Standard crypto analyst Benjamin Cowen is warning Bitcoin (BTC) merchants that the highest crypto asset is at the moment flashing an ominous indicator.

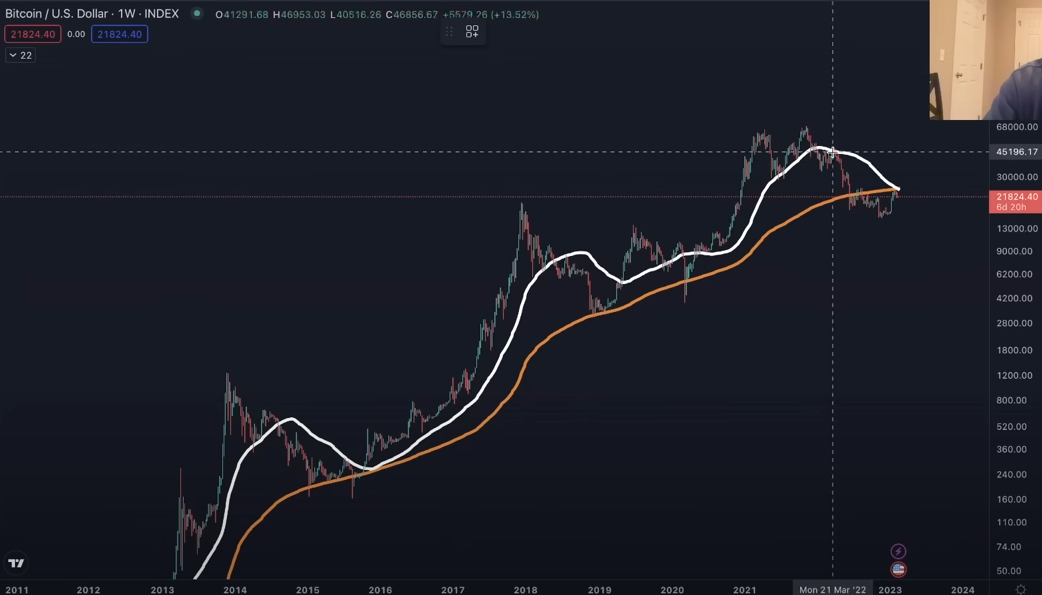

In a brand new YouTube video, Cowen tells his 784,000 subscribers that Bitcoin is experiencing a weekly demise cross for the primary time ever.

A demise cross takes place when a short-term transferring common crosses beneath a long-term transferring common, reflecting worth weak point.

The analyst notes that BTC’s 50-week easy transferring common (SMA) is at $24,678 and its 200-week SMA is now at $24,999.

Says Cowen,

“Usually in bear markets, we’re not beneath the 200-week SMA, like hardly in any respect. And if [Bitcoin] is, it’s a comparatively brief time frame. It’s kind of simply these wicks for essentially the most half. Now, on this bear market, we’ve mainly been beneath it since June, for essentially the most half…

Now [BTC] type of come again as much as [the 200-week SMA], however now we have not definitively damaged by means of the extent that traditionally held as assist.”

Cowen says the worst-case situation for Bitcoin can be it mimicking the Nasdaq through the dot-com crash from 2000-2002.

“You get that 77% pullback, adopted by a 60% rally as much as the 50-week SMA, after which adopted by a gradual bleed into the ultimate low. However do word that even the Nadaq, if you did get that, it truly had type of a neighborhood double prime, the place it got here as much as the 50-week, got here again down, hovered for a… month, popped again up, after which got here down. In order that’s truly what the Nasdaq did approach again when, so perhaps be looking out for that.”

BTC is buying and selling at $21,721 at time of writing.

I

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney

Featured Picture: Shutterstock/Andy Chipus