- Layer-2 options present development by way of TVL share, based on a brand new report

- The variety of lively addresses and transactions elevated as effectively

In accordance with information supplied by Messari, a crypto analytics agency, layer-2 options, resembling Arbitrum and Optimism witnessed enhancements by way of adoption. This could possibly be because of the rising TVL share of each L2s.

As developer tooling has matured, it’s change into simpler for tasks to port over to rollups like @arbitrum and @optimismFND and for CEXs to combine as fiat on and off-ramps.

Because the hype of different L1s wore off, dedication to scaling the Ethereum ecosystem paid dividends. pic.twitter.com/xMTo0DfaOm

— Messari (@MessariCrypto) December 17, 2022

Learn Optimism’s [OP] Value Prediction for 2023-24

Arbitrum and Optimism: Competing within the large leagues

Messari’s information additional discovered that Arbitrum and Optimism had grown by way of whole worth locked (TVL) share. These protocols outperformed different protocols resembling Fantom and Solana on this class.

One cause for a similar could be that as know-how has progressed, it has change into simpler for tasks to port over to rollups like Arbitrum and Optimism. Centralized exchanges have additionally built-in these layer 2 options.

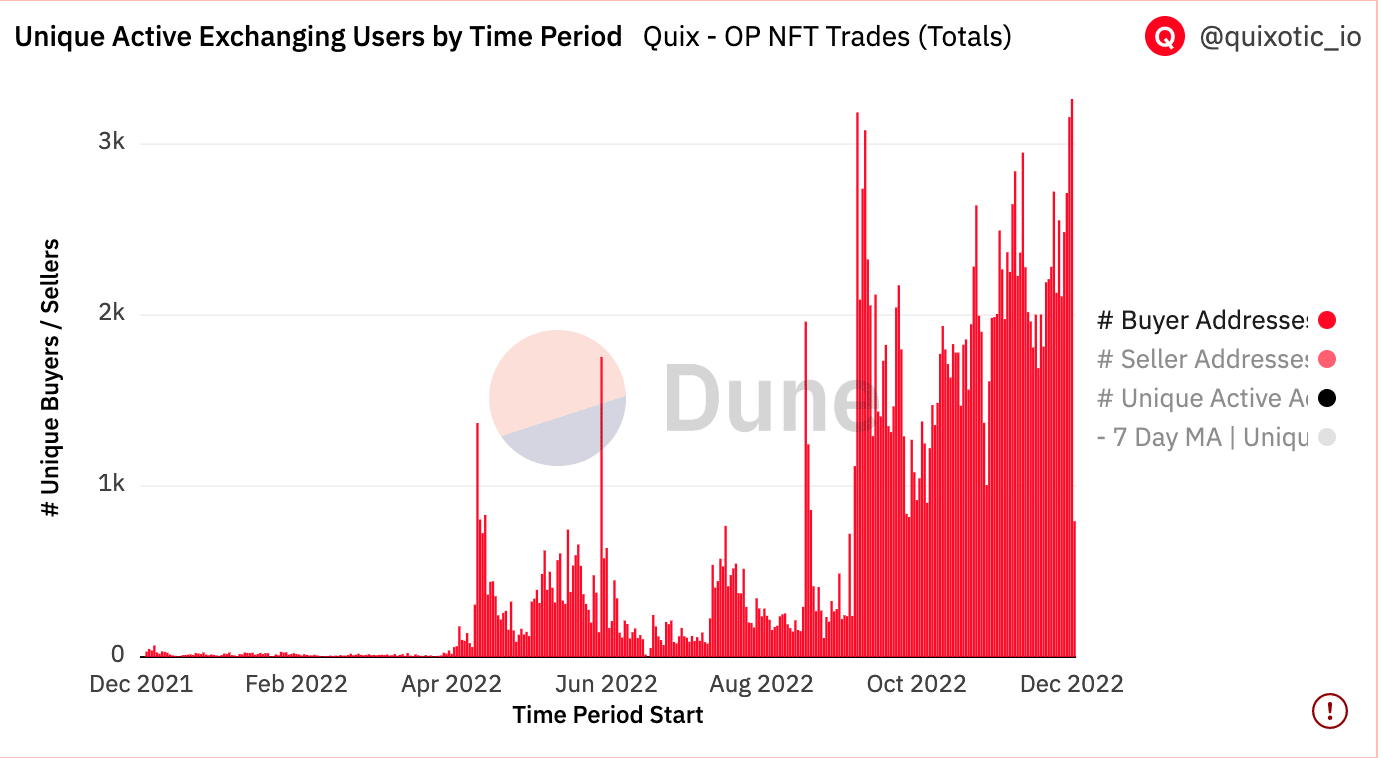

These L2 options generated consumer curiosity by way of different means as effectively. As an example, Optimism confirmed constructive development within the NFT house.

Information acquired by Dune Analytics advised that the variety of patrons of Optimism NFTs had grown considerably over the previous couple of months. Initiatives resembling launching Optimism quests and different launches to draw extra customers paid off for the layer 2 options.

Supply: Dune Analytics

Comparisons to be made on Layer 2 options

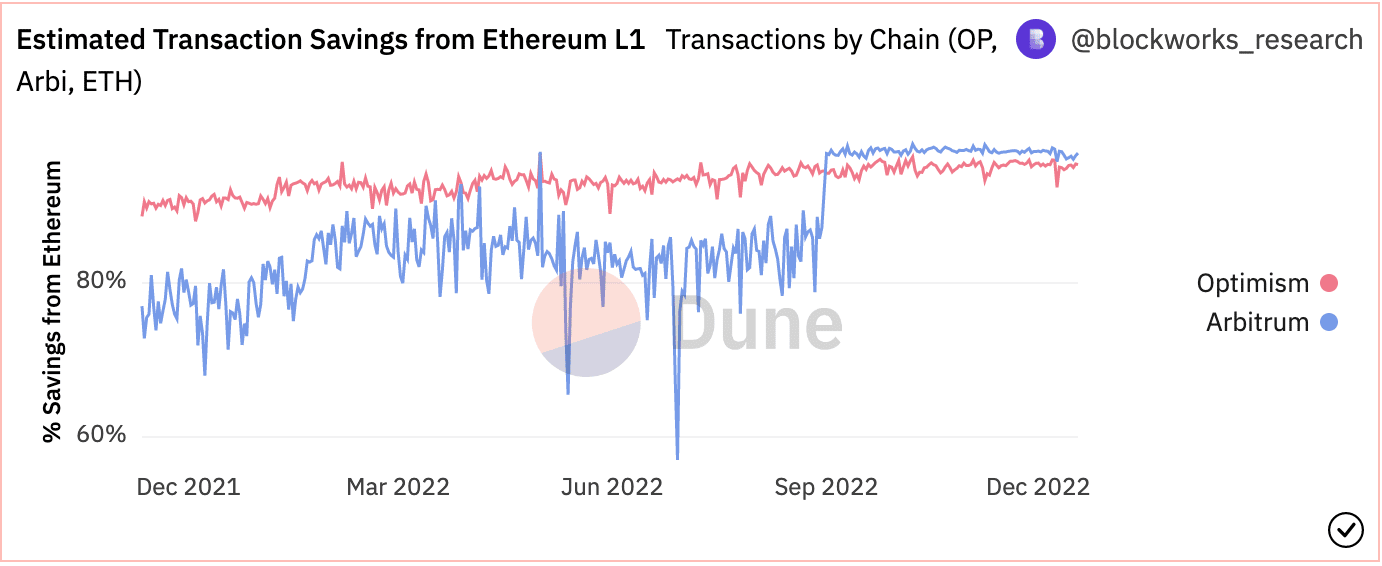

Nonetheless, the principle enchantment of the Layer 2 options could be their declining transaction charges.

In accordance with information gathered by Dune Analytics, the charges on each the layer 2 options had declined considerably. Coupled with that, each layer 2 options helped customers save funds. Despite the fact that each options helped customers from excessive Ethereum fuel charges, Arbitrum outperformed Optimism and saved customers extra money.

Supply: Dune Analytics

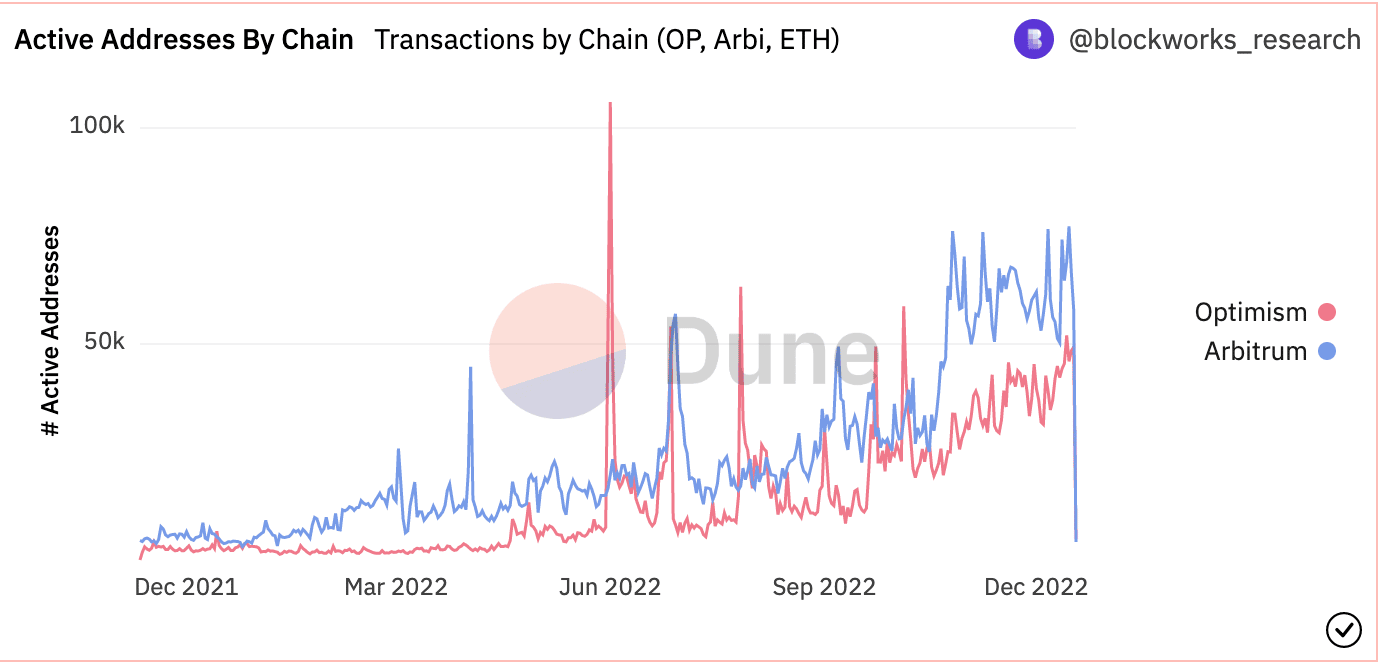

Each options witnessed a spike in exercise, too. During the last three months, lively addresses on each options observed an enormous spike. Nonetheless, even on this regard, Arbitrum had extra lively addresses on its community than Optimism.

Supply: Dune Analytics

One other indicator of the expansion of the layer 2 options could be the truth that the variety of transactions on the options was escalating. The transactions being made on their protocols have been getting nearer to the variety of transactions being made on Ethereum.

If these layer 2 options transactions proceed moving into the identical trajectory, they could match the variety of transactions being made on the Ethereum community.

Supply: Dune Analytics

It stays to be seen whether or not the L2 options would be capable to meet up with Ethereum sooner or later.

On the time of writing, Optimism’s native token, OP, had capitalized on the curiosity in its community. It was at the moment buying and selling at 0.9406 after its value rose by 0.43% within the final 24 hours.