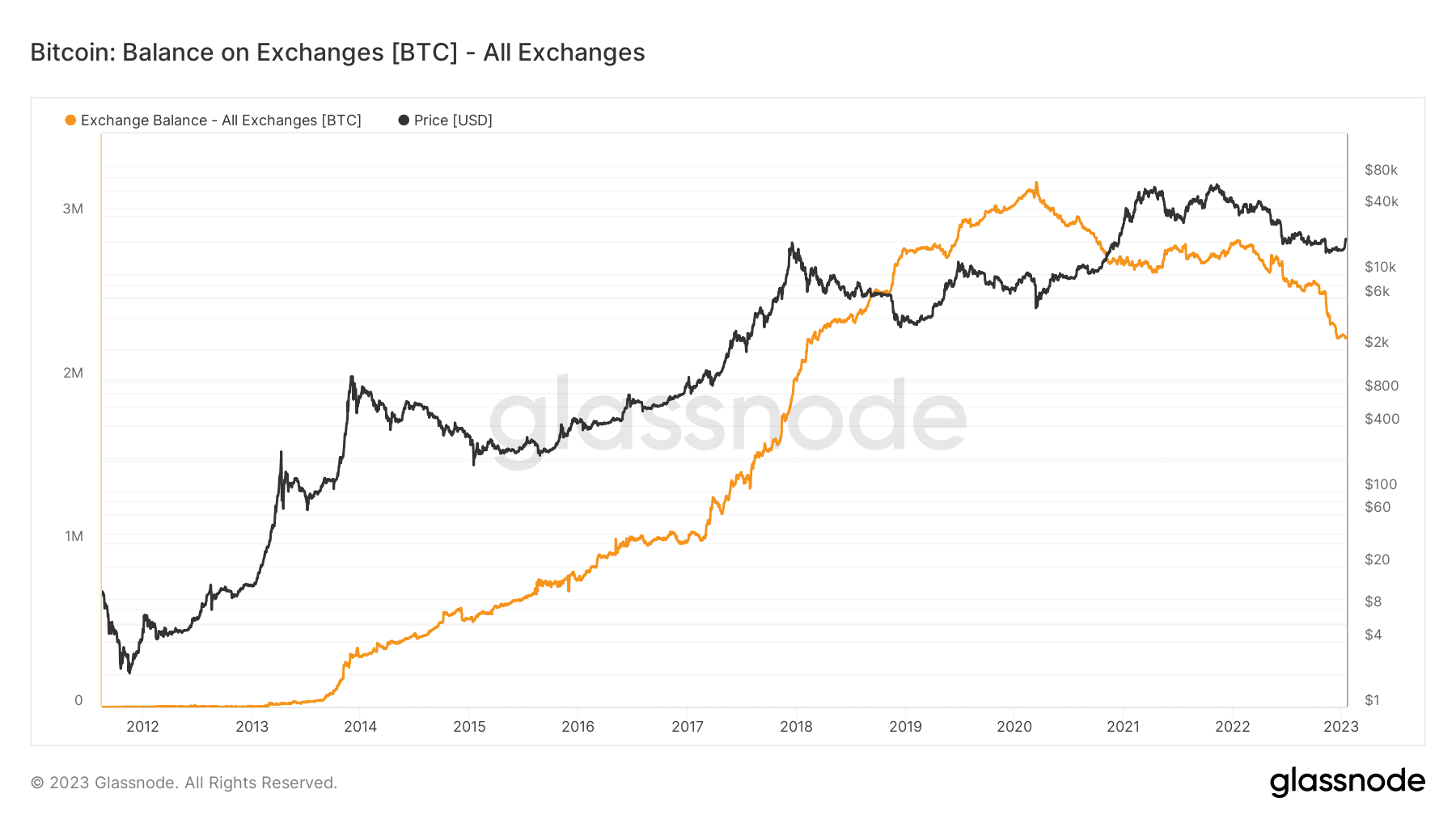

- Glassnode chart revealed that Bitcoin was experiencing a low alternate steadiness.

- The present downtrend is likely to be indicative of a bull pattern fairly than a bear pattern.

After the FTX meltdown, Bitcoin [BTC] started a rally that noticed its worth enhance by over 25% and make up for the losses. The remainder of the cryptocurrency market might additionally rise due to the king coin’s rally. Nonetheless, Glassnode’s steadiness on exchanges metric displayed a low quantity regardless of this surge. What may this point out for BTC?

📉 #Bitcoin $BTC Steadiness on Exchanges simply reached a 4-year low of two,249,824.148 BTC

Earlier 4-year low of two,249,845.086 BTC was noticed on 19 December 2022

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/0xWWsLeIXM

— glassnode alerts (@glassnodealerts) January 18, 2023

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Steadiness on Alternate declines

Bitcoin had been buying and selling at round $17,000 for November and December 2017. Current good points of almost 26% have pushed the worth over its degree of preliminary resistance.

It was anticipated that after the rally, a flurry of actions would happen that would result in a decline in worth. Nonetheless, Glassnode reviews that there are fewer BTC obtainable on key exchanges.

As per the tweet above, BTC’s Steadiness on Exchanges was 2,249,824.148 BTC, on 18 January, a brand new all-time low. Earlier than this new low, on December 19, 2022, the amount of Bitcoin first fell to 2,249,845.086 BTC. May this affect the worth of BTC negatively?

Supply: Glassnode

It isn’t at all times the case that low Bitcoin balances on centralized exchanges point out a downward market pattern. Fewer individuals holding Bitcoin could promote them on exchanges, stopping a big market correction. This shift to longer-term holding choices, resembling chilly wallets, could imply an optimistic sentiment amongst Bitcoin homeowners.

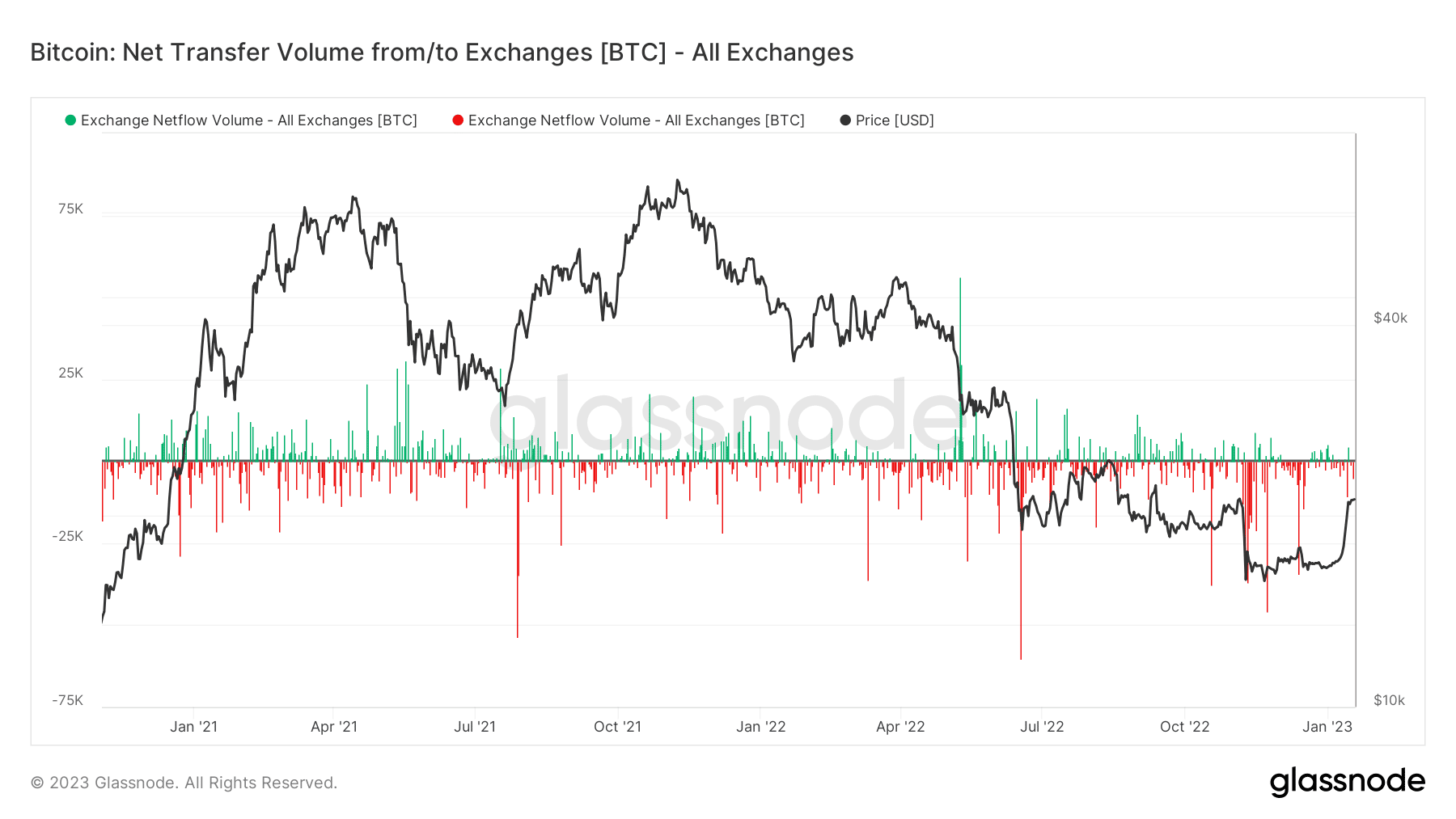

Bitcoin (BTC) Netflow reveals outflow bias

The outflow that the asset has been experiencing over the earlier months was additionally evident within the Bitcoin Alternate Netflow Quantity measure. The statistics indicated that there had been a higher outflow of BTC from vital exchanges than influx. This aids in additional contextualizing the Steadiness on Alternate metric.

Supply: Glassnode

How a lot are 1,10,100 BTCs value right this moment?

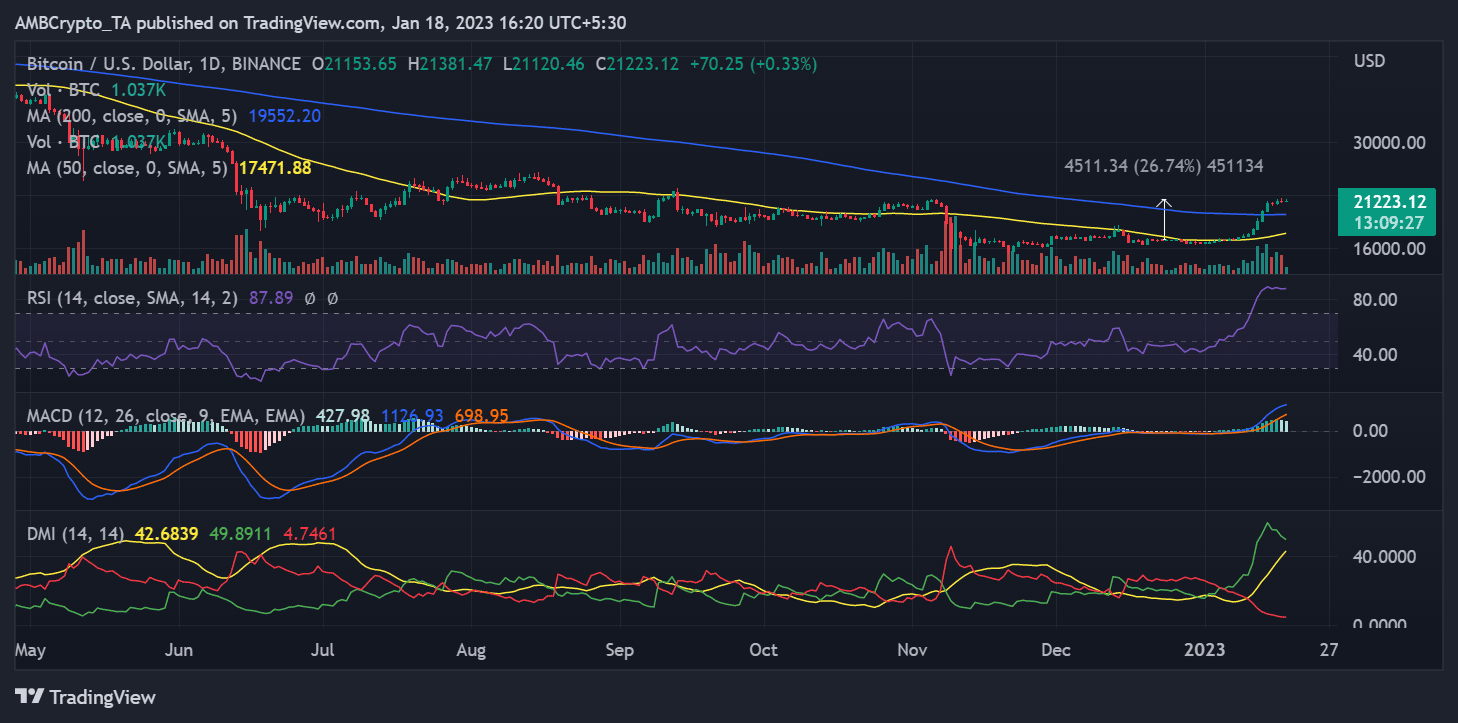

BTC’s present pattern won’t finish quickly

BTC was nonetheless in a bull pattern on the day by day timeframe. Moreover, the asset was creating a brand new assist degree to consolidate the present worth. As of the time of this writing, BTC had surpassed the psychological resistance mark of $20,000 and was buying and selling at over $21,200.

Supply: Buying and selling View

The Relative Energy Index line was firmly within the overbought space on the present worth degree. Normally, a worth correction can be anticipated on the present degree of the RSI. Nonetheless, the asset may keep there for longer, given the declining provide of main exchanges.