- YFI suffers a bearish divergence that signifies a decline in shopping for momentum.

- Sellers take management of the YFI market in the course of the intraday buying and selling session.

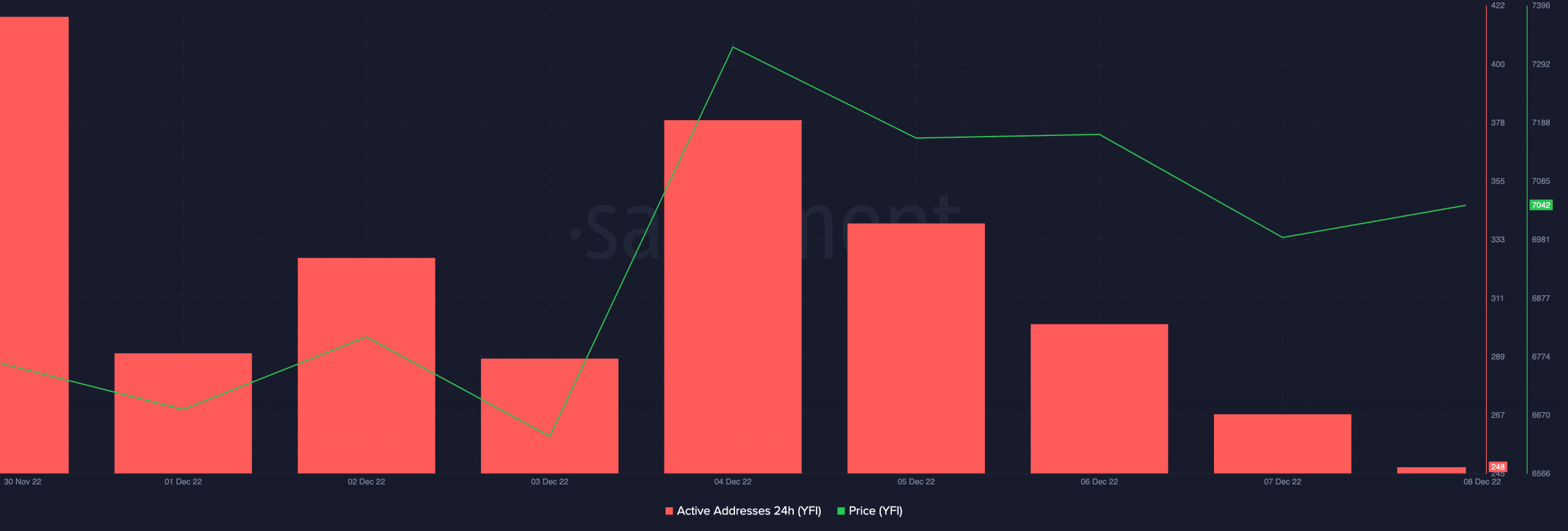

Regardless of the expansion within the worth per Yearn Finance (YFI) token, the rely of each day lively addresses on the community continues to fall, knowledge from Santiment revealed.

As of this writing, YFI traded at $7,027.16. Within the final week, its worth went up by 7%, per knowledge from CoinMarketcap.

Learn Yearn Finance (YFI) Worth Prediction 2023-2024

With simply 248 distinctive addresses concerned in YFI transactions at press time, the variety of each day lively addresses which have traded the alt has fallen persistently by 41% within the final week.

Supply: Santiment

YFI’s worth and the rely of its lively addresses transferring in reverse instructions create a bearish divergence that precedes a worth drawdown.

Likewise, a worth/buying and selling quantity divergence was noticed on a each day chart. As YFI’s worth rallied by 3% within the final 24 hours, its buying and selling quantity fell by 25% inside the identical interval.

This was a sign of exhaustion among the many present patrons within the YFI market and marked a possible re-entrance level for sellers. In consequence, new demand could be required to drive up the alt’s worth additional.

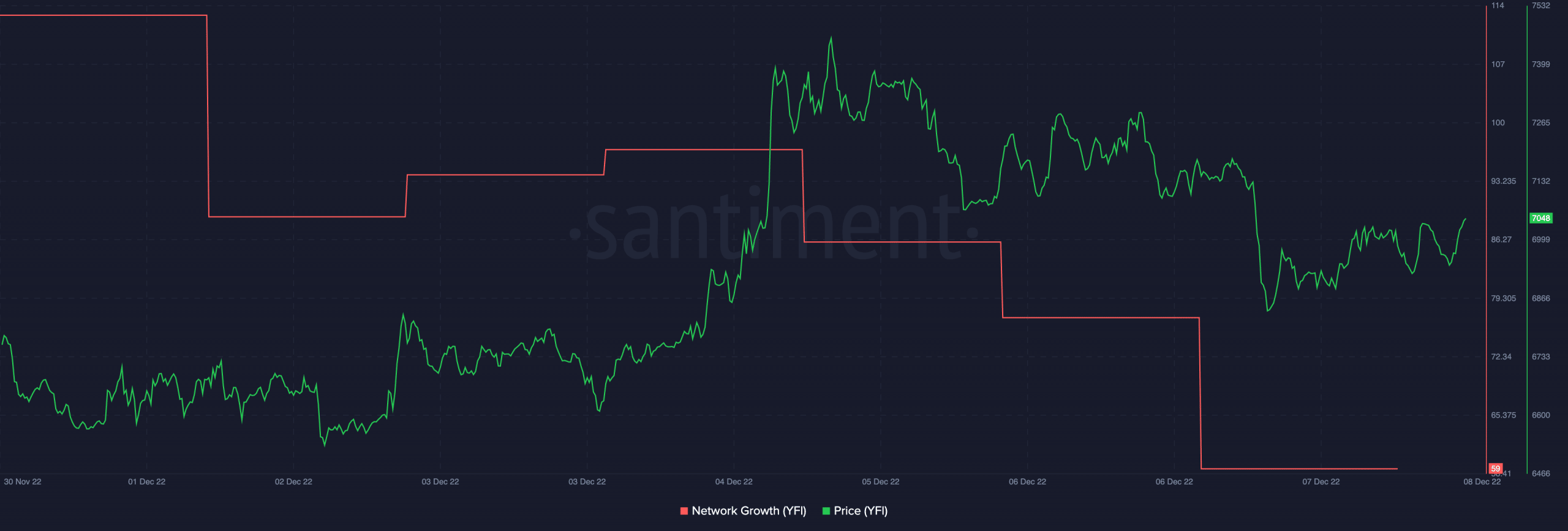

Nonetheless, knowledge from Santiment confirmed that new demand for YFI has declined because the starting of the month. As of this writing, 59 new addresses have been on the YFI community. Within the final eight days, this has fallen by 48%.

Supply: Santiment

Day merchants should not smiling

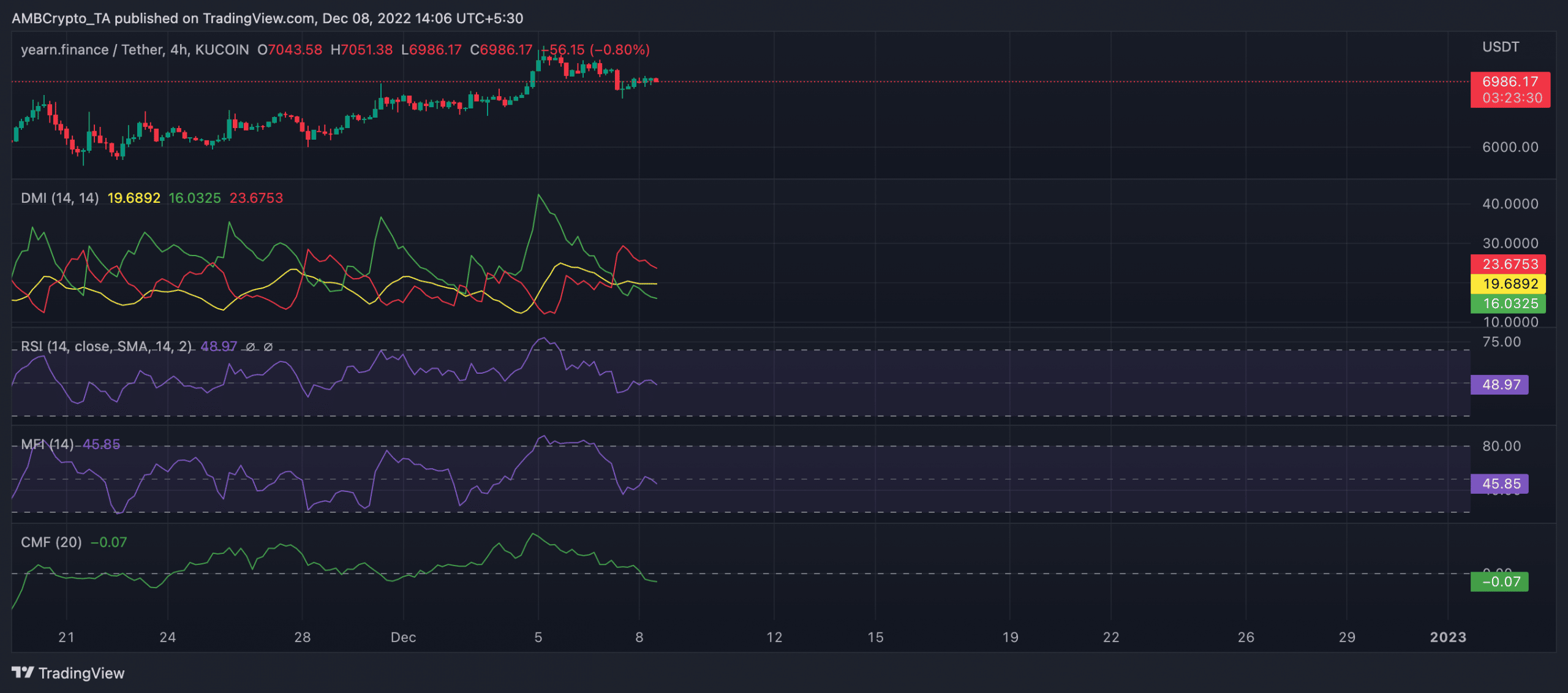

An evaluation of YFI’s efficiency on a 4-hour chart revealed that sellers had management of the intraday market. Promoting stress rallied as each day merchants shied away from accumulating the alt.

At press time, the dynamic line (inexperienced) of YFI’s Chaikin Cash Circulation (CMF) rested beneath the middle line to return a adverse worth of -0.07. A fall of an asset’s CMF beneath the middle line often signifies that the token’s distribution fee exceeds its accumulation fee inside a specified interval. A adverse CMF is a sign of weakened shopping for stress.

Moreover, the Relative Energy Index (RSI) was noticed at 48.97 in a downtrend. Stationed beneath the 50-neutral area dealing with south, promoting stress rallied as extra patrons exited the YFI market. Likewise, its Cash Circulation Index (MFI) was pegged at 45.85 at press time.

The place of the Directional Motion Index (DMI) confirmed the energy of YFI sellers in the course of the intraday buying and selling session.

The sellers’ energy (pink) at 23.67 was solidly above the patrons’ (inexperienced) at 16.03. Moreover, the Common Directional Index (ADX) confirmed that the vendor’s energy was a tough one which patrons may discover not possible in the course of the day’s buying and selling session.

Supply: TradingView