- Avalanche’s RSI was in an overbought place.

- Nevertheless, different metrics and market indicators had been bearish.

Avalanche [AVAX] buyers had an excellent begin to 2023 because the token registered large features on its chart. In accordance with CoinMarketCap, AVAX’s worth elevated by over 30% within the final seven days, and on the time of writing, it was buying and selling at $15.35.

High Gainers in @Avalancheavax Ecosystem Final 24H 🚀🚀$XAVA @AvalaunchApp $SAVAX @BenqiFinance $AVAX @avalancheavax $JOE @traderjoe_xyz $ALPHA @alphaventuredao $AAVE @AaveAave $SYN @SynapseProtocol $QI @BenqiFinance $FXS @fraxfinance $UNI @Uniswap #avalanche $AVAX pic.twitter.com/8g9Iw1bHIx

— AVAX Each day 🔺 (@AVAXDaily) January 12, 2023

Practical or not, right here’s AVAX’s market cap in BTC’s phrases

This large surge in worth will be attributed to Avalanche’s newest partnership with AWS, which might promote the widespread use of blockchain know-how in companies and authorities companies. Not solely that, however AVAX additionally made it to the checklist of the highest gainers within the Avalanche ecosystem during the last 24 hours.

Nevertheless, the buyers had cause to fret as CryptoQuant’s information revealed a serious bearish sign, which could limit AVAX’s worth from going up any additional within the coming days.

Avalanche buyers ought to be cautious

As per CryptoQuant’s data, AVAX’s Relative Energy Index (RSI) was in an overbought place, suggesting a development reversal quickly. Curiously, Avalanche’s NFT ecosystem witnessed progress, as in keeping with AVAX Each day, AVAX’s market cap elevated by 8%, whereas its quantity went up by practically 20%.

🔺Avax NFT Weekly Highlights🔺

MarketCap: $43.05M

Quantity: $219.69K

Gross sales: 9129Overview 🧵👇#AVAX #Avalanche $AVAX #NFT #GameFi pic.twitter.com/YXU19vCAb7

— AVAX Each day 🔺 (@AVAXDaily) January 12, 2023

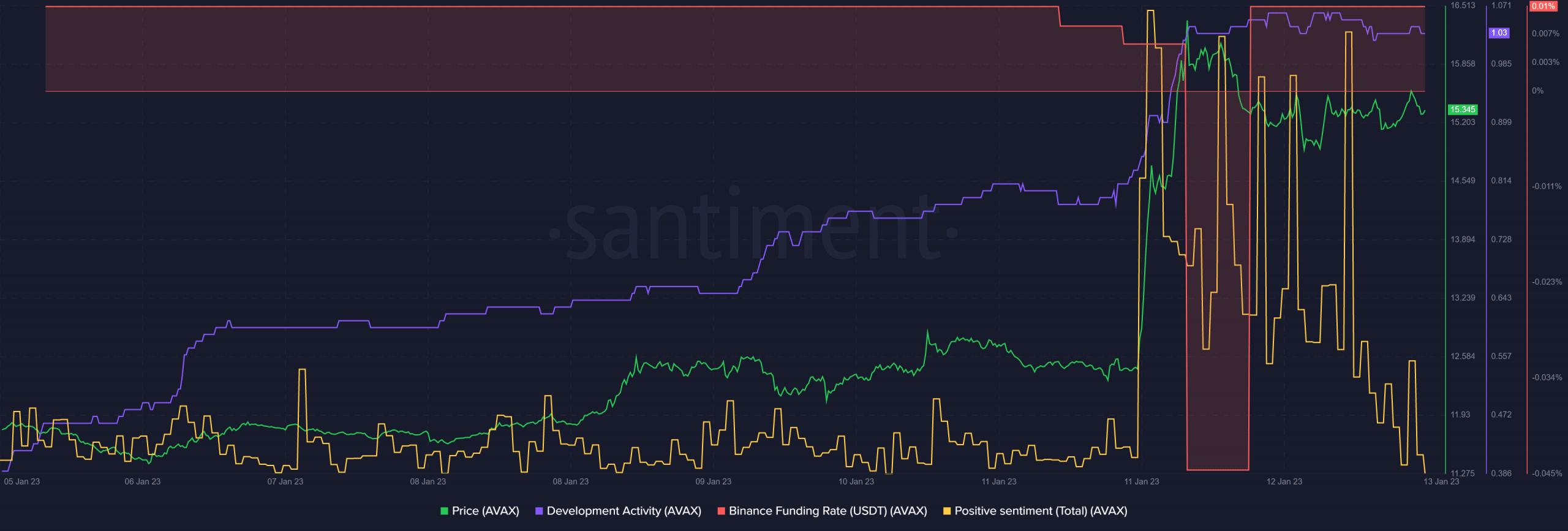

Avalanche’s growth exercise has additionally elevated these days, which was a optimistic sign. Other than these, the remainder of the on-chain metrics had been supportive of a worth decline.

As an example, AVAX’s Binance refunding fee registered a pointy decline, reflecting much less demand from the derivatives market. After spiking, AVAX’s optimistic sentiments additionally went down, which was not in favor of the token.

Supply: Santiment

Learn Avalanche’s [AVAX] Worth Prediction 2023-24

Is promoting strain inevitable?

AVAX’s every day chart revealed that the Cash Movement Index (MFI) adopted the RSI and was additionally within the overbought zone, which might provoke promoting strain and scale back AVAX’s worth within the coming days. The On Stability Quantity (OBV) and Chaikin Cash Movement (CMF) each registered downticks, growing the possibilities of a worth decline.

Nonetheless, the Exponential Transferring Common (EMA) Ribbon displayed the potential of a bullish crossover, which may also help AVAX preserve its uptrend.

Supply: TradingView