%Looks as if the market is setup for a squeeze after yesterday’s motion, merchants are closely brief the crypto market. However, we’ll want a draw back miss IMO! pic.twitter.com/qrxADT6IdG

— tedtalksmacro (@tedtalksmacro) March 10, 2023

Assessing the state of Bitcoin derivatives

A surge in Bitcoin Funding charges suggests that there’s presently a robust improve in shorts. This implies there’s an elevated threat of shorts liquidations if whales all of the sudden begin shopping for.

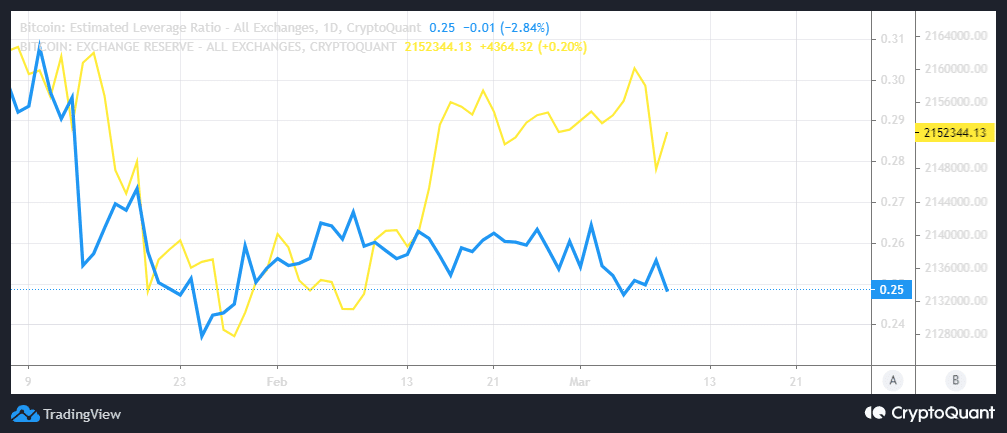

Such a situation is extra more likely to happen when there’s a excessive degree of leverage out there. The extent of leverage remains to be low to date, therefore the danger of liquidation might not be as pronounced.

Supply: CryptoQuant

The BTC change reserve metric signifies a pivot after the newest promote stress. Alternate reserves are on the rise, courtesy of the current promote stress.

Alternatively, the sturdy pullback noticed this week has additionally supplied a decrease entry level which will entice many to start out accumulating.

Learn Bitcoin [BTC] Value Prediction 2023-24

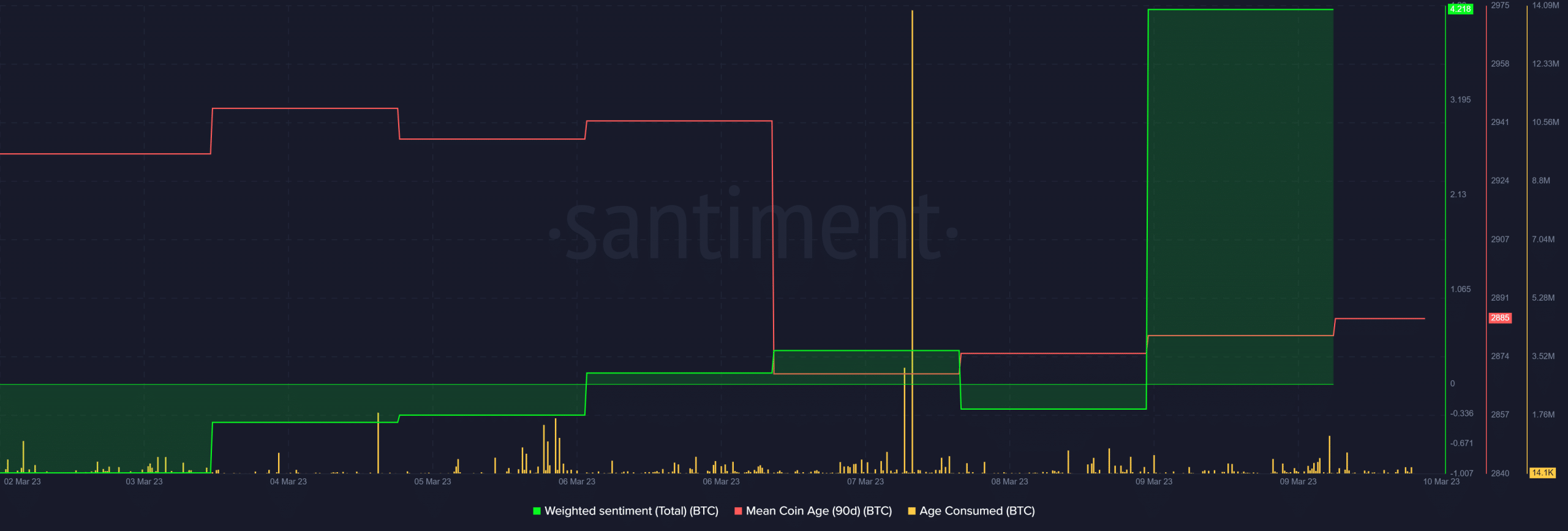

The weighted sentiment metric is now at its highest weekly degree as a result of expectations of a aid rally. Moreover, the imply coin age metric has been on the rise for the final three days, suggesting that there was a big accumulation.

Supply: Santiment

One also can interpret it as an indication that many merchants are HODLing amid the continued promoting stress. Taking a look at Bitcoin’s provide distribution reveals outflows from addresses holding between 10,000 and 100,000 BTC within the final seven days. Alternatively, addresses holding between 10 and 10,000 BTC have been accumulating particularly within the final 24 hours.

Bitcoin traders ought to hold a detailed eye on whale exercise. The current value crash kicked into excessive gear after a big surge within the age-consumed metric, confirming numerous gross sales.

The identical metric might provide insights into the subsequent transfer by BTC whales particularly one associated to accumulation.