- BTC lengthy liquidations rose to their highest place since August 2022.

- Analysts imagine {that a} decline in BTC’s worth is imminent.

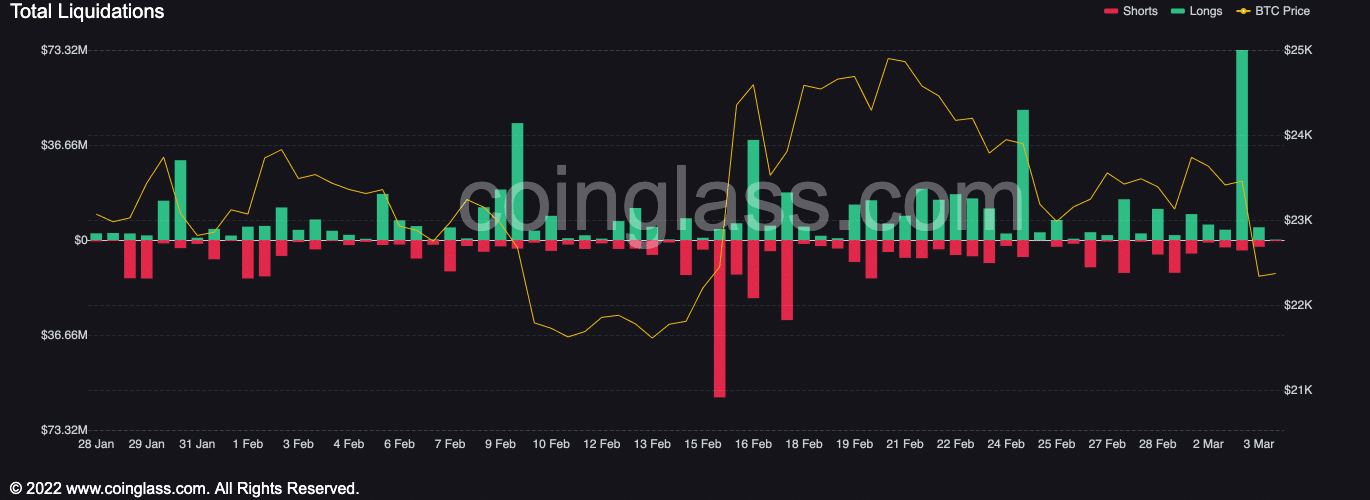

Following the sharp decline in Bitcoin’s [BTC] worth within the early buying and selling hours of three March, lengthy liquidations soared to a seven-month excessive, knowledge from Coinglass confirmed.

The drop in worth was triggered by apprehension and uncertainty concerning Silvergate Capital, a monetary establishment acknowledged for its supportive angle towards digital currencies.

Supply: Coinglass

In accordance with CryptoQuant analyst caueconomy, these lengthy liquidations have been the third such occasion because the Terra/LUNA crash in Might 2022 and the second following the fallout of cryptocurrency FTX in November 2022.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The pseudonymous analyst discovered additional that the sharp decline out there was brought on by a large spot sale on most exchanges, notably on Binance, the place many patrons had positioned contracts.

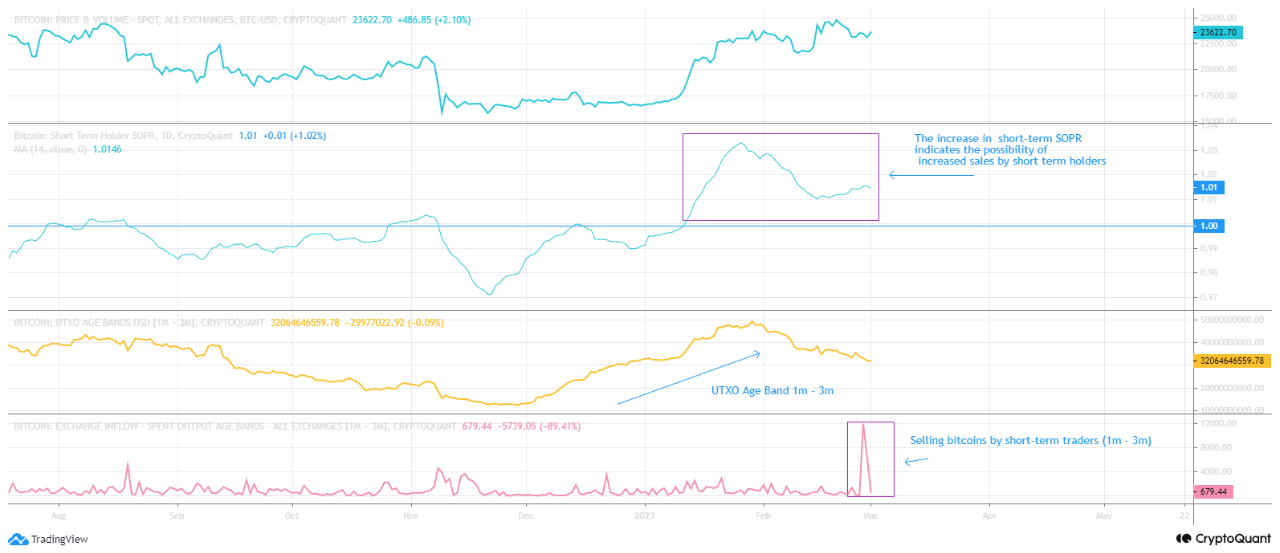

Supply: CryptoQuant

Extra ache for BTC holders?

With BTC struggling to reclaim the $25,000 worth mark, one other CryptoQuant analyst with the pseudonym CryptoOnchain has opined that the king coin’s worth would possibly drop additional.

In accordance with CryptoOnchain, whereas short-term holders have been shopping for BTC, long-term holders haven’t supported the latest worth rise.

To learn from the value progress up to now this yr, an on-chain evaluation of BTC’s worth revealed a surge in coin distribution by these short-term holders as properly.

BTC’s trade influx by 1-3 months holders was noticed at its highest worth since June 2022, CryptoOnchain famous.

Supply: CryptoQuant

Furthermore, the crypto market has seen a rise within the outflow of stablecoins from exchanges, which can not maintain the present worth improve and will probably result in an additional lower in costs, the analyst added.

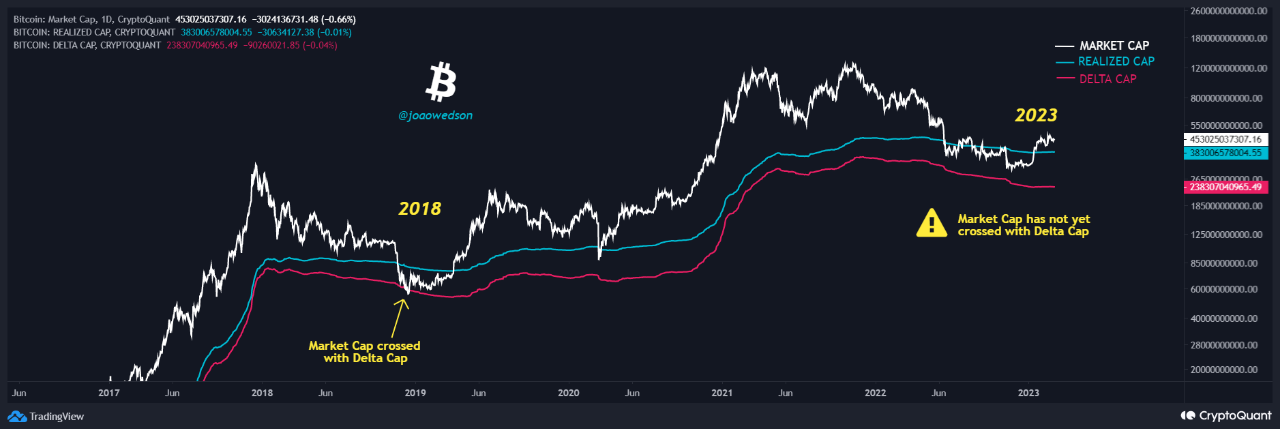

One other analyst Joao Wedson warned traders to gear up for a “attainable new situation of worth capitulation.”

Wedson assessed BTC’s Delta Cap metric and located {that a} worth backside is fashioned when the coin’s market capitalization crosses with its Delta Cap.

This crossing occurred on three earlier events: in 2011, 2015, and 2018 and in all three circumstances, the crossing was adopted by a major drop in BTC’s worth.

Learn Bitcoin [BTC] Value Prediction 2023-24

Whereas the crossing is but to happen within the present market cycle, Wedson warned that “we can not rule out the potential of new worth lows for Bitcoin, as this is able to be the primary time in historical past that the crossing didn’t happen.”

Supply: CryptoQuant

![Bitcoin’s [BTC] price struggles continue as analysts warn of further drop](https://cryptonitenews.io/wp-content/uploads/2023/03/shubham-s-web3-V0f8N73V4To-unsplash-1-1000x600-768x461.jpg)