Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- Litecoin fell right into a zone of sturdy assist from the mid-range, bullish order block and a high-volume node

- This might nonetheless fail if Bitcoin stumbles beneath $16.2k within the subsequent couple of days

Litecoin [LTC] introduced a barely dangerous shopping for alternative on the worth charts. Danger-averse merchants ought to await 19 December’s buying and selling to set a path for Litecoin within the coming week. Nonetheless, the development has been bearish in latest days.

Learn Litecoin’s [LTC] Value Prediction for 2023-24

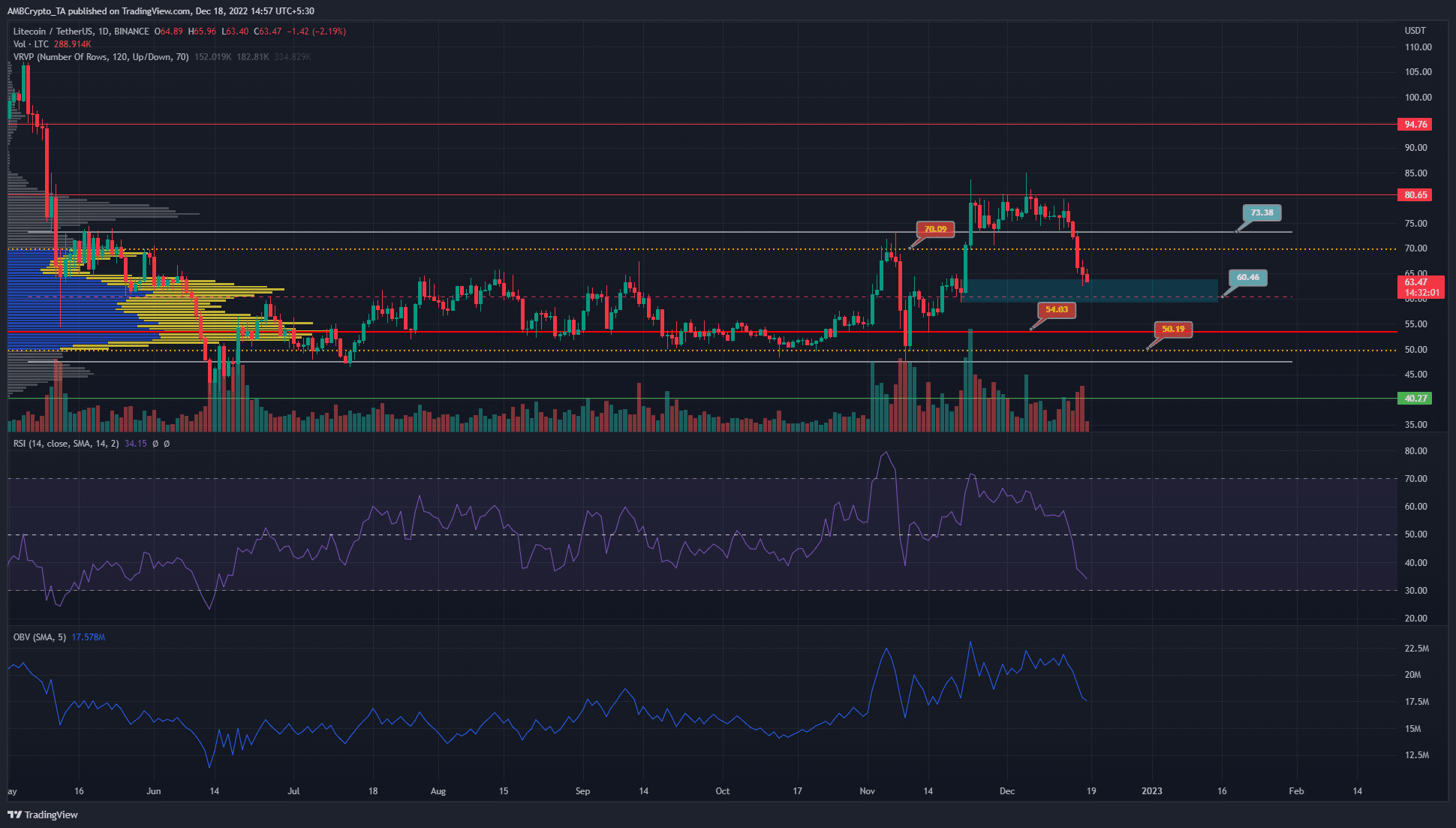

Late in November, Litecoin retested the previous vary highs as assist and bulls sought to push the costs again above $80.65. Their efforts had been met with higher promoting stress. The weak spot of Bitcoin [BTC] noticed Litecoin lose $73.4 as assist.

Litecoin falls again into the vary: can the bulls defend $60?

Supply: LTC/USDT on TradingView

Since June, Litecoin has traded inside a variety from $73.4 to $50.2. The mid-point of this vary lay at $60.5. This degree additionally has confluence with a bullish order block on the day by day timeframe that LTC shaped on 21 November.

Due to this fact, a bullish dealer can search for entries to an extended place within the $60-$64 area. A decrease timeframe swing failure sample and a bullish reversal might be one such set off to look out for.

The concept that consumers nonetheless have some power got here from the On-Stability Quantity (OBV). This indicator shaped increased lows since mid-June. Nonetheless, the latest wave of promoting pressured the OBV to interrupt its construction. It stays to be seen if demand arrives as soon as extra. Invalidation of the thought of a bounce from the mid-range worth can be a day by day session shut beneath $59.4. In that state of affairs, the bias would have flipped to a bearish one.

The Relative Energy Index (RSI) additionally dropped sharply beneath impartial 50 to point bears had been dominant. The VPVR instrument confirmed the Level of Management at $54, marking it as a assist degree ought to LTC fall beneath $59.4. The Worth Space Excessive at $70 can function resistance within the occasion of a bounce. The $61.7 space was a high-volume node, making it a assist zone alongside the mid-range and the bullish order block.

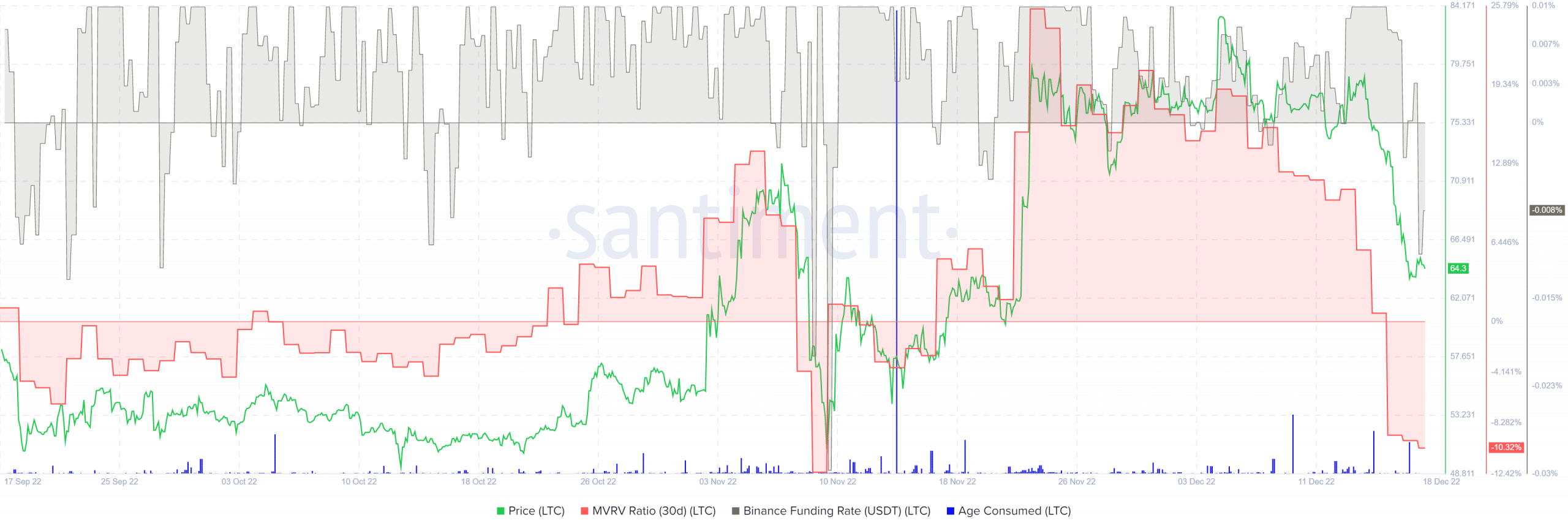

The funding price was unfavourable in response to the steep drop, and MVRV additionally took successful

Supply: Santiment

The Market Worth to Realized Worth (MVRV) ratio (30-day) had been nicely above the zero mark since 17 November, following Litecoin’s surge from $60 to $70.44. Within the weeks that adopted, the MVRV slowly tailed off, and the latest losses pressured the metric into unfavourable territory. This confirmed short-term holders at a loss as soon as extra. The funding price was additionally deeply unfavourable, exhibiting sentiment was bearish towards the asset within the futures markets.

In the meantime, there was no massive spike on the age consumed metric. The age consumed was higher through the December 10 retest of $73.4 as assist. The inference from this metric alone was {that a} restoration might be doable, as promoting was not as intense because it appeared on the worth charts.