- Regardless of updates relating to liquidity staking, TRX’s value was declining.

- A number of of the metrics had been within the patrons’ favor whereas the market indicators had been bearish.

Justin Solar, the founding father of TRON [TRX] acknowledged that the TRON basis introduced the upcoming launch of liquid staking, as outlined in TIP467. With the launch of this new function, customers will have the ability to seamlessly swap their staked TRX for STRX.

Furthermore, Tron may also be introducing a decentralized useful resource market, as outlined in TIP484, additional bringing TRON to a brand new stage of performance and utility.

Even earlier than the launch of the brand new function, DeFiLlama’s data revealed that TRON’s whole worth locked has been on an uptrend for a few weeks, which was encouraging.

#TRON is worked up to announce the upcoming launch of liquid staking, as outlined in TIP467. This new function will permit customers to simply swap their staked #TRX for #STRX, growing the general liquidity of staked #TRX. @trondao @trondaoreserve

— H.E. Justin Solar🌞🇬🇩🇩🇲🔥₮ (@justinsuntron) January 21, 2023

Not solely this, however a number of days in the past TRON introduced that the No. 82 committee proposal had not too long ago handed and was scheduled to take impact quickly. When the replace goes reside, it would facilitate the quicker calculation of associated transactions.

Learn TRON’s [TRX] Value Prediction 2023-24

Nevertheless, traders ought to think about this

Although the brand new function will improve the choices and capabilities of TRON, the community’s efficiency on the value entrance doesn’t appear to correspond. As per CoinMarketCap, TRX’s value decreased by greater than 1.3% within the final 24 hours, and on the time of writing, it was buying and selling at $0.06141 with a market capitalization of over $5.6 billion. A number of of the on-chain metrics additionally raised considerations for TRX.

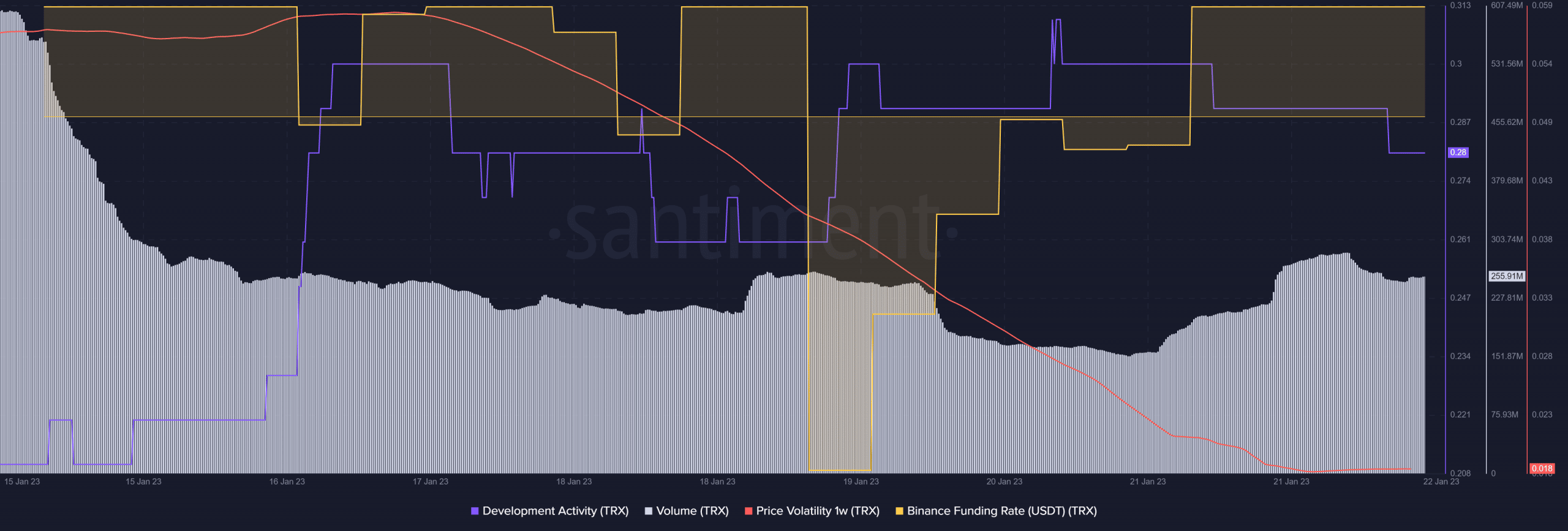

For instance, TRX’s quantity decreased significantly over the past week. The one-week value volatility declined, minimizing the possibilities of an unprecedented surge.

Furthermore, LunarCrush’s data revealed that TRX’s market dominance additionally declined by 20% over the past seven days. Nevertheless, the event exercise elevated, reflecting the elevated efforts of builders. TRX additionally managed to realize curiosity from the derivatives market as its Binance funding fee registered an uptick.

Supply: Santiment

Is your portfolio inexperienced? Verify the TRON Revenue Calculator

Extra causes to be involved about

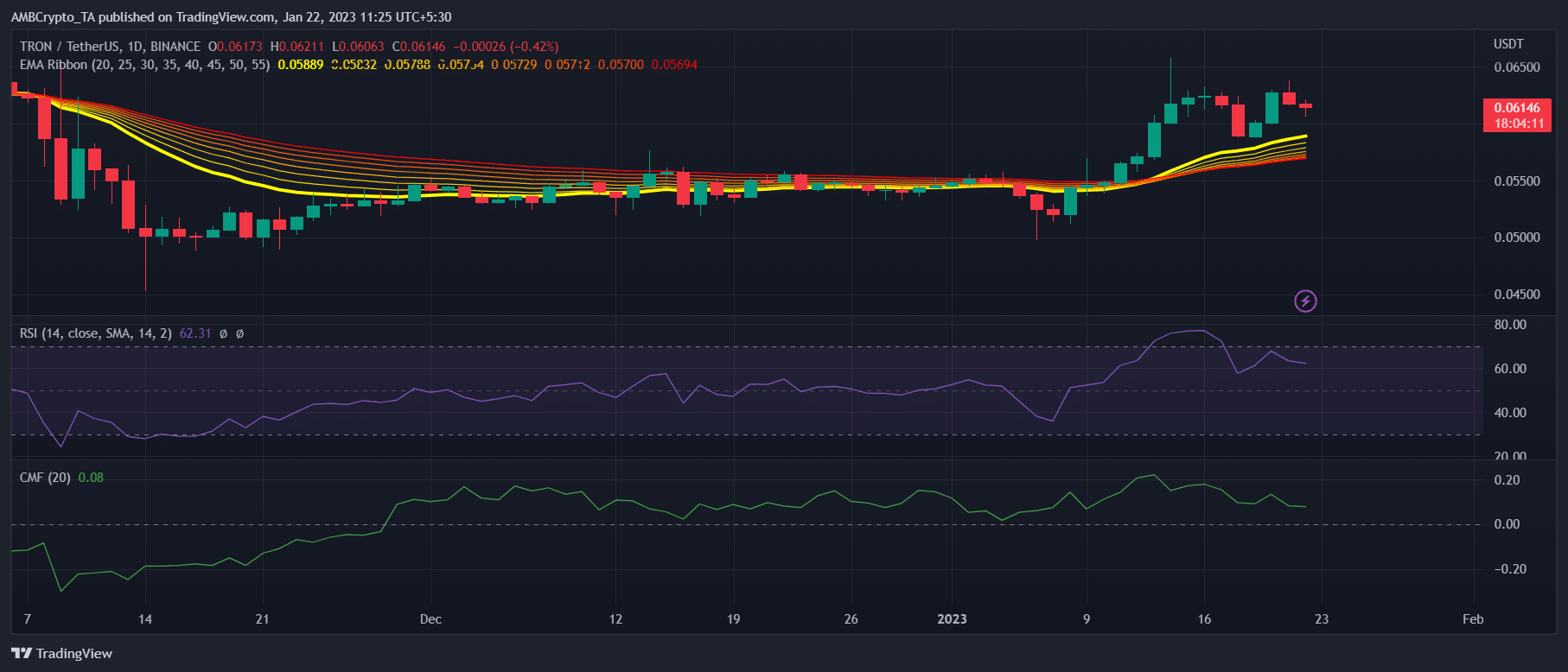

TRON’s every day chart instructed that after a week-long bullish market, the bears had been bucking up. The Relative Power Index (RSI) registered a downtick and was heading towards the impartial mark.

TRX’s Chaikin Cash Movement (CMF) additionally went the identical method, additional growing the possibilities of a downtrend within the coming days. The exponential Transferring Common (EMA) Ribbon, alternatively, remained bullish because the 20-day EMA was resting above the 55-day EMA.

Supply: TradingView