- ETH whales make AAVE one of many prime 10 bought cash of the week.

- AAVE may witness a bullish divergence this week.

Aave’s [AAVE] efficiency this week indicated a continuation of the bearish pattern that began final week. Up to now, the coin has did not safe sufficient shopping for stress to recuperate November losses. However it isn’t all doom and gloom, now that ETH whales have elevated their demand.

Learn Aave’s [AAVE] Value Prediction 2023-24

WhaleStats revealed that AAVE was one of many prime 10 most-purchased tokens among the many 500 largest ETH whales within the final 24 hours. Why is that this an necessary remark?

Nicely, ETH whales have an enormous impression on demand and costs in DeFi. The WhaleStats remark may thus signify that ETH whales discover AAVE to be engaging at its present worth level.

JUST IN: $AAVE @AaveAave now on prime 10 bought tokens amongst 500 largest #ETH whales within the final 24hrs 🐳

Peep the highest 100 whales right here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see information for the highest 500!)#AAVE #whalestats #babywhale #BBW pic.twitter.com/3KASt8SJP7

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 13, 2022

Is AAVE on the trail to a bullish breakout?

This new revelation about ETH whales meant AAVE was increase bullish demand on the time of writing. This made it some of the fascinating tokens to observe for in direction of mid-week, as this may set off a resurgence of bullish demand and extra volatility. However buyers want to take a look at the place AAVE was by way of worth exercise to know the potential impression.

AAVE’s $60.16 press time worth represented a slight premium from its $58.25 low within the final 24 hours. This confirmed that there was certainly some bullish stress coming into the market. However was it sufficient to assist extra upside?

Supply: TradingView

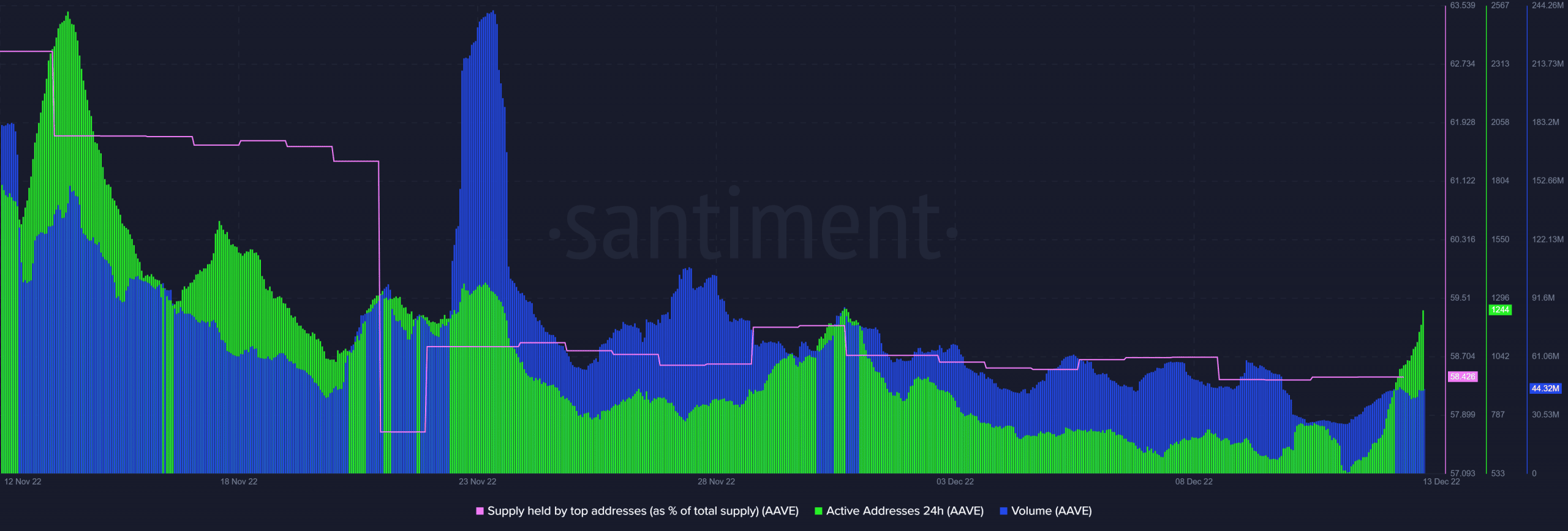

AAVE’s quantity registered a slight uptick within the final 24 hours, confirming its elevated buying and selling exercise. Nevertheless, the uptick was comparatively low, thus explaining why the worth didn’t obtain a considerable bounce. Regardless of this, there was a large enhance within the variety of day by day energetic addresses.

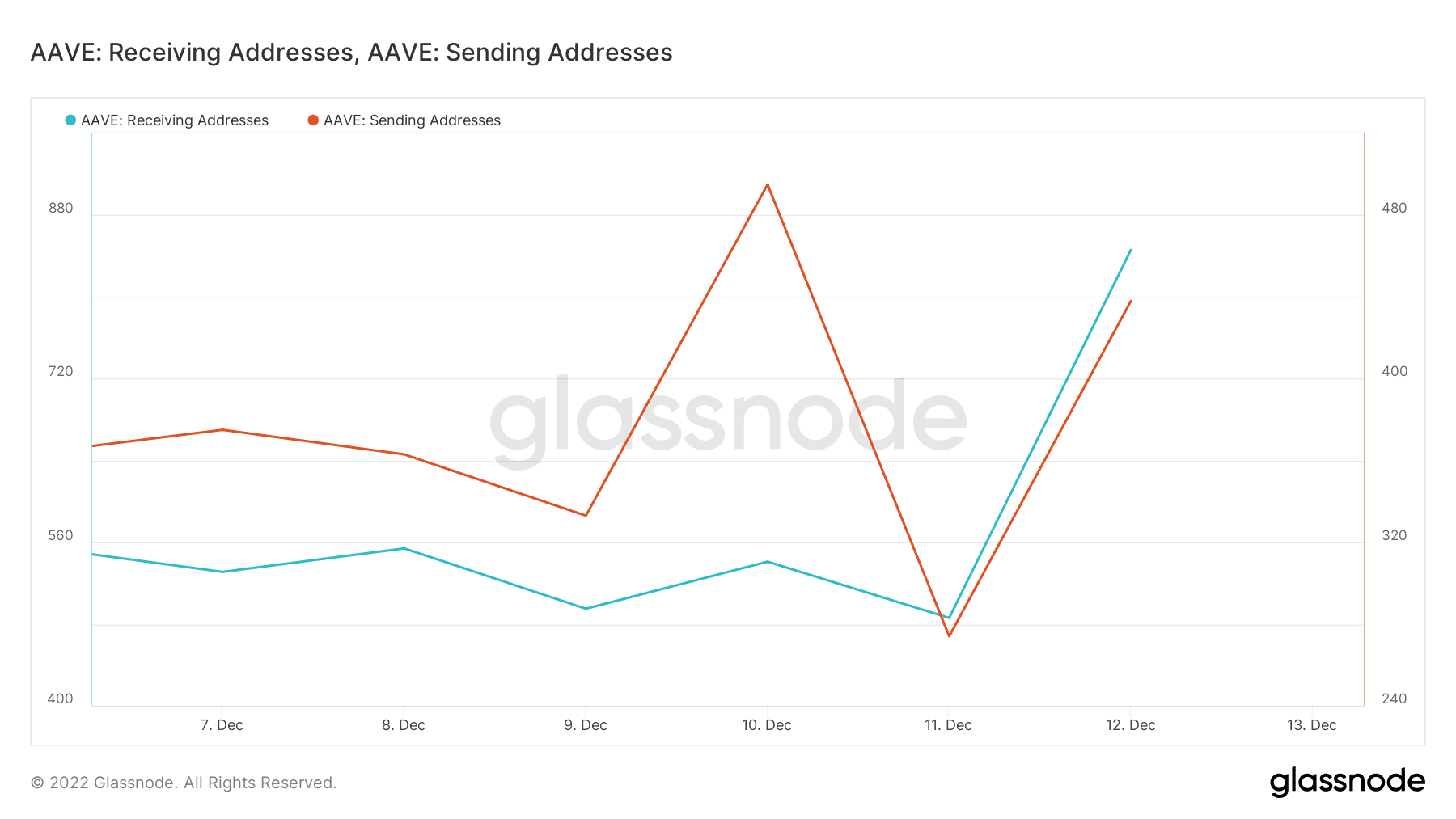

AAVE buyers could discover it fascinating that the coin’s tackle flows elevated within the final 24 hours till press time. Much more noteworthy is that receiving addresses outweighed the sending addresses by virtually double. In different phrases, there’s a web increased purchase stress than promote stress available in the market.

Supply: Glassnode

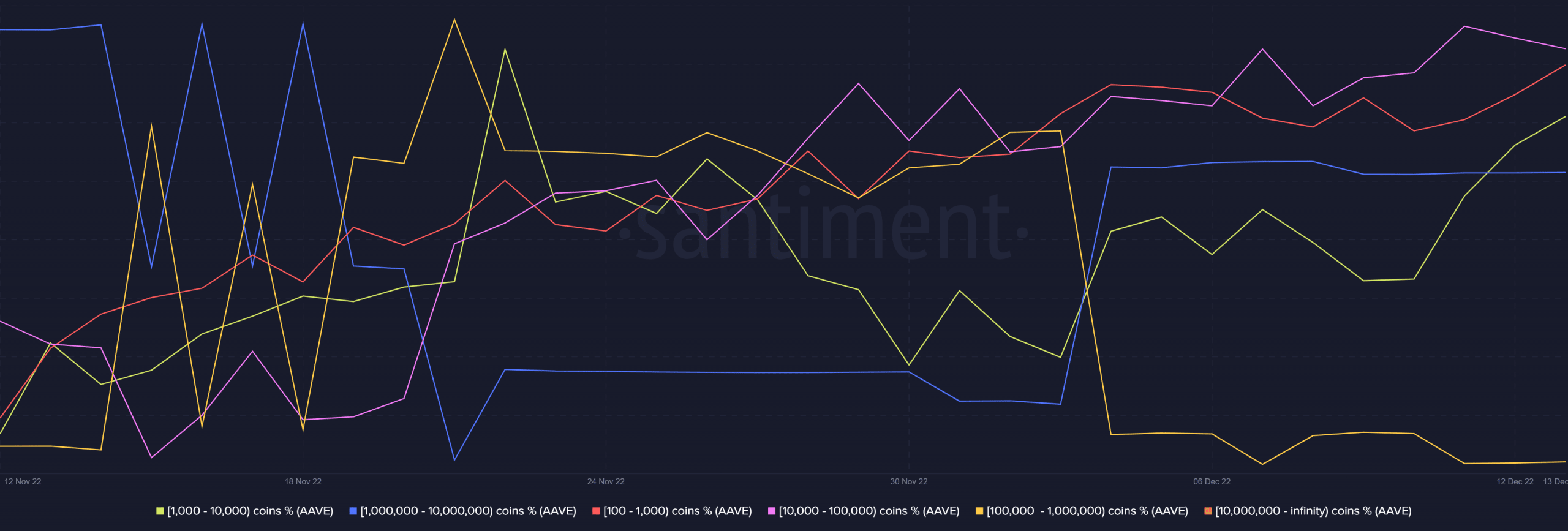

The provision distribution facet of issues revealed that the majority prime addresses haven’t added or subtracted from their balances within the final 24 hours.

That is notably the case for addresses holding 100,000 – 10 million AAVE. However, there was some promoting stress from addresses within the 10,000 – 100,000 bracket.

Supply: Santiment

Addresses within the 100 – 10,000 vary have steadily accrued within the final two days, thus canceling out a lot of the promoting stress.

What to anticipate shifting ahead

The above observations may point out that buyers have been growing their demand for AAVE as of 13 December. Thus, the coin could expertise extra volatility within the subsequent few days if the identical pattern continues. The truth that the present demand is backed by ETH whales is already excellent news for AAVE bulls.