Blockchain

App-specific blockchains, or appchains, are particularly designed to help the creation and deployment of decentralized purposes (DApps). In an appchain, every app runs on its separate blockchain, linked to the principle chain. This permits for larger scalability and adaptability, as every app will be custom-made and optimized for its particular use case.

Appchains are additionally an alternate answer for scalability to modular blockchains or layer-2 protocols. Appchains current related traits to modular blockchains, as it’s a sort of blockchain structure that separates the info, transaction processing and consensus processing components into distinct modules that may be mixed in varied methods. These will be considered “pluggable modules” that may be swapped out or mixed relying on the use case.

This separation of features is why there’s larger flexibility and flexibility to appchains in comparison with conventional, monolithic blockchain architectures, the place these features are all constructed into one program. They permit for the creation of custom-made, sovereign blockchains — tailor-made to fulfill particular wants and use circumstances — the place customers can deal with particular duties whereas offloading the remainder to different layers. This may be useful concerning useful resource administration, because it permits totally different events to specialise in totally different areas and share the workload.

The scalability of blockchain expertise is a key issue for its future success. As a result of scalability points in layer-1 blockchain structure, there was a shift towards utilizing modular blockchains or layer-2 protocols, which supply options to the restrictions of monolithic methods.

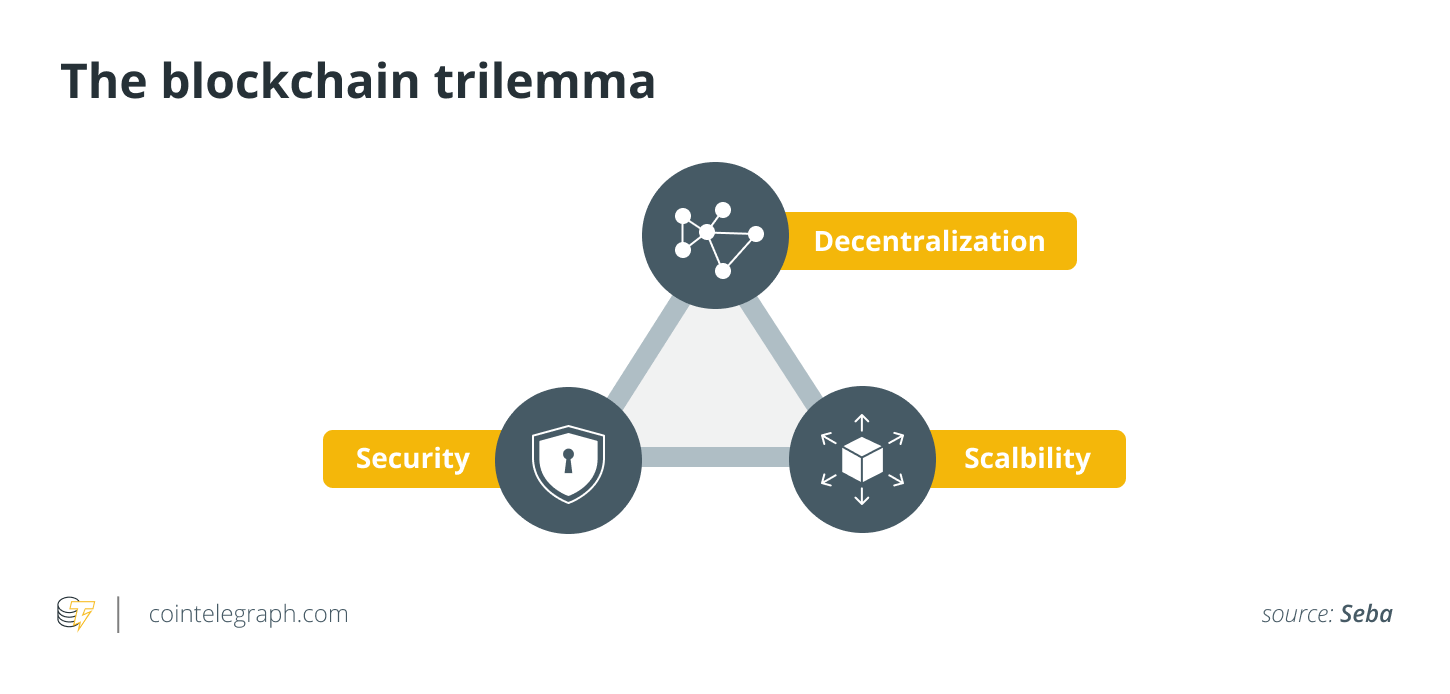

Scalability is one facet of the blockchain trilemma going through builders.

Consequently, the adoption of layer-2 networks is rising, as they supply a strategy to handle scalability and different points in present blockchain networks, significantly for a layer-1 like Ethereum. Layer-2 protocols provide decrease transaction charges, fewer capability constraints and quicker transaction speeds that paved the best way for its rising adoption, catching the eye of 600,000 customers.

Appchains vs. monolithic chains

Appchains will not be solely totally different from monolithic chains. Monolithic chains, like appchains, observe the fat-protocol thesis the place a single chain handles most decentralized finance (DeFi) exercise and settles all the things on one layer with a precious token. Nevertheless, layer-1 blockchains are exhausting to scale. Appchains don’t at present have the identical restricted house points as monolithic chains, however they will use modular options sooner or later if vital.

“The basic worth proposition of appchains is sovereign interoperability,” defined Stevie Barker, a researcher at Osmosis Labs, a decentralized buying and selling protocol on the Cosmos ecosystem. He instructed Cointelegraph:

“Appchains are sovereign as a result of they’ve exact management over their total stack and another space of blockchain construction and operations they need to customise. And they’re interoperable as a result of appchains can freely work together with one another.”

Appchains can optimize for person expertise and make execution quicker, simpler and extra environment friendly. They will additionally safe their chain by recruiting validators to implement code, produce blocks, relay transactions and extra. Alternatively, they will borrow the safety from one other set of validators, interchain safety, or mix each choices to share safety among the many total interchain.

Associated: US federal companies launch joint assertion on crypto asset dangers and protected practices

Osmosis has developed a brand new tackle proof-of-stake known as “superfluid staking” that goals to enhance each safety and person expertise. This strategy permits liquidity suppliers to stake the tokens of their liquidity pool (LP) shares to assist safe the chain. In return, they are going to obtain staking rewards along with their LP rewards, which may help enhance their capital effectivity. This is usually a extra seamless and built-in strategy to staking, as liquidity suppliers can concurrently earn rewards for his or her LP and staking actions.

With present developments, all the interchain will be capable to use its staked property for DeFi actions with out risking centralization or compromising chain safety, as is commonly the case with conventional liquid staking derivatives. This can enable customers to make the most of DeFi alternatives whereas sustaining the safety and decentralization of their staked property.Valentin Pletnev, CEO and co-founder of Quasar, a decentralized appchain designed for asset administration, instructed Cointelegraph:

Proudly owning all the stack from prime to backside permits for straightforward worth technology and objective for the token — it additionally permits for greater effectivity as chains will be designed round a particular use case and optimized for it.

Appchains can also successfully handle Maximal Extractable Worth (MEV), which refers back to the earnings obtained by those that have the ability to determine the order and inclusion of transactions. MEV has been an issue for DeFi customers throughout varied ecosystems. Nevertheless, appchains can extra rapidly implement on-chain options that considerably cut back malicious MEV and redirect wholesome arbitrage earnings from third events to the appchain itself. This may help enhance the person expertise and cut back the potential for exploitation within the DeFi ecosystem.

Appchains enable for radical blockchain experiments to be carried out rapidly. Whereas Tendermint and the Cosmos SDK are outstanding applied sciences that allow apps to spin up inter-blockchain communication (IBC) protocol-ready blockchains rapidly, the entire Cosmos stack shouldn’t be essential to develop into an IBC-connected appchain. Barney Mannerings, a co-founder of Vega Protocol, an application-specific blockchain for buying and selling derivatives, instructed Cointelegraph:

“Because the house is transferring towards a multichain and multi-layered world — through which property will be moved between chains and particular scaling layers — a distribution of an software on a number of hubs could make sense.”

Appchains provide a path for the brand new communication normal of blockchains. Native token switch between ecosystems eliminates bridges and permits for native token switch cross-chain.

App-specific blockchains additionally provide a number of precious advantages that make them engaging for builders and customers alike. Their potential to enhance purposes’ scalability, efficiency, safety and interoperability makes them a precious software for constructing the following technology of software program. Because the expertise continues to evolve, we’ll seemingly see increasingly more builders adopting app-specific blockchains for his or her purposes.

Associated: Blockchain Interoperability, Defined

Nevertheless, the usage of a number of appchains could make them extra complicated and troublesome to handle in comparison with different varieties of blockchain expertise. Since every app runs on its blockchain, managing and sustaining a number of blockchains will be resource-intensive and time-consuming. Integrating totally different app chains will be difficult on account of potential compatibility points.

Total, the advantages and disadvantages of app chains depend upon the particular use case and necessities of the DApps underneath growth. In some circumstances, app chains could present the best answer for constructing and deploying DApps, whereas different varieties of blockchain expertise could also be extra appropriate in others.