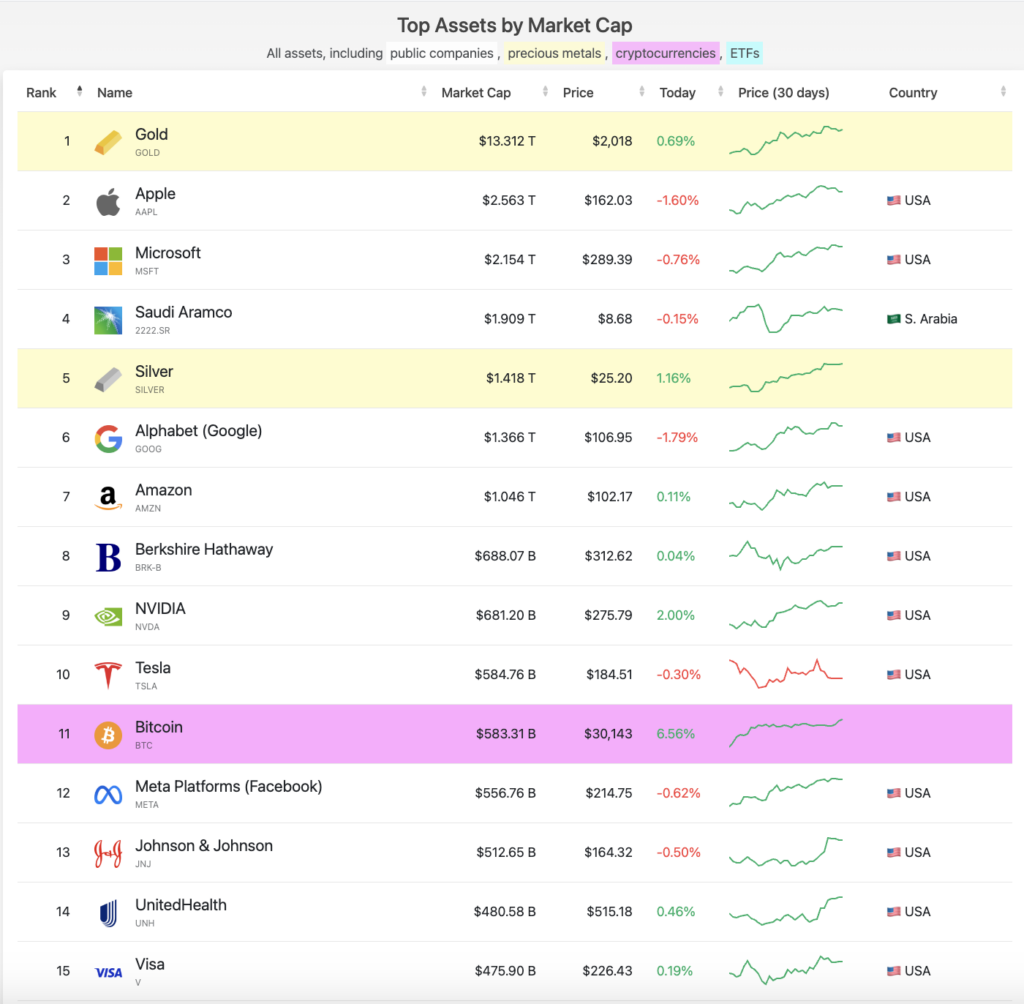

Bitcoin (BTC) rallied final evening to a 10-month excessive, peaking at $30,380 after two days of a meteoric rise. In that rally, BTC’s market cap hit $585.05 billion — briefly making it the tenth largest asset on the planet.

Whereas BTC has since consolidated to simply over $30,000 — doubtlessly creating some assist — the market sentiment stays overwhelmingly bullish.

Knowledge from CompaniesMarketCap confirmed BTC spent a number of hours above Tesla — whose $584.7 billion market cap ranked it eleventh among the many high 100 public corporations, , cryptocurrencies, and ETFs. The consolidation to $30,000 pushed Bitcoin again to eleventh place — permitting Tesla to reclaim its tenth place.

Nevertheless, BTC nonetheless ranks greater than Fb’s Meta — whose $556.7 billion market cap makes it the twelfth largest asset on the planet.

This isn’t the primary time Bitcoin surpassed established, legacy firms. Nevertheless, that is the primary time public corporations may expertise vital turmoil within the close to future.

Present macroeconomic situations spell hassle for shares and different belongings. If the U.S. market enters stagflation — somewhat than a recession — inventory costs could be the primary to take a beating. A decade of low rates of interest and a traditionally unprecedented pandemic stimulus have pumped inventory costs to their all-time highs.

Sustaining these costs via rising rates of interest and a possible stagflation will probably be troublesome and will result in huge losses throughout markets. As extra buyers rush to Bitcoin as a method to shield their liquidity, we may see one other main rally that pushes Bitcoin previous Tesla once more — and nearer to trillion-dollar giants like Amazon and Alphabet.

The publish Bitcoin briefly flips Tesla, turns into the tenth largest asset by market cap appeared first on CryptoSlate.