- Bitcoin holders’ earnings attain a brand new all-time excessive.

- Promoting stress stays comparatively low, nonetheless, quantity declines.

Attributable to all of the concern, uncertainty, and doubt (FUD) that surrounded the crypto area over the past yr, many addresses have been compelled to promote their Bitcoin holdings.

Nonetheless, there was a bit of addresses that continued to indicate religion within the king coin BTC and HODLed their manner via the woods.

Curiously, these long-term holders at the moment are seeing all-time highs by way of their profitability.

Learn Bitcoin’s Value Prediction 2023-2024

Undecided which #Bitcoin holder is extra spectacular as all of them proceed to make all-time highs.

1+ yr = Have held the whole lot of 2022

2 + years = Purchased the highest of the 2021 bull

3+ years = Count on this to start out trending upwards ( 1 week away from covid)

5+ years = Purchased… https://t.co/IzUbZeZRX8 pic.twitter.com/6B2g3vV1QU— James V. Straten (@jimmyvs24) March 4, 2023

Reportedly, HODLers who’ve held their BTC for wherever between 1-5 years, have been seeing a profit-making alternative.

Nonetheless, because the profitability of those holders rises, the general incentive to promote these holdings will increase.

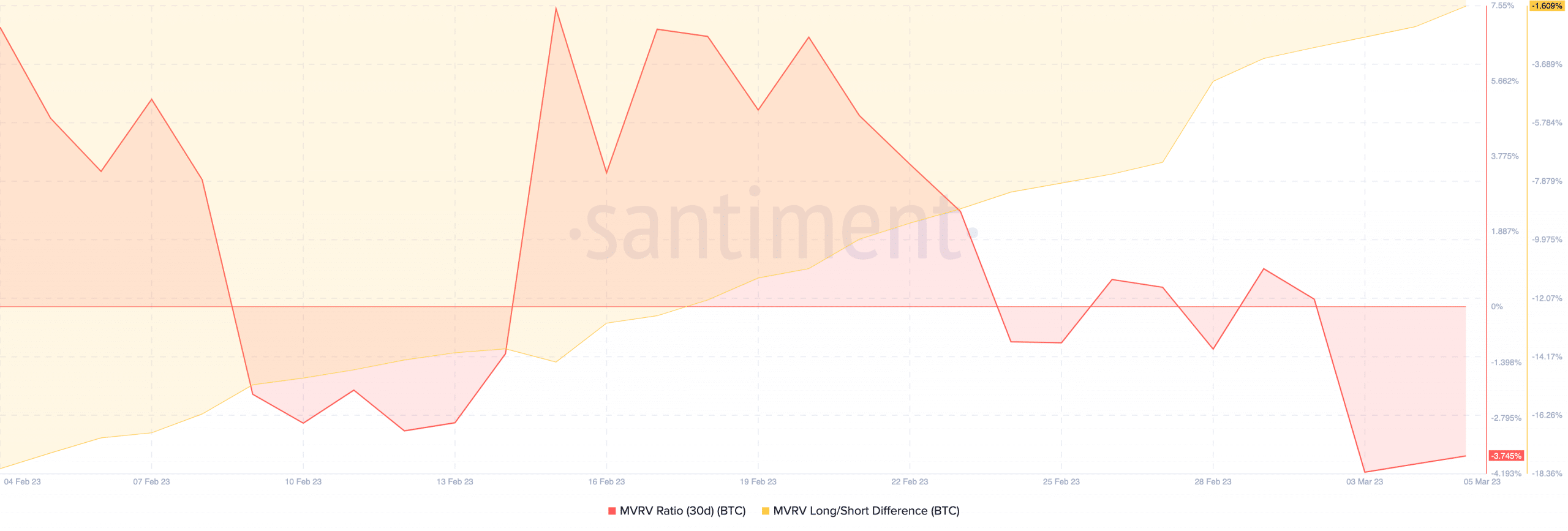

An attention-grabbing metric to take a look at at this level could be the MVRV ratio.

Effectively, the MVRV ratio for the king coin was adverse, on the time of writing. This implied that almost all of BTC holders would find yourself taking a loss in the event that they bought their coin on the present value.

This additionally recommended that the worthwhile holders have been a minority on the Bitcoin community. And, therefore there was no main promoting stress that might be anticipated.

Supply: Santiment

Addresses get lively

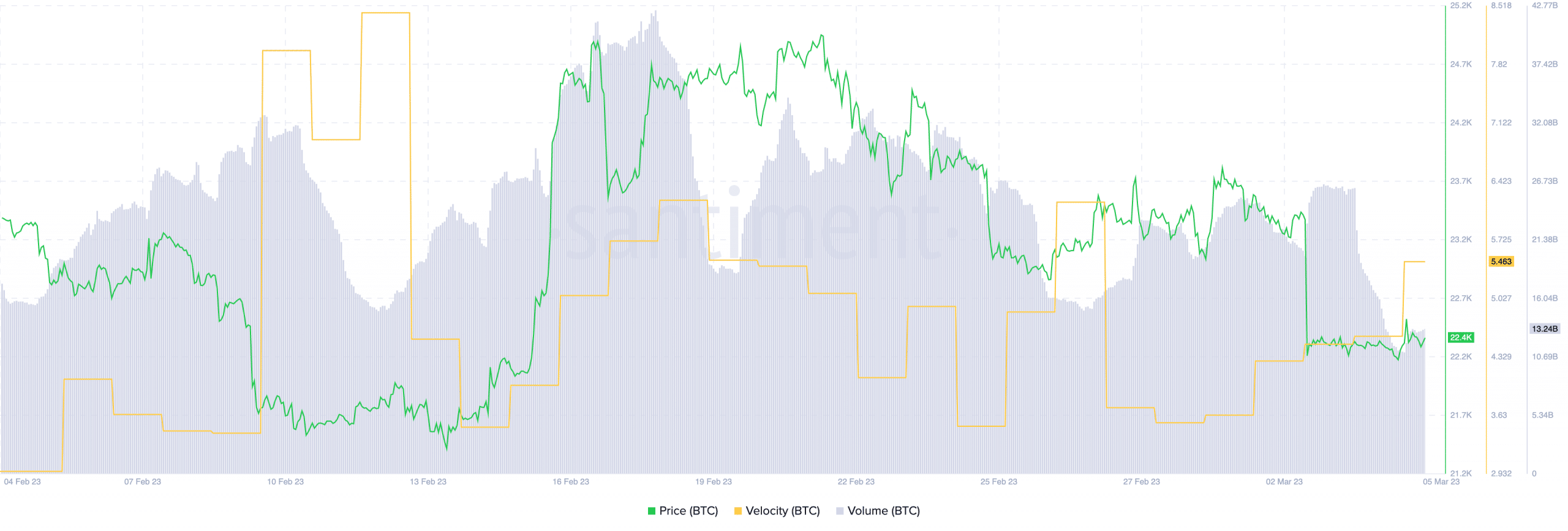

The truth is, whales additionally confirmed huge curiosity within the coin of late. Therefore, normal exercise on the Bitcoin community started to rise.

In accordance with knowledge supplied by glassnode, the variety of BTC transactions reached a 2-year excessive on 5 March.

Moreover, the excessive velocity of Bitcoin implied that the variety of occasions BTC was being transferred amongst addresses, had elevated. Sadly, that wasn’t the case with the quantity metric.

Supply: Santiment

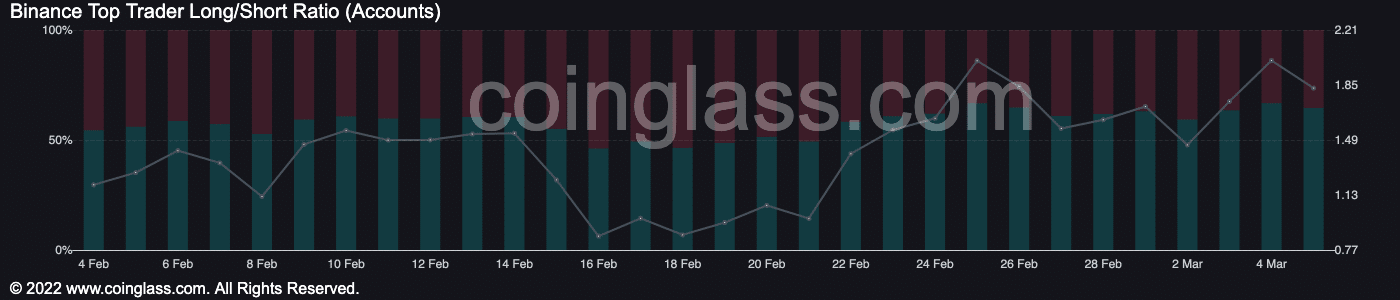

Nonetheless, the declining quantity didn’t deter merchants from going lengthy on Bitcoin. In accordance with coinglass’ knowledge, the share of lengthy positions taken for Bitcoin on the Binance change elevated from 50.5% to 64.66% up to now few weeks.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Supply: coinglass

That being stated, it stays to be seen how these lengthy positions on BTC play out for merchants in the long run.