- One River CEO Eric Peters believes the following crypto bull run will likely be very highly effective and pushed by institutional adoption

- Regulatory uncertainty stopping institutional entry, he added

Eric Peters, CEO of One River Digital Asset Administration, believes the following crypto bull run will likely be very highly effective as it will likely be pushed by institutional adoption. In reality, the exec believes {that a} bull run may need begun already, regardless of prevailing downsides.

On a latest edition of the Bankless podcast, the exec claimed that crypto-winter has already handed, evaluating final 12 months’s debacle to the Wall Avenue crash of 1929.

Peters believes main establishments will take part within the subsequent cycle. In reality, he’s “extraordinarily bullish” for the medium to long run. Moreover, he urged that the bull run has already begun, citing the market’s appreciation because the starting of the 12 months.

Bitcoin completed 2022 with a worth of round $16,500. On the time of writing, it was buying and selling at round $22,400 (A surge of 35%). It even peaked to $25,000 in February, a worth final seen in June final 12 months.

Peters additionally touched upon the FTX episode. In doing so, he credited his agency’s conservative method and shared the explanations behind them not falling for FTX’s hype.

In line with Peters, what stops establishments from diving into the crypto-ecosystem is the regulatory uncertainty. As of now, two nationwide regulatory our bodies, the Commodity Futures Buying and selling Fee (CFTC) and the Securities and Change Fee (SEC), are engaged in a battle for management over crypto-assets. At present, there may be lots of confusion as as to whether Bitcoin, Ethereum are securities or commodities.

As soon as the U.S., Europe, and Canada impose acceptable guidelines and rules, institutional capital ought to move into the business, he concluded.

Peters additionally urged that the collapse of the cryptocurrency market in 2022 taught folks some vital buying and selling classes. He suggested potential buyers to hitch the bandwagon, provided that they’re ready for volatility and totally different cycles.

A lowdown on institutional investments

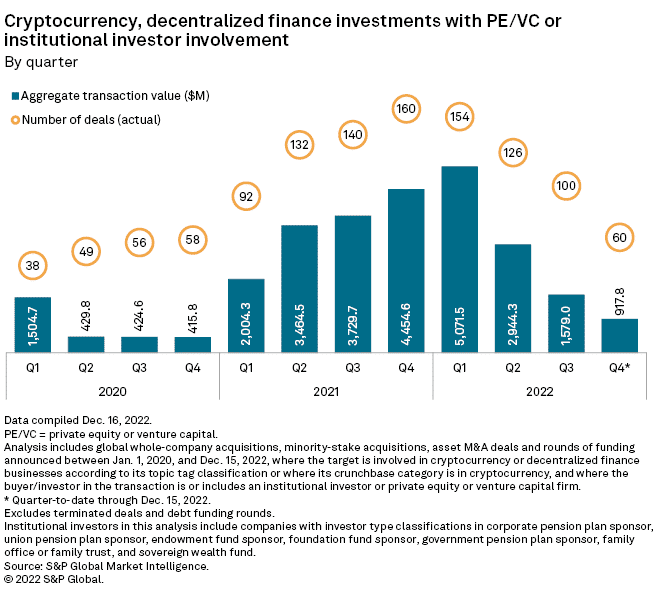

In the direction of the tip of final 12 months, S&P World Market Intelligence revealed a report, one which make clear institutional funding in cryptocurrencies and decentralized finance (DeFi).

As of 16 December, institutional buyers, non-public fairness, and enterprise capital investments in cryptocurrency and DeFi totalled $917.8 million because the starting of This autumn 2022. The quarterly complete was the bottom over the past two years. This was the identical interval throughout which FTX collapsed.

Supply: S&P World

Non-public fairness, enterprise capital, and institutional buyers elevated their investments in cryptocurrency and DeFi practically fivefold in 2021, totaling $13.65 billion. This development continued into the primary quarter of 2022, when institutional funding in cryptocurrency and DeFi reached a peak of $5.07 billion, earlier than plummeting precipitously.

The second-quarter complete of $2.94 billion in investments noticed a decline of practically 42% from the earlier three-month interval. Throughout this section, the Terra ecosystem collapsed too.