Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- The market construction was bearish on the 12-hour timeframe

- Mixed with technical indicators, a rally appeared unlikely

Volatility is an absolute necessity for merchants. Traders would possibly dislike or worry volatility however merchants, particularly decrease timeframe ones, are likely to thrive on it. Nevertheless, the crypto markets have dried up in quantity in latest days because the festive season units in.

– A 163.63x hike on the playing cards IF BCH hits Bitcoin’s market cap?

Bitcoin Money fashioned a bearish order block and confronted rejection at it a number of instances up to now week. A transfer upward to gather liquidity from keen quick sellers may jeopardize merchants who’re already bearishly positioned. Bitcoin additionally faces stiff opposition close to the $17.3k mark.

Hidden bearish divergence indicators the continuation of the downtrend

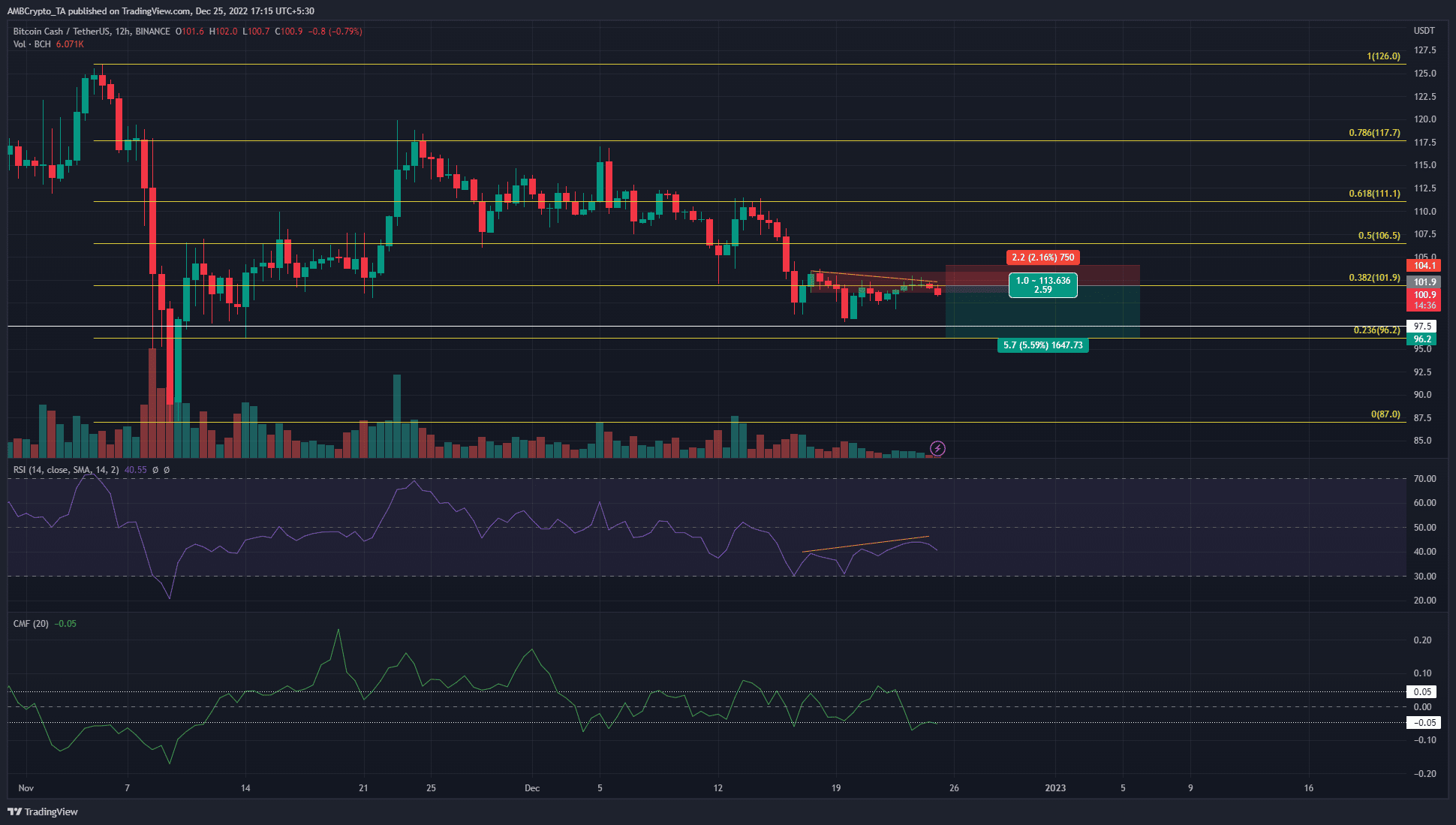

Supply: BCH/USDT on TradingView

In early November, following the panic across the FTX implosion, Bitcoin Money dropped from $126 to $87. Fibonacci retracement ranges had been plotted (yellow) primarily based on this transfer. The following rally from $87 was halted on the 78.6% retracement degree at $117.7 on November 24.

Since then, the value has been in a downtrend. It shifted to a bearish construction after the drop from $108.9 to $106.1 on 11 December. For many of December, the Relative Energy Index (RSI) has additionally been beneath the impartial 50 momentum to indicate that bears have the higher hand.

The Chaikin Cash Movement (CMF) was unable to interrupt out previous the +0.05 or -0.05 ranges, and due to this fact didn’t point out vital capital stream into or out of the market in latest weeks.

Are your BCH holdings flashing inexperienced? Verify the Revenue Calculator

The RSI additionally fashioned a hidden bearish divergence (orange) with the value. On condition that the development was downward, this steered that quick sellers could be as soon as once more.

The H12 bearish order block round $102 (marked in crimson) was prone to reject any bullish makes an attempt. Due to this fact, a brief place could be taken, with a stop-loss above $104 and focusing on the $96-$97.5 area of assist.

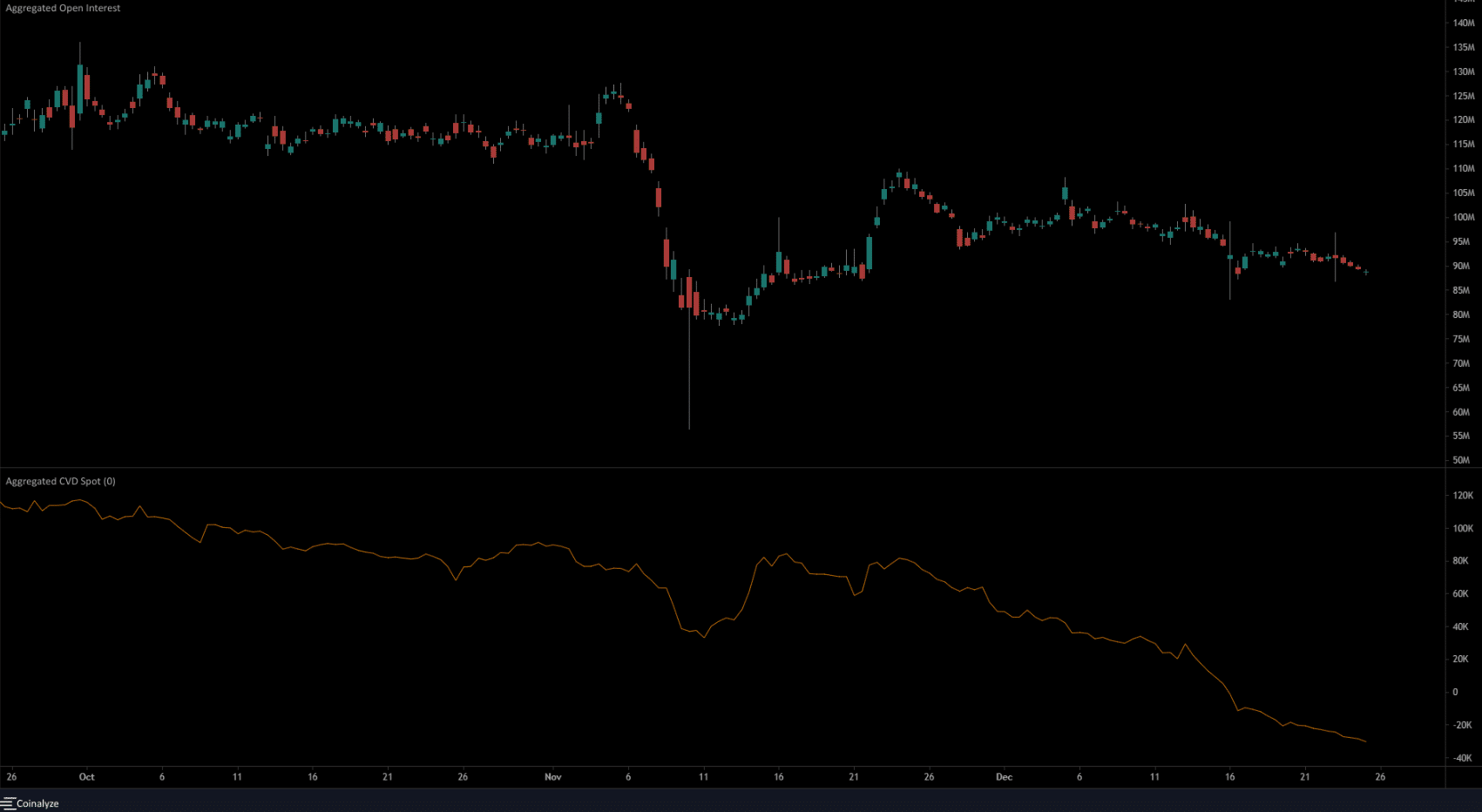

Spot Cumulative Quantity Delta confirmed sellers had been in management

Supply: Coinalyze

From 13 December, each the costs and the Open Curiosity have been in a downtrend. This confirmed that lengthy positions had been discouraged and that futures market individuals had been bearishly biased. The spot CVD has additionally been in freefall since late November.

Taken collectively, we are able to infer that promoting strain was immense, and will proceed to be that means heading into the brand new 12 months. For Bitcoin Money to interrupt the bearish shackles, it should reclaim the $104 space as assist and rise larger with growing OI to sign bullish power.