Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The upper timeframe charts confirmed overbought circumstances however APT hasn’t slowed down but.

- Brief-term consolidation close to $18 meant a retest might supply a shopping for alternative, with Fibonacci extension ranges to take revenue at.

Bitcoin broke out of a bull flag near-term sample. On the time of writing, it retested the $22.9k-$23k area and stays more likely to proceed larger within the hours that observe. Aptos has hardly wanted encouragement in latest weeks.

Is your portfolio inexperienced? Examine the Aptos Revenue Calculator

Regardless of overbought circumstances, the worth has gained greater than 50% in below two days. This highlighted the sturdy bullish sentiment. Fading this rally could possibly be particularly risky- however was it sensible to aim to purchase the asset now?

In case you’re a bull, be careful for these short-term assist ranges

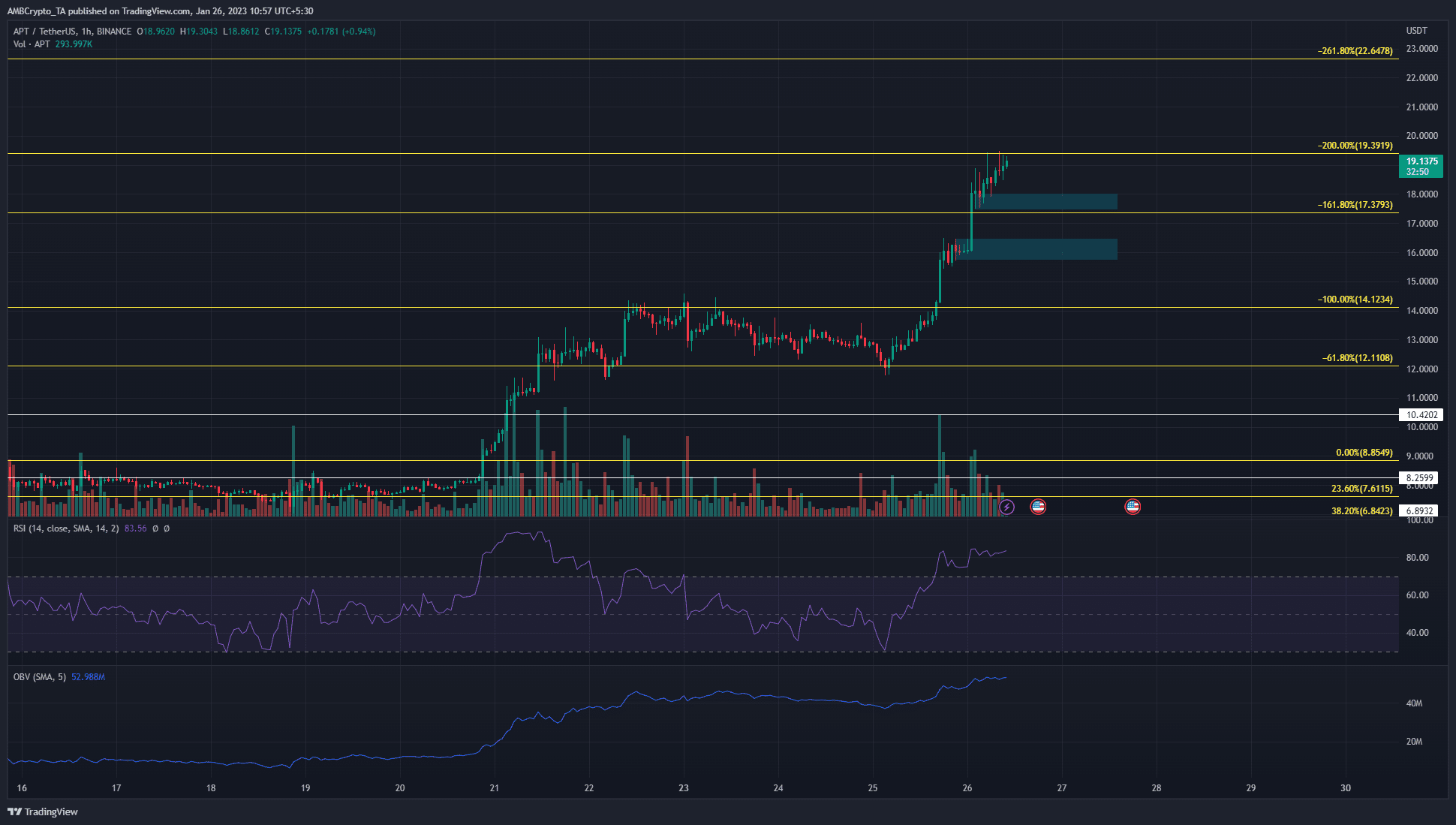

Supply: APT/USDT on TradingView

Bitcoin’s impending transfer upward was an element that would sway APT to make additional good points. A number of days in the past, Aptos consolidated within the $12-$14 area earlier than exploding larger to achieve $19. Equally, merchants can wait for one more vary to be established.

The near-term consolidation seen at $16 and $17.7, highlighted in cyan, could possibly be a spot to be careful for. A pointy bullish response from both of those ranges could possibly be a tell-tale signal of the underside of a variety.

Practical or not, right here’s APT’s market cap in BTC’s phrases

Additionally it is attainable that APT can retrace beneath $16. If that occurs, the $14.12 stage might see bulls re-enter the market with energy. Alternatively, an prolonged transfer above $19.39 can be the extra harmful situation. This could possibly be fueled by quick liquidations reasonably than demand, and attempting to commerce that transfer could possibly be dangerous.

The 4-hour RSI was above the 70-mark to indicate sturdy bullish momentum, and a bearish divergence has not fashioned on this timeframe but. The OBV has additionally fashioned larger lows over the previous 24 hours to point out regular shopping for strain.

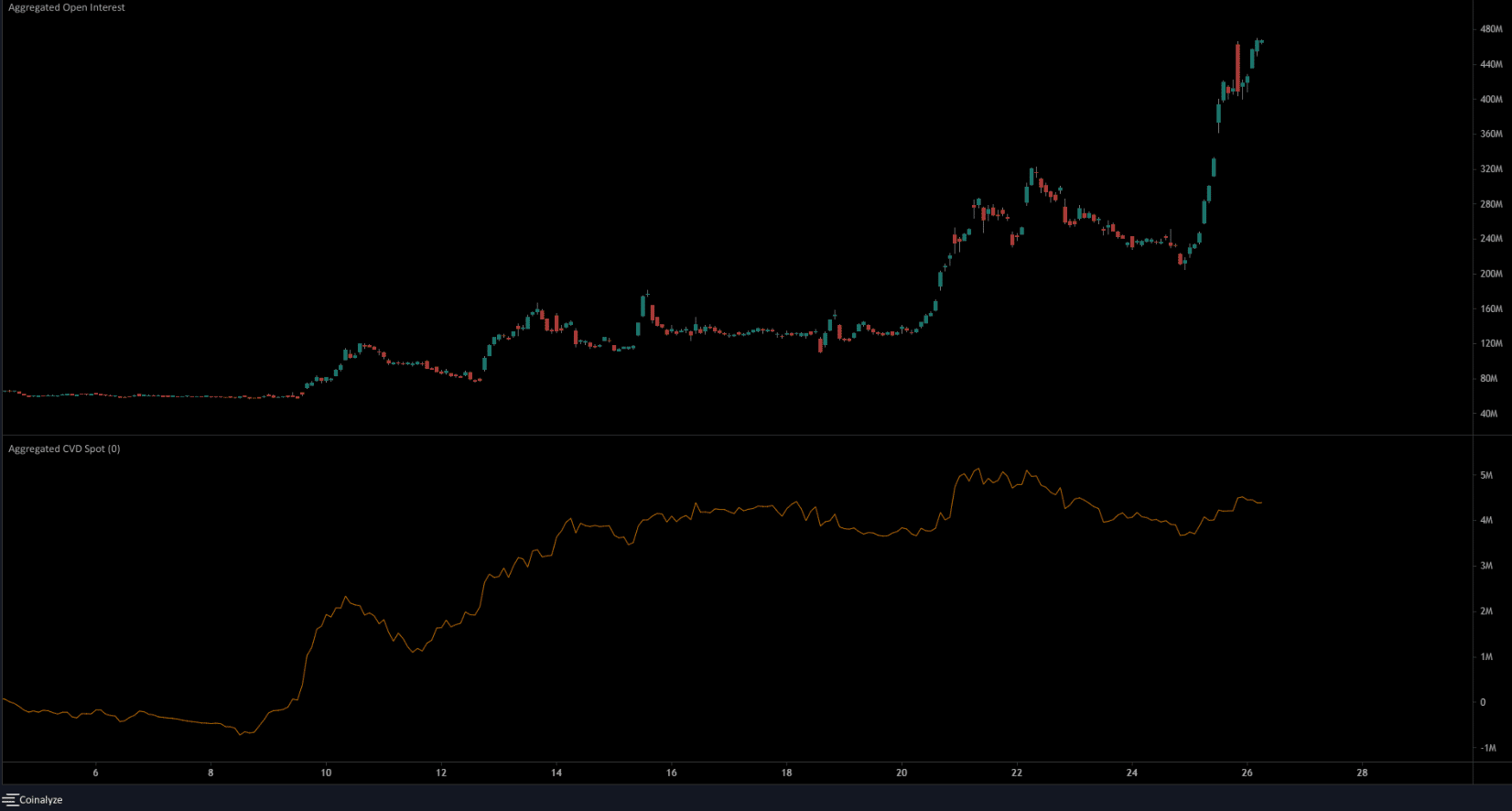

Spot CVD has receded and Open Curiosity and funding fee imply volatility might ensue

Supply: Coinalyze

The Open Curiosity has elevated enormously up to now three weeks. The spot CVD was additionally in a powerful uptrend until January 21. Thereafter, the spot CVD tailed off to make a collection of decrease highs. Regardless of this, the OI continued to rise massively.

Coinglass information confirmed funding rate was extraordinarily negative- a sign that many merchants had been attempting to quick APT. This might see a brief squeeze, to drive early quick entries to puke their positions earlier than a downward reversal. Such a brief squeeze can be the riskiest situation to attempt to commerce.

![Aptos [APT] is in price discovery, are you too late to the party?](https://cryptonitenews.io/wp-content/uploads/2023/01/PP-1-APT-cover-1000x600-768x461.jpg)