- AVAX rallied to achieve over 25% inside 24 hours in a latest rally.

- The rally is tied to the latest Avalanche partnership with Amazon AWS.

Regardless that the market could also be in a downturn, Avalanche [AVAX] has taken benefit of each likelihood to forge important partnerships. With its most up-to-date alliance, Avalanche is placing itself able to supply institutional providers, which can mark the start of the subsequent stage of blockchain use.

Learn Avalanche’s [AVAX] Value Prediction 2023-24

Avalanche groups up with Amazon AWS

On 11 January, Avalanche and Amazon Net Companies introduced their partnership, which might promote the widespread use of blockchain know-how in companies and authorities companies.

It’s official! @Amazon #ChoseAvalanche to deliver scalable blockchain options to enterprises and governments 🔺#AWS totally helps Avalanche’s infrastructure and dApp ecosystem, together with one-click node deployment, providing the very best tooling for these excessive compliance use instances. pic.twitter.com/syInSrU9XD

— Avalanche 🔺 (@avalancheavax) January 11, 2023

To facilitate the partnership, AWS will provide one-click code deployment by way of the AWS market. Use instances requiring adherence to FedRAMP requirements might be carried out on AWS GovCloud by working Avalanche node operators.

As well as, Ava Labs will present “Subnet deployment” as a service within the AWS Market. This suggests that any enterprise or group can rent Ava Labs to create a novel AWS Subnet.

AVAX surges in a day by day timeframe, however…

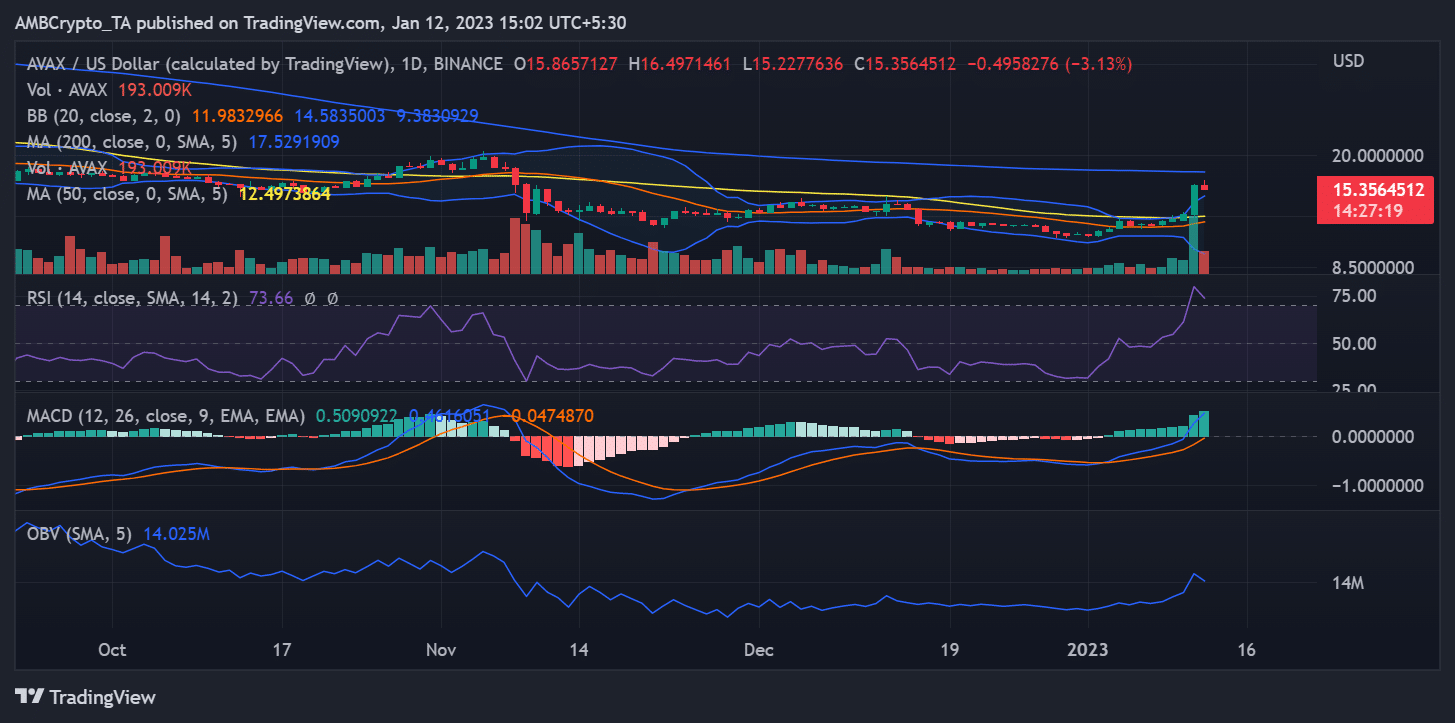

AVAX responded favorably to the AWS alliance, as evidenced by the asset’s day by day timeframe chart. On the shut of commerce on 11 January, AVAX had elevated in worth by over 24%. The asset was buying and selling at about $15 on the time of writing, regardless of shedding about 3%. Its value earlier than the just about 25% enhance was roughly $12.

Supply: TradingView

The newest value actions efficiently overcame the resistance degree created by the brief Shifting Common (yellow line). Nevertheless, given the place AVAX is, a value decline is probably going.

AVAX had entered the overbought zone, as evidenced by the Relative Power Index (RSI) line. The inference is {that a} value correction is approaching, which is more likely to end result, given the RSI’s present place.

Is your portfolio inexperienced? Take a look at the AVAX Revenue Calculator

Dev exercise witnesses an uptrend

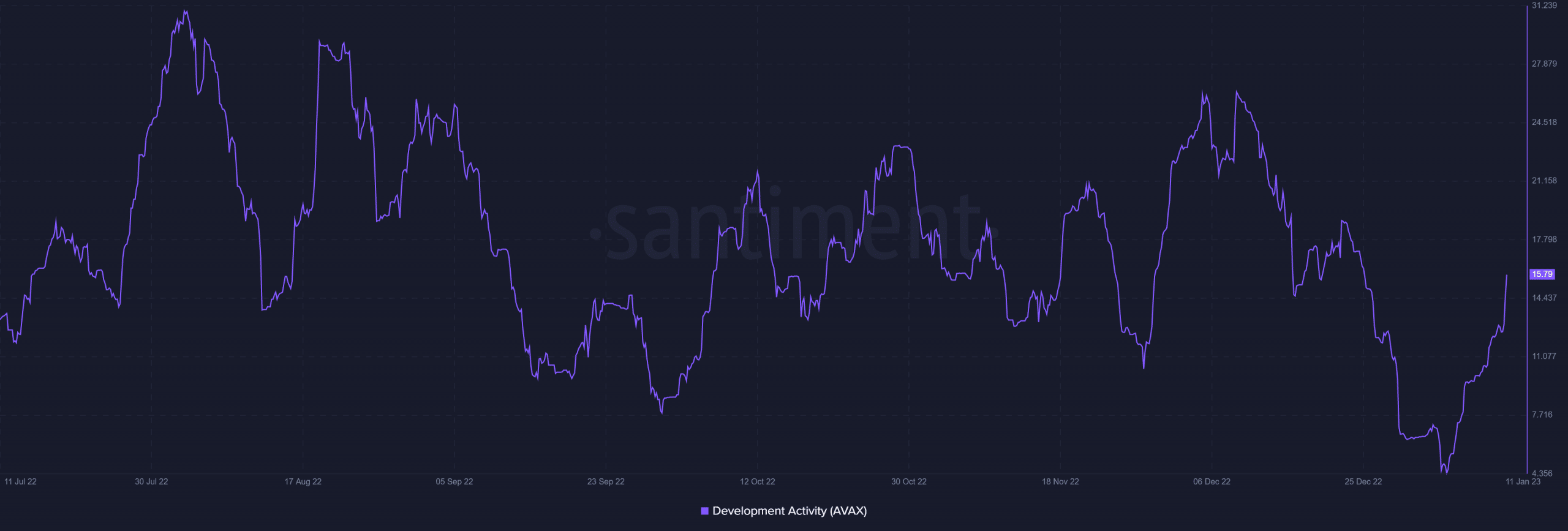

The Improvement Exercise indicator additionally confirmed an upward development. In keeping with the dev exercise measure, community builders’ actions have scaled up. The dev exercise chart on the time of this writing indicated that it had risen to roughly 15.79.

Supply: Santiment

![Avalanche [AVAX] gains 25% in a day, thanks to the Amazon AWS](https://cryptonitenews.io/wp-content/uploads/2023/01/avax-1000x600-768x461.jpg)