Macroeconomist Henrik Zeberg is predicting both Bitcoin (BTC) and US stocks are on the verge of a massive upswing.

Zeberg tells his 109,900 Twitter followers that he believes Bitcoin will soon break out from the $28,000 level and cross $30,000.

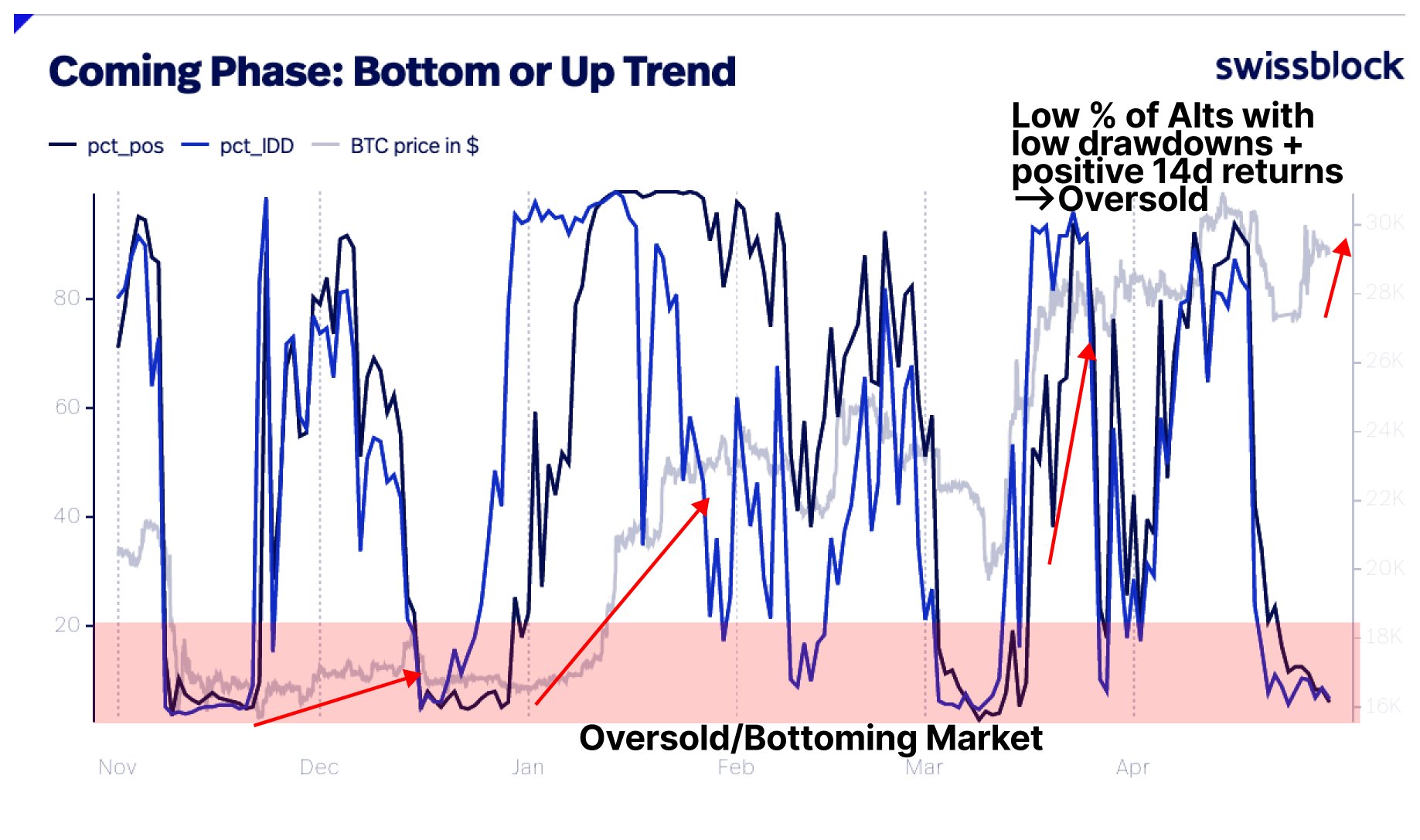

Zeberg shares a chart from crypto-focused hedge fund Swissblock that indicates Bitcoin is oversold and trading below its true value.

“Bitcoin $28,000 is the battleground. Swissblock’s indicators tell us the uptrend is coming next!”

Bitcoin is trading for $28,665, up 2.2% during the past 24 hours.

Zeberg also believes stocks are about to experience a “blow-off top,” and predicts the Federal Reserve will start printing more money, injecting liquidity into the markets.

He uses the Fibonacci Ratio within an Elliott Wave structure to predict the S&P 500 will skyrocket beyond 5,700 points before imploding down to 1,567 points.

“Lesson of the Day:

‘Wealth cannot be printed’ (Feeling of Wealth) All the ‘Wealth’ following the start of Money Printing will eventually collapse.

This is called the Deflationary Bust!

First – Blow-off top.”

The macro expert also says that multiple indicators are flashing bullishness for the Dow Jones Industrial Average (DJIA) index, including the Relative Strength Index (RSI), a technical indicator used in trading to gauge an asset’s momentum, and the moving average convergence divergence (MACD), a trend-following indicator.

“There is NOTHING BEARISH about this chart DJIA. This is as technically bullish as they come. Furthermore, economy is not in recession and inflation cools. Goldilocks phase and blow-off top are developing (no matter how much you swear).”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio