- The 24-hour TwelveFold public sale raised 735 BTC, or about 16.45 million at press time market worth

- Technical indicators sounded a bearish alarm for APE on the time of writing

Yuga Labs is within the information after it concluded the much-publicized public sale of its inaugural Bitcoin-based non-fungible token (NFT) assortment – TwelveFold. The highest 288 bidders gained one NFT every and can obtain their inscriptions inside per week, in line with an replace from Yuga Labs.

The TwelveFold public sale has ended. Congratulations to the highest 288 bidders – you’ll obtain your inscription inside one week. Legitimate bids that didn’t rank within the high 288 can have their bid quantity returned to their receiving deal with inside 24 hours.

— Yuga Labs (@yugalabs) March 6, 2023

In truth, TwelveFold went on so as to add that the 24-hour public sale raised 735 BTC or about $16.45 million, as per the press time market worth. Additionally, the best profitable bid was 7.1159 BTC – Price $159,282.

Yuga Labs added that unsuccessful bids that might not characteristic within the listing of the top-288 can have their bid quantity returned to the consumer’s receiving addresses in 24 hours.

Learn ApeCoin’s [APE] Worth Prediction 2023-24

Public sale hype fails to carry APE

The hype related to public sale didn’t carry the spirits of Apecoin [APE] traders, nonetheless. Take into account this – In response to CoinMarketCap, the altcoin fell by 1.7% over a 24-hour interval, on the time of writing.

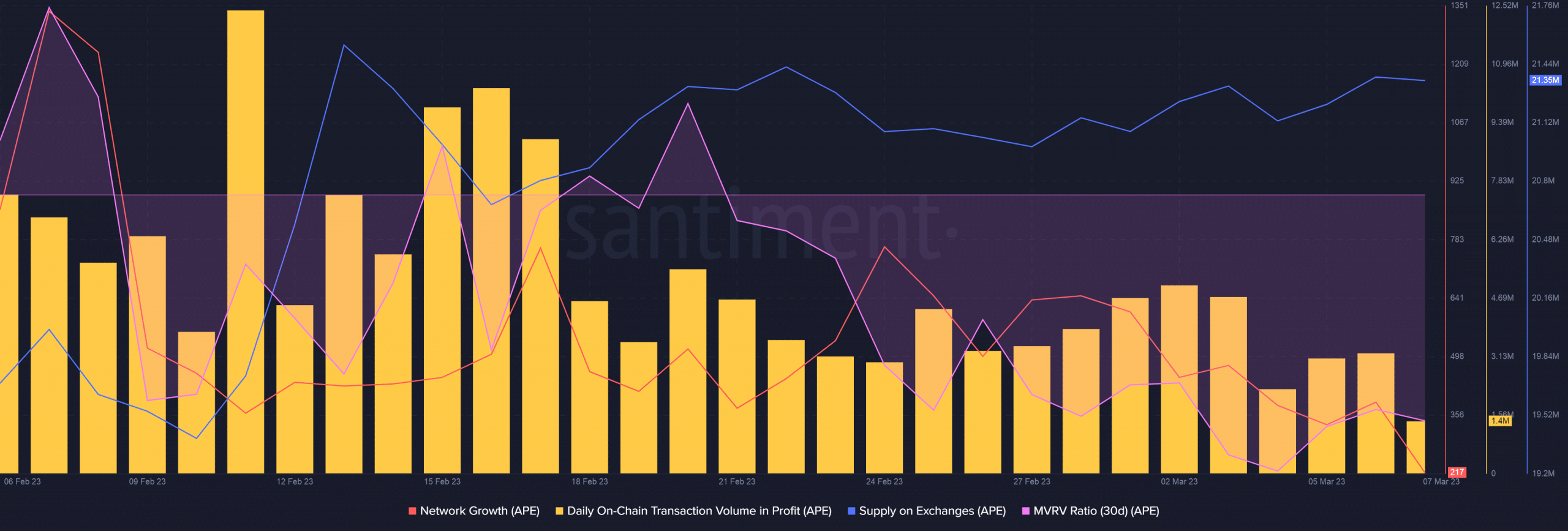

Moreover, it’s value mentioning that community progress went downhill after spiking within the early a part of February. This indicated that new addresses weren’t too eager on amassing APE.

One cause may very well be the sharp drop in every day transaction quantity in revenue. Figures for a similar contracted from $8.95 million in mid-February to only over $3.2 million, as of 6 March.

The adverse MVRV Ratio supported the aforementioned deduction. The potential of making losses on their holdings deterred new contributors from becoming a member of the community.

On the similar time, provide on exchanges elevated over the previous week, which may improve promoting strain within the brief time period.

Supply: Santiment

APE in bears’ grasp?

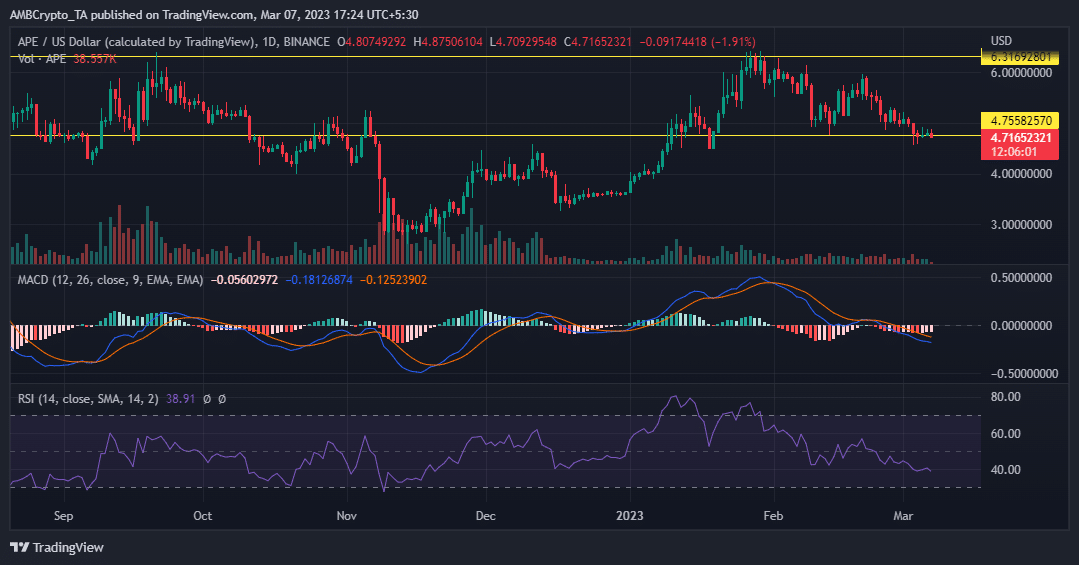

APE moved throughout the indicated vary for probably the most a part of February. On the time of writing, the bulls have been struggling to defend the vary lows, nonetheless. A transfer under it will tilt the market within the bears’ favor.

The Shifting Common Convergence Divergence (MACD) traversed contained in the adverse territory, sounding a bearish alarm. The Relative Power Index (RSI) inched in direction of the oversold territory, implying that promoting strain has remained excessive too.

Supply: Buying and selling View APE/USD

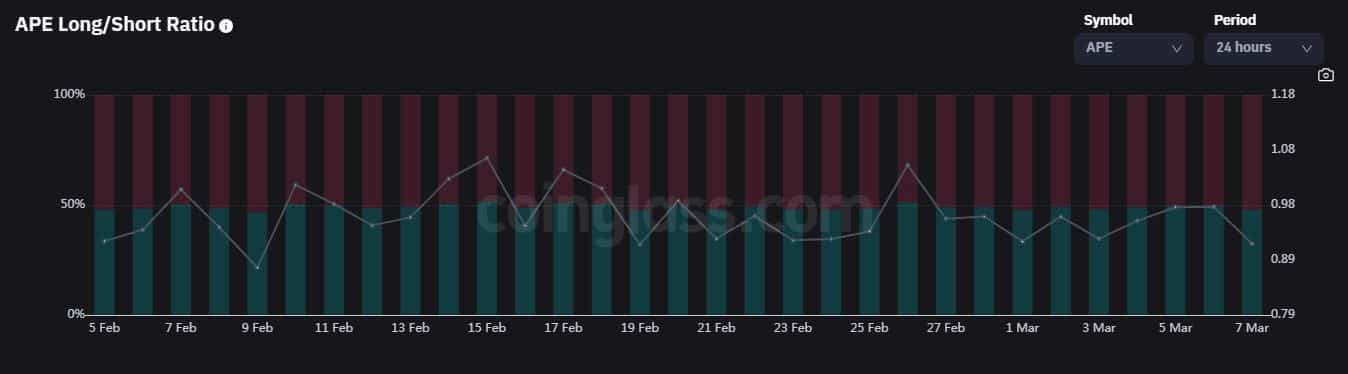

Lastly, traders have been turning pessimistic because the variety of brief positions for the crypto hiked during the last two days, in line with Coinglass. In truth, the Longs/Shorts Ratio was 0.92, on the time of writing.

Supply: Coinglass

How a lot are 1,10,100 APEs value at this time?

Whereas largely profitable, Yuga Labs bought some flak from customers for the best way it carried out the auctioning course of. Casey Rodarmor, the creator of Bitcoin Ordinals, criticized the method, one which concerned sending all the bid quantity with a purpose to be thought of for the public sale.

![Yuga Labs’ TwelveFold auction had this effect on Apecoin [APE]](https://cryptonitenews.io/wp-content/uploads/2023/03/william-phipps-i-v5vAQoYzc-unsplash-1000x600-768x461.jpg)