Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- Avalanche has made regular progress up the worth charts over the previous week.

- These good points may very well be undone over the subsequent few days until the bearish breaker was crushed.

Bitcoin [BTC] climbed to $16.8k at press time, and lots of altcoins have made good points over the previous few hours. Property comparable to Avalanche [AVAX] reached robust areas of resistance.

Even Ethereum [ETH] traded at $1250 at press time. Is it seemingly that there’s a northward swing failure sample for a number of altcoins earlier than a plunge downward over the approaching week?

Learn Avalanche’s [AVAX] Worth Prediction 2023-24

The minutes from the FOMC assembly in December might be launched on 5 January. This might present perception into how the present tightening cycle might play out. For crypto merchants, the hours main as much as the discharge might see heightened volatility, liquidity hunts, and a reversal.

Avalanche is able to slide as soon as extra after climbing previous $11 to succeed in resistance

Supply: AVAX/USDT on TradingView

On decrease timeframes, Avalanche possessed good bullish momentum. It flipped the $11 degree to assist previously few days and even retested it as affirmation. But, bulls should beware. Avalanche entered a bearish breaker in late November, an space of resistance that hasn’t been defeated since mid-December.

The $12 was a profitable degree for enthusiastic patrons, however the larger timeframe development remained bearish. Due to this fact, the extra seemingly commerce to revenue was to promote close to $12 relatively than shopping for AVAX close to $12.

Are your AVAX holdings flashing inexperienced? Test the Revenue Calculator

Brief sellers can look to enter the $11.7 – $12 area, with a stop-loss set above $12.25. Bearish targets lie at $11, $10.6 and $10, the 23.6% extension degree. However, a each day session shut above $12-$12.2 will invalidate this bearish thought. Additional north, resistance may be discovered at $13 and $14.

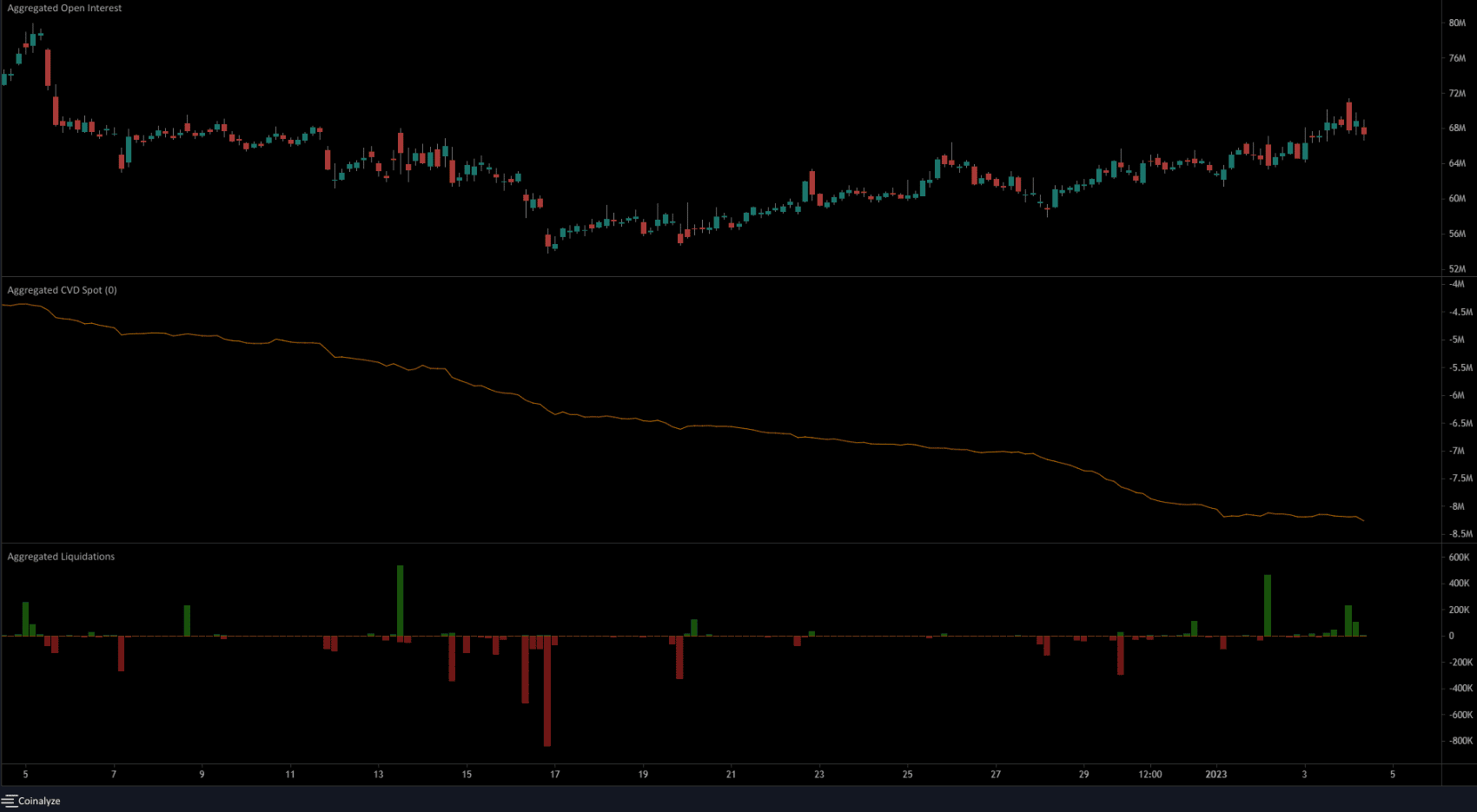

The declining spot CVD indicated robust promoting pressure- is it an excessive amount of to be defeated?

Supply: Coinalyze

Since early December 2022, the spot Cumulative Quantity Delta has been in freefall. Over the previous week, it has stabilized and remained flat. But the bias remained bearish. Patrons are weak and sellers have all the facility out there.

The liquidation chart confirmed some quantity of brief positions liquidated as AVAX climbed previous the $11 resistance. A pointy transfer upward to flush out much more shorts earlier than a drop might seize an unlimited quantity of liquidity and ship Avalanche careening decrease. In the meantime, the rise in costs was accompanied by a rising OI as nicely. This prompt short-term bulls confirmed power and capital coming into the market.