- Bitcoin opened curiosity returns, however funding fee tanked

- Bitcoin volatility witnessed an increase upon contemplating the exercise of indicators

Bitcoin [BTC] launched into some upside final week, triggering hopes of a possible restoration above $20,000. Nevertheless, the upside was short-lived, and the cryptocurrency was again beneath $17,000 at press time.

However what can the market count on this week, now that demand slowed down in the course of the weekend?

Learn Bitcoin’s [BTC] Value Prediction for 2023-24

A take a look at the present stage of demand out there may assist decide how Bitcoin’s worth motion will play out. Based on the most recent Glassnode alerts, the variety of Bitcoin addresses holding greater than 10 BTC was at a two-year excessive. This statement meant there’s nonetheless some demand for BTC out there.

📈 #Bitcoin $BTC Variety of Addresses Holding 10+ Cash simply reached a 2-year excessive of 154,796

View metric:https://t.co/0NzRiyaeFg pic.twitter.com/Xt7oalCjU0

— glassnode alerts (@glassnodealerts) December 17, 2022

This confirmed that Bitcoin was nonetheless experiencing important demand at the same time as the value continued to slip. However this may not be sufficient to generate sturdy bullish momentum. A take a look at BTC’s efficiency within the derivatives market might assist present a greater understanding of the extent of volatility to count on within the subsequent few days.

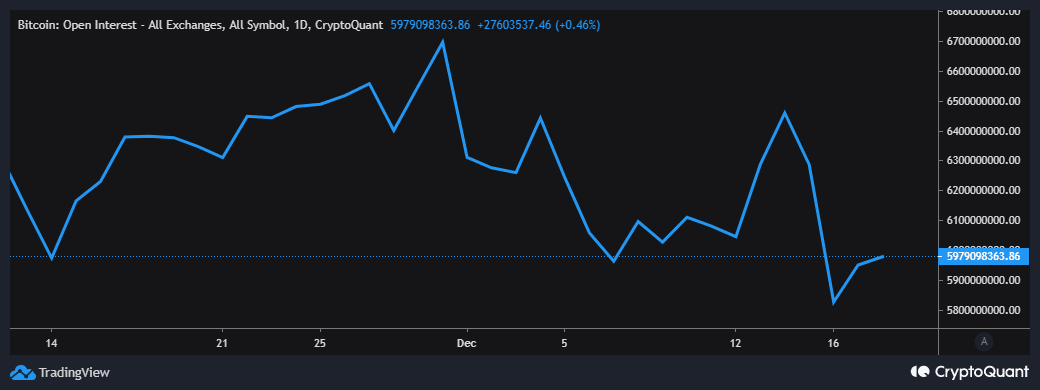

Bitcoin skilled a pointy drop in open curiosity within the derivatives market between 14 – 16 December. This was across the similar time that the value gave up its weekly positive aspects.

Supply: CryptoQuant

The identical metric revealed that Bitcoin’s open curiosity recovered barely within the final two days, though not with as a lot enthusiasm as its earlier decline. Regardless of this slight restoration, the Bitcoin funding fee had not recovered but.

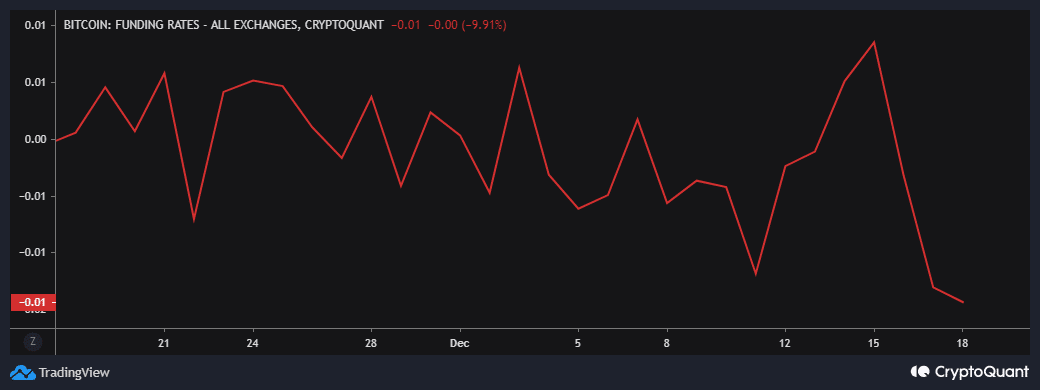

Supply: CryptoQuant

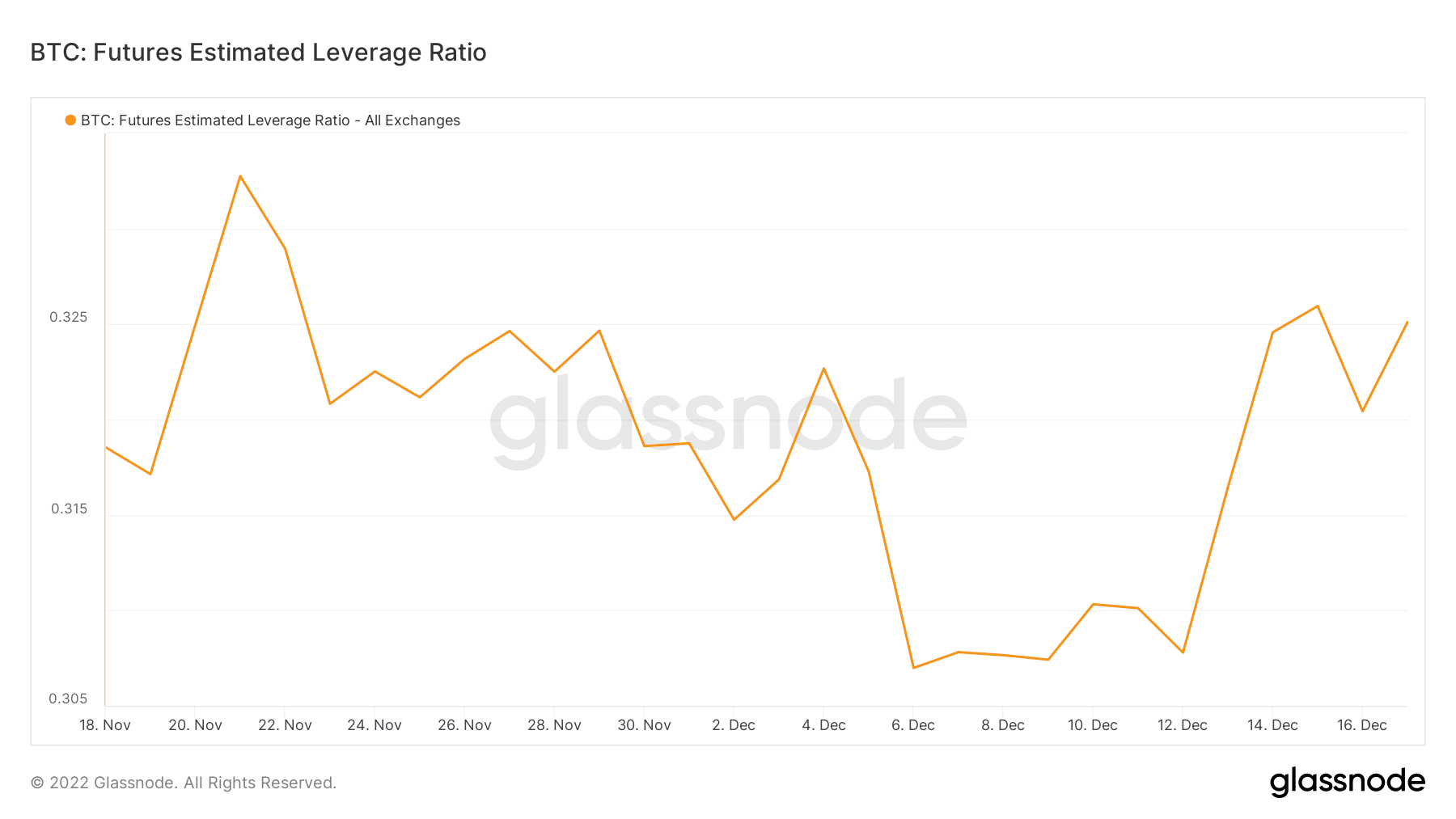

This drop in funding charges indicated that brief merchants had the higher hand and had been keen to pay funding to long-term merchants. However does this imply that buyers may see extra volatility in favor of the draw back? Bitcoin’s futures estimated leverage ratio rose during the last six days.

Supply: Glassnode

Increased leverage meant that Bitcoin was more likely to expertise increased volatility. A collective statement of the indications recommended a considerable chance of extra downward stress. Nevertheless, the demand for BTC at cheaper price ranges recommended that it would face important friction on its method down.

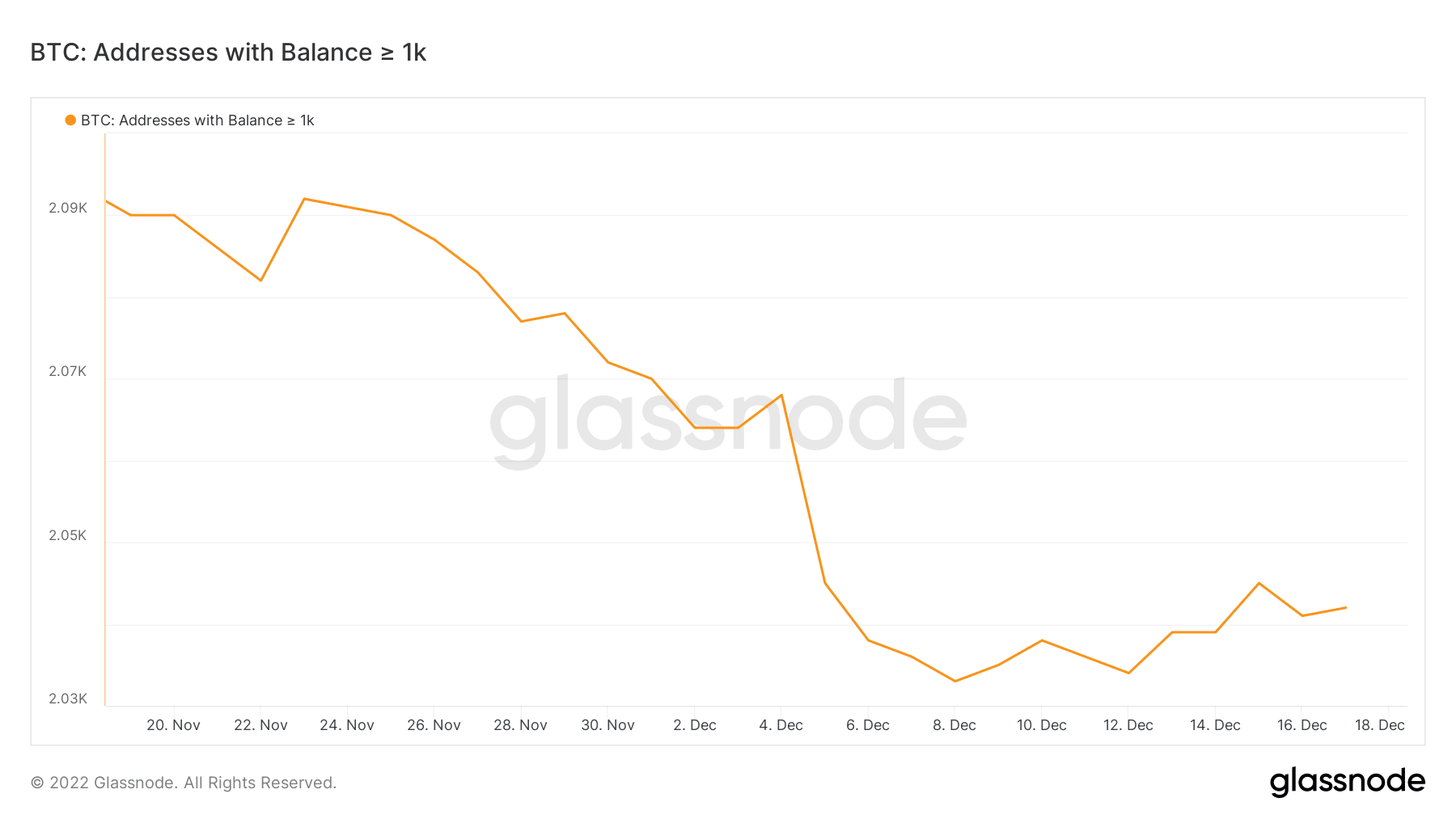

On the plus facet, Bitcoin noticed a gradual demand restoration from whales. Addresses holding over 1,000 BTC elevated barely within the final 10 days. This may additionally soften the draw back and herd BTC in direction of a slim vary.

Supply: Glassnode

Primarily based on the above observations, it’s clear that Bitcoin’s volatility was on its strategy to restoration, and so was demand from whales. Alternatively, bullish demand was nonetheless low. Promote stress and low funding fee recommended the potential for an fascinating week forward.

![Assessing the state of Bitcoin’s [BTC] demand in the derivatives market](https://cryptonitenews.io/wp-content/uploads/2022/12/1671359324931-143de8c2-9593-416c-a7cd-1db57863c131-1000x600-768x461.png)