- Retail traders’ curiosity in Bitcoin elevated.

- Improve in profitability and potential for elevated promoting strain for BTC.

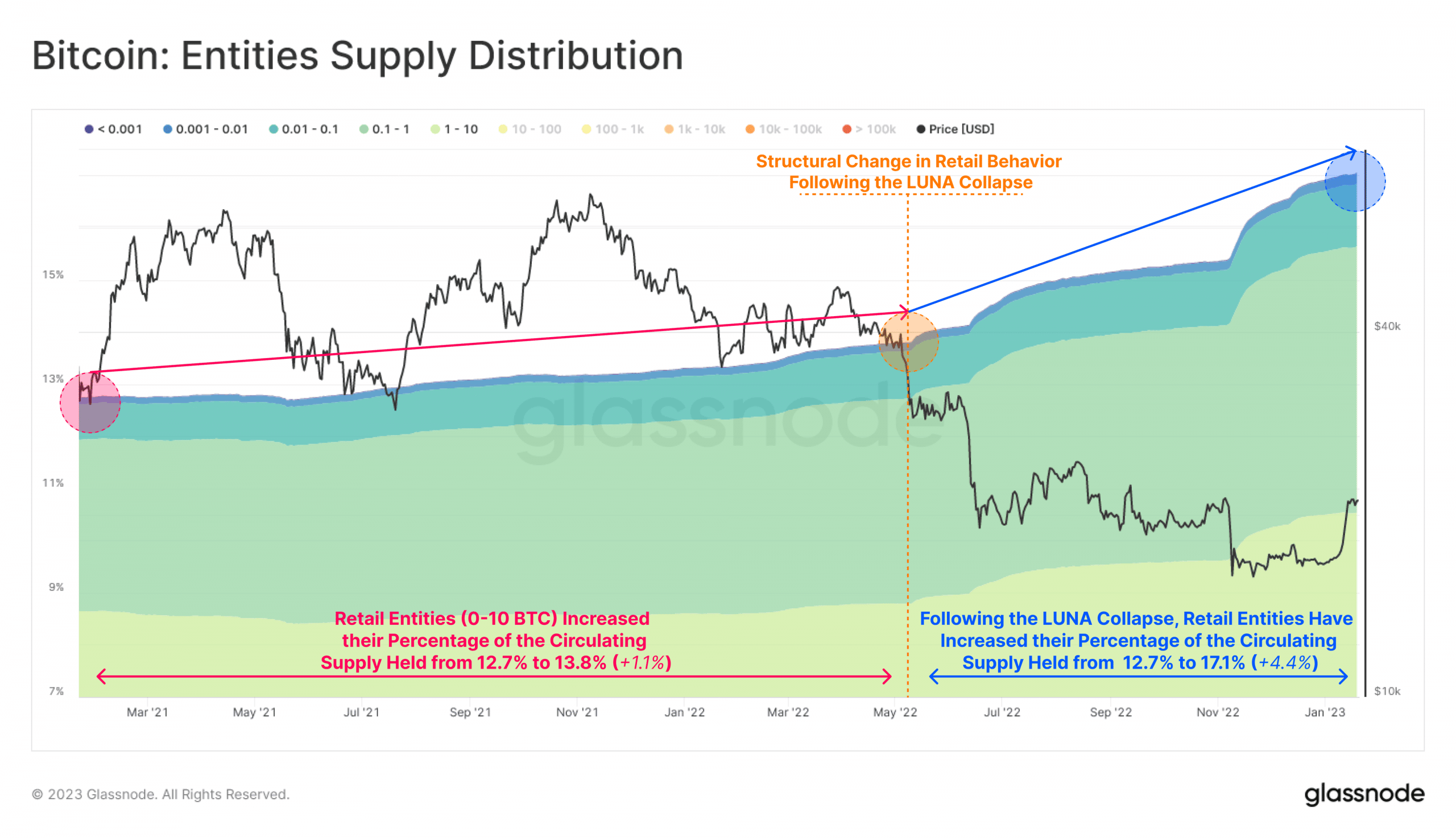

For the reason that Terra Luna [LUNC] collapse, the variety of Bitcoin [BTC] retail traders continued to rise and stood at 17.1% of the overall circulating provide at press time, in response to Glassnode.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

This represented a 4.4% enhance over the previous eight months, which was a constructive signal for the decentralization of the Bitcoin community, because it recommended that it was not as managed by massive “whale” traders.

Holders get tempted

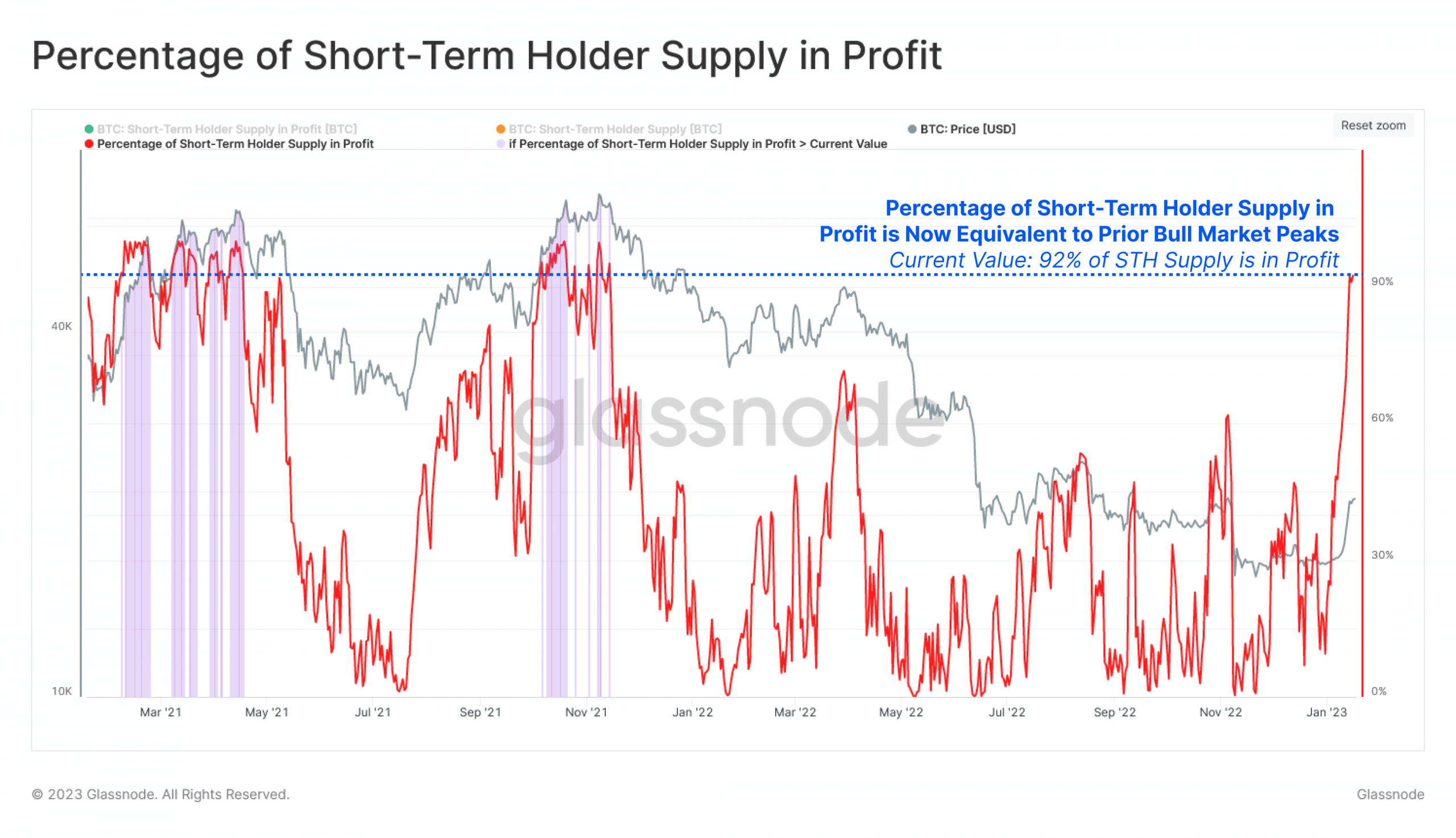

Along with the rising variety of retail traders, the variety of traders in revenue additionally elevated throughout this era.

In line with Glassnode’s information, the proportion of short-term holders in revenue reached 92%. Nevertheless, this might affect the promoting strain on Bitcoin, as many short-term holders might select to promote their BTC for a revenue, which may finally have an effect on retail holders.

Supply: glassnode

Regardless of the rising profitability of Bitcoin and the potential for elevated promoting strain, information recommended that the promoting strain might not have elevated but.

In line with information offered by CryptoQuant, the alternate reserve continued to say no. The alternate reserve is the quantity of Bitcoin held by exchanges and is a key indicator of promoting strain. A decline within the alternate reserve suggests low promoting strain.

Supply: CryptoQuant

BTC exercise declines

Nevertheless, issues may take a flip for the more severe for BTC quickly. One worrying indicator was the decline in Bitcoin addresses exercise. In line with data offered by CryptoQuant, the variety of energetic addresses on the Bitcoin community decreased by 27.64% within the final 24 hours.

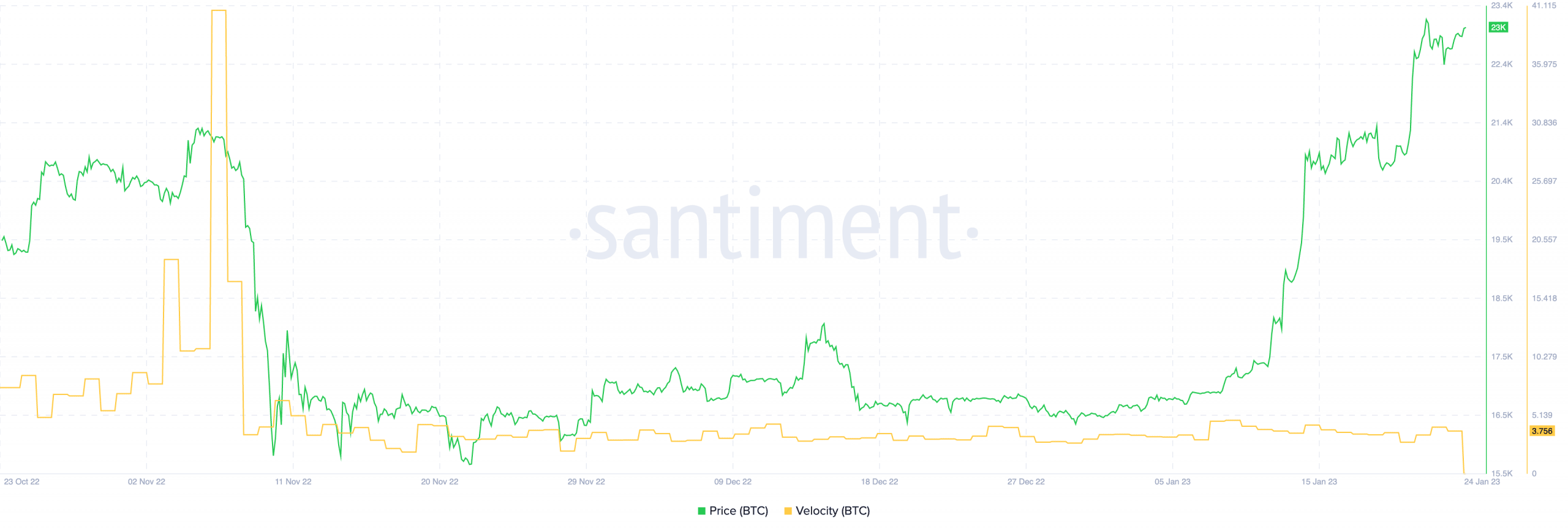

Moreover, Bitcoin‘s velocity fell sharply as effectively, indicating that the frequency of BTC transfers amongst addresses has decreased.

What number of are 1,10,100 BTC price as we speak?

Supply: Santiment

Regardless of this decline in exercise, merchants continued to go lengthy on Bitcoin at press time. In line with information offered by Coinglass, dealer sentiment in the direction of the king coin turned constructive over the previous few days, and on the time of writing, 51.92% of all trades had been lengthy positions made in favor of Bitcoin.

It stays to be seen if holders cave into the promoting strain or in the event that they proceed to HODL BTC. On the time of writing, Bitcoin was buying and selling at $23,082.73 and its worth grew by 1.56% within the final 24 hours, as per CoinMarketCap.

![Analyzing retail investors’ growing faith in Bitcoin [BTC] as prices soar](https://cryptonitenews.io/wp-content/uploads/2023/01/1674501504282-df812724-a211-4626-a956-a23b61edbd33-3072-1000x600-768x461.png)