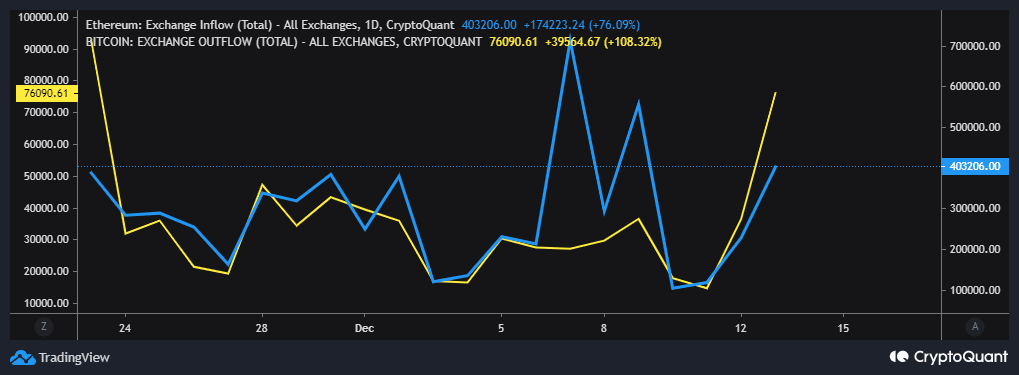

- A surge in BTC’s demand within the spot market was noticed within the final 24 hours at press time.

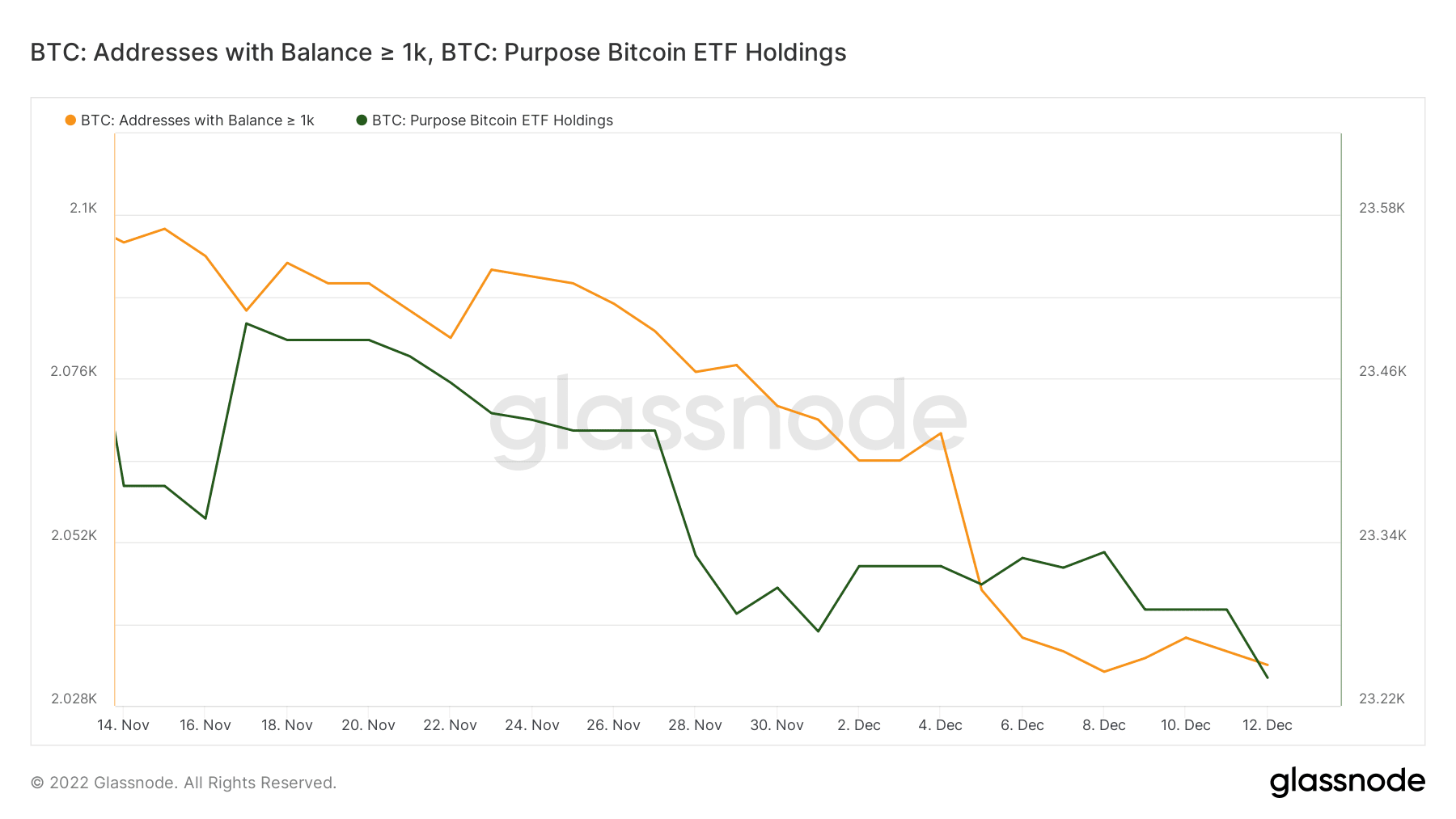

- Addresses with balances larger than 1,000 BTC haven’t but began accumulating.

An fascinating factor simply occurred with Bitcoin’s value motion. It managed to tug off a 5% rally in the previous couple of hours earlier than this press, briefly pushing above its 50-day Shifting common. This transfer occurred proper after the discharge of U.S. CPI knowledge and right here’s why.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

The explanation for Bitcoin’s rally within the final 24 hours is similar cause as why it has been on a bearish trajectory for many of 2022. Inflation has been on the rise, and the Federal Reserve has been elevating charges in an try to curb it. Greater charges have resulted in a harsh investing setting and the liquidation of funding belongings.

CPI: 7.15 vs 7.3 Exp.

That is the primary a part of what we anticipated this week.

Tomorrow Powell will elevate by 0,5% as an alternative on 0,75%!— Ran Neuner (@cryptomanran) December 13, 2022

The most recent Client Worth Index (CPI) knowledge got here in at 7.15. That is decrease than the 7.3 consensus estimate, therefore the ultimate determine has outperformed buyers’ expectations.

Extra importantly, it signifies that inflation is lastly declining. This consequence means the FED’s battle in opposition to inflation is yielding constructive outcomes. It additionally means the funding panorama is enhancing, and for this reason the CPI report inspired some accumulation.

Ought to buyers anticipate extra upside?

All eyes at the moment are on the Federal Reserve which is predicted to make an rate of interest resolution within the subsequent few hours. There is likely to be extra hope for Bitcoin bulls if the FED hikes charges by 50 BPS, relatively than 70 BPS.

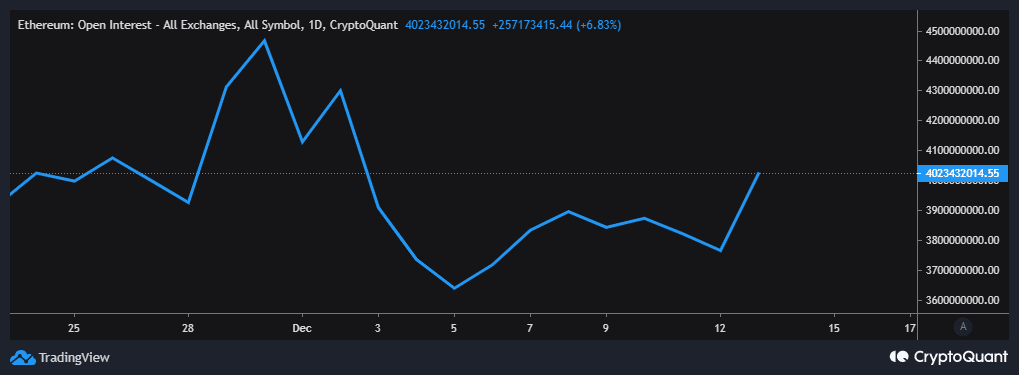

In the meantime, on-chain metrics already look fairly favorable. The final 24 hours have been characterised by a surge in Bitcoin’s open curiosity, suggesting that demand for BTC within the derivatives market was up.

A surge in demand for Bitcoin within the spot market was additionally noticed within the final 24 hours at press time. This was mirrored in Bitcoin alternate outflows which have been nearly double the alternate inflows, on the time of writing.

Supply: CryptoQuant

However we have to consider whale and institutional demand to determine whether or not Bitcoin can preserve the identical momentum.

The Goal Bitcoin ETF holdings continued to trim its balances and was but to start out accumulating. That is regardless of improved BTC prospects within the final 24 hours. The metric represents institutional demand which at the moment means that it’s not fairly there.

So far as whale demand is worried, addresses with balances larger than 1,000 BTC have additionally not began accumulating. This is likely to be an indication that the newest upside can be restricted since institutional and whale demand is absent.

The subsequent 24 hours needs to be fairly fascinating due to the upcoming rate of interest revision.

![Bitcoin [BTC] bounces above 50-day MA, but what should LTH expect?](https://cryptonitenews.io/wp-content/uploads/2022/12/1668068430325-cc4f269e-802d-4e9e-b7c6-48c930f541bc-1-1000x600-768x461.png)