- BTC traded momentarily above $26,000 on 14 March.

- On-chain information indicated constructive sentiment.

In the course of the intraday buying and selling session on 14 March, Bitcoin [BTC] momentarily traded at a staggering excessive of $26,500 for the primary time since August 2022. The rally in value was as a result of constructive sentiment that lingered available in the market as many count on potential US rate of interest cuts.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

After buying and selling under the $20,000 value mark final weekend following the collapse of Silicon Valley Financial institution (SVIB), BTC regained its momentum and rallied after Federal Regulators confirmed that they might make SVIB depositors entire.

BTC has since clinched essential milestones on-chain. Per information from on-chain information supplier Santiment, through the buying and selling session on 14 March, BTC whales made the very best rely of transactions exceeding $1 million since November 2022.

A rise in whale transactions is a good indicator of bullish sentiments available in the market. If momentum is sustained, additional value development is assured.

🥳 #Bitcoin is continuous its wonderful restoration, taking pictures all the way in which above $26.5k alongside #bullish #Fed information of potential US rate of interest cuts. Whales are making the very best stage of $BTC $1M+ transactions in 4 months after breaking 9-month value highs. https://t.co/me6fogpy6X pic.twitter.com/HIGnVAqYKz

— Santiment (@santimentfeed) March 14, 2023

Additional, the current uptick within the king coin’s value “has despatched +2.7M Cash into profitability,” on-chain information supplier Glassnode mentioned in a tweet.

In response to Glassnode,

“This means that ~20% of the Adjusted Circulating Provide was acquired throughout the $20k – $26k area.”

BTC’s “Adjusted Circulating Provide” refers back to the variety of cash which are actively in circulation, minus any cash that haven’t moved for a protracted interval (these are thought-about “misplaced” cash).

Glassnode’s assertion that round 20% of BTC’s adjusted circulating provide was acquired throughout the value vary of $20,000 to $26,000 meant that these holders had been put again in revenue when BTC traded above $26,000.

The current surge in #Bitcoin value motion (+22%) has despatched +2.7M Cash into profitability. This means that ~20% of the Adjusted Circulating Provide was acquired throughout the $20k – $26k area.

This workbench is accessible for Tier 2 membership and above: https://t.co/BgfZ9OsJPA pic.twitter.com/pxCg90n3M7

— glassnode (@glassnode) March 14, 2023

What else can we see on-chain?

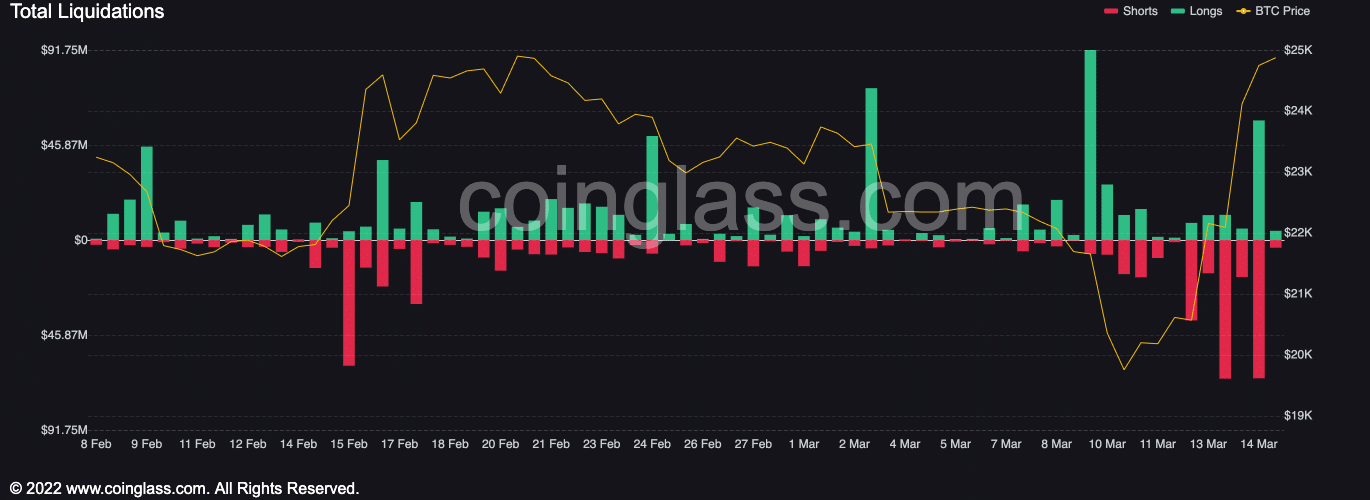

Market sentiment has improved considerably because the week started. BTC’s value traded as excessive as $24,574 on Monday and compelled the liquidation of about $81 million BTC quick positions. With many betting in favor of additional value development, information from Coinglass revealed that quick merchants remained the largest losers within the BTC market.

Supply: Coinglass

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

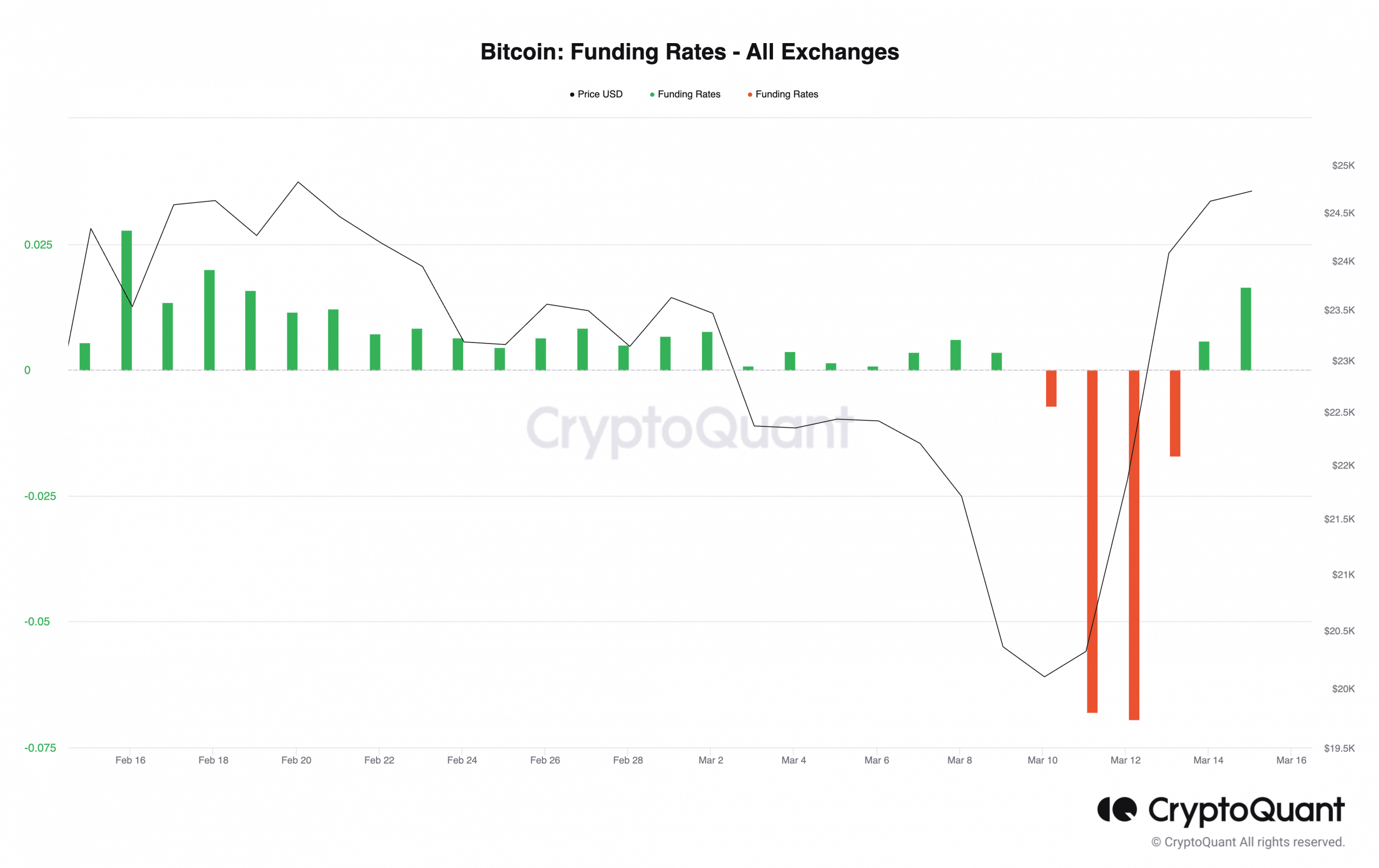

Additional, for the primary time since SVIB’s collapse, BTC funding charges have turned constructive. When an asset’s funding charges are constructive, it signifies that the demand to go lengthy (purchase) is excessive. This may be seen as a bullish sign, suggesting that merchants are keen to pay a premium to take care of their lengthy positions.

Supply: CryptoQuant

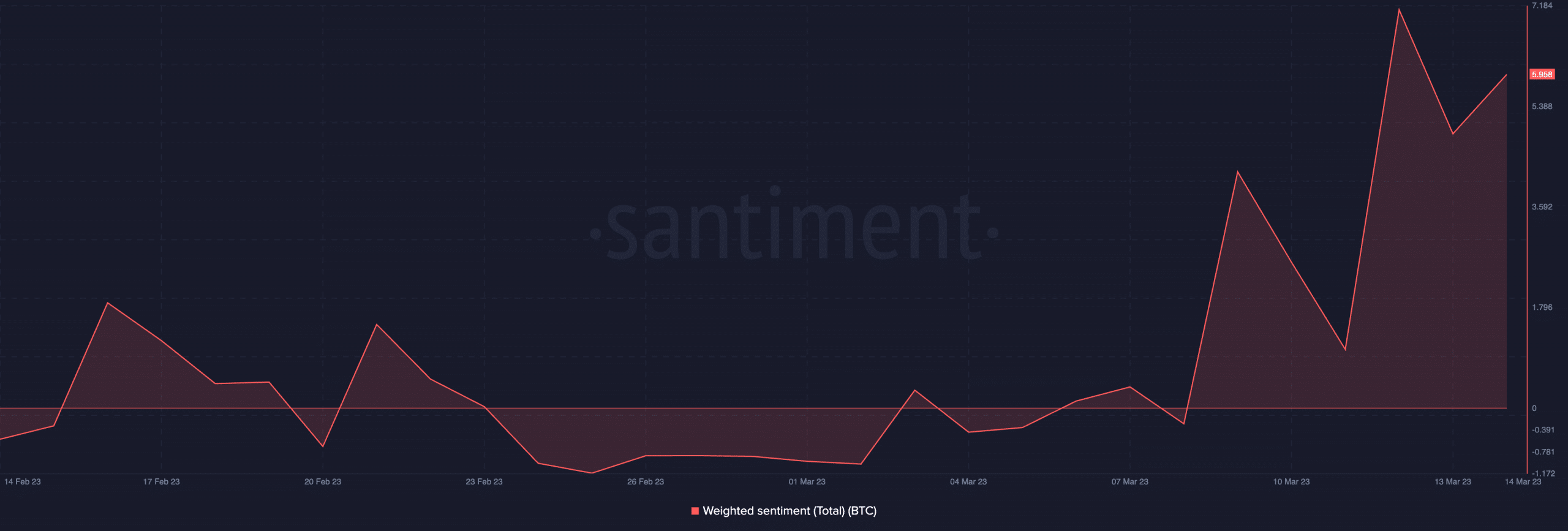

At press time, BTC’s weighted sentiment was a constructive 5.958. If BTC sustains this stage, costs may improve additional.

Supply: Santiment

![Bitcoin [BTC] bounces back: All you need to know as king coin crosses $26k](https://cryptonitenews.io/wp-content/uploads/2023/03/shubham-s-web3-S3eXVbkB9-g-unsplash-2-1-1000x600-768x461.jpg)