- BTC’s worth may see an additional upward motion because the 12 months progresses.

- Many traders presently maintain the king coin at a revenue.

Based on two analysts from CryptoQuant, historical past means that the worth of Bitcoin [BTC] is poised to surge in 2023. The specialists have shared their predictions primarily based on historic traits and patterns noticed within the BTC’s worth actions within the 2018 – 2019 market cycle.

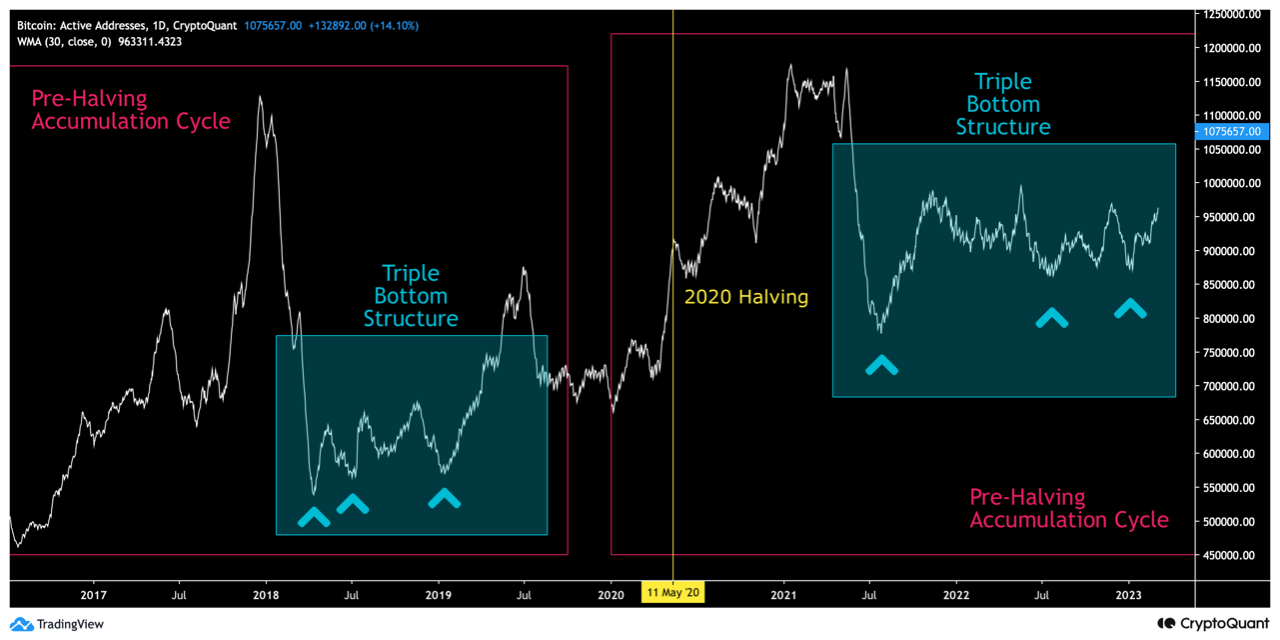

Pseudonymous analyst oinonen_t checked out BTC’s on-chain energetic tackle knowledge throughout the 2018-2019 cycle and located that it generated three particular person bottoms as a part of the reversal course of.

Based on the analyst, the 2021-2023 cycle has additionally proven an identical construction as energetic addresses reached three particular person lows.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Subsequently, the market might even see incremental worth development all through 2023, following the triple backside construction of the final main cycle, oinonen_t opined. The analyst additional famous,

“If bitcoin follows the triple backside construction of the final main cycle, we’re about to see incremental worth will increase throughout 2023. Bitcoin’s present “honest worth” is at $43 598, intently aligned with our final worth projection of $46 092.”

Supply: CryptoQuant

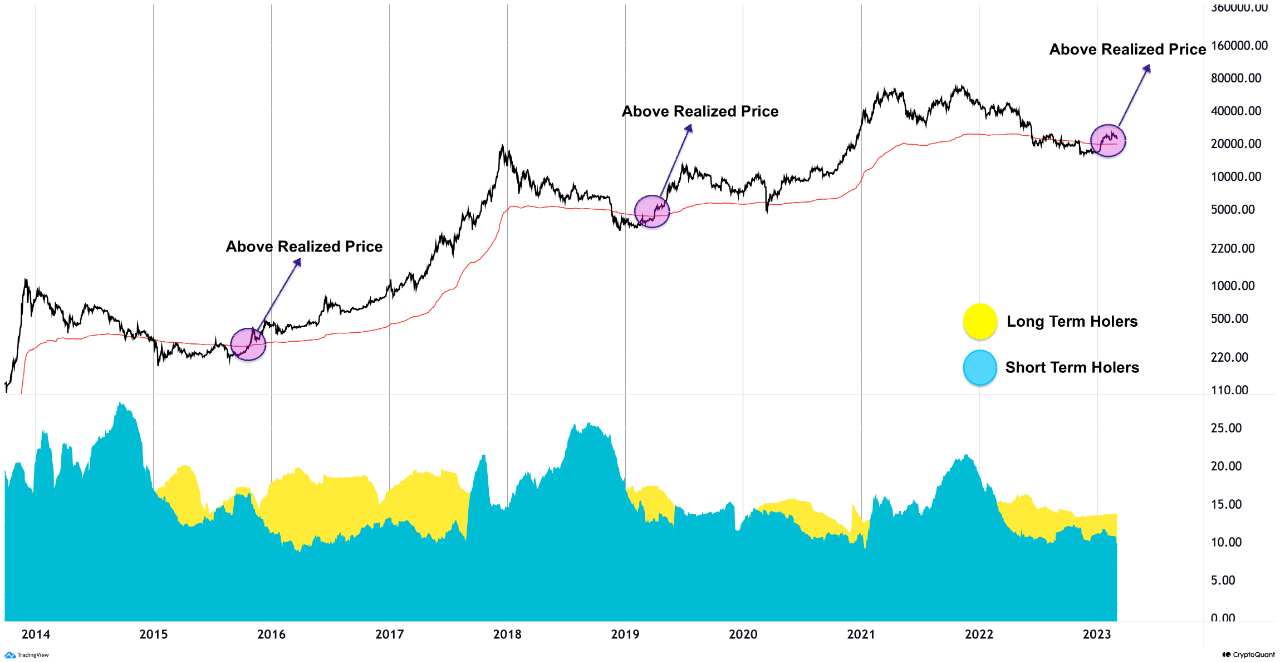

Additional, one other analyst Woominkyu studied the conduct of BTC long-term and short-term holders in relation to the coin’s realized worth.

Based on Woominkyu, historic precedents revealed that BTC long-term holders have persistently outweighed short-term holders in periods when the cryptocurrency’s worth has efficiently crossed the realized worth.

This has typically led to a rally in BTC’s worth. Within the present market cycle, long-term holders are anticipated to achieve market management and increase costs steadily, Woominkyu famous.

“The state of affairs doesn’t seem to have materially modified from the previous, and plainly “long-term holders” will steadily acquire management of the market and lift costs once more.”

Supply: CryptoQuant

Good tidings for BTC holders

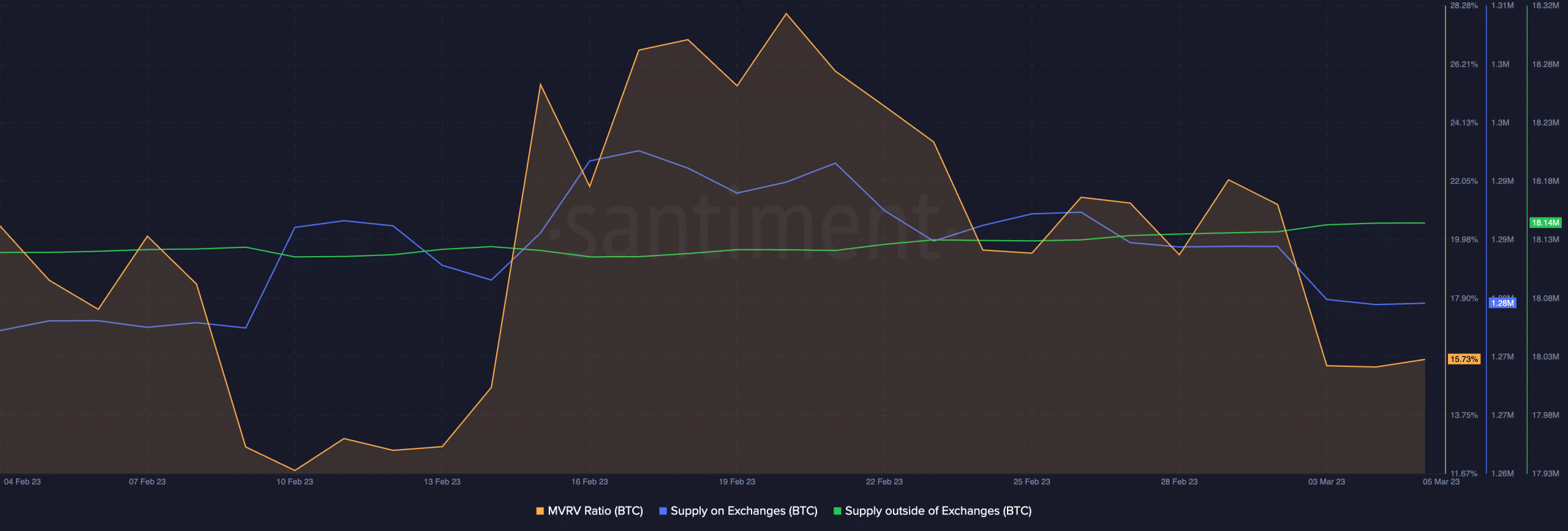

Regardless of the momentary slip in BTC’s worth on 3 March and its failure to reclaim the $25,000 mark within the final month, on-chain knowledge revealed that its traders proceed to carry at a revenue.

Based on knowledge from Santiment, BTC’s Market Worth to Realized Worth ratio (MVRV) stays positioned within the constructive territory. Typically, a constructive MVRV ratio for an asset implies that if all holders offered their holdings on the present worth of the asset, they might generate twice the revenue on common.

Learn Bitcoin [BTC] Worth Prediction 2023-24

Additional, a take a look at the king coin’s trade exercise confirmed an uptick in its provide outdoors of exchanges and a corresponding decline in its provide on exchanges.

That is sometimes considered a bullish sign because it signifies that extra traders are fascinated about holding reasonably than promoting. This can assist drive up the worth of an asset.

Supply: Santiment