- The crypto market rallied considerably within the final 24 hours.

- Brief merchants have seen probably the most liquidation.

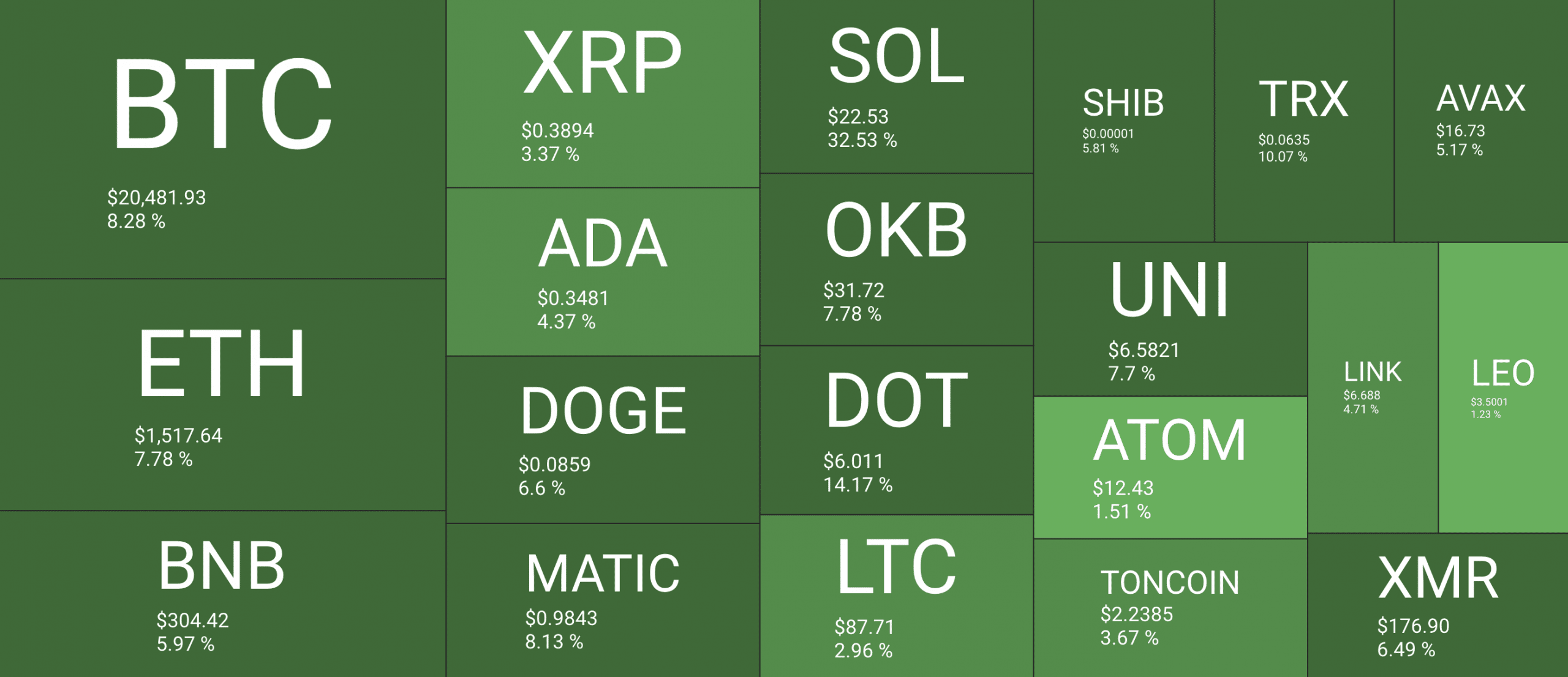

Within the final 24 hours, the worldwide cryptocurrency market capitalization grew by over 5%, per knowledge from CoinGecko.

For the primary time post-FTX collapse, Bitcoin [BTC] traded above the $21,000 value mark, whereas main altcoin Ethereum [ETH] modified arms at $1,600, based on knowledge from CoinMarketCap.

Additionally, sharing a statistically important constructive correlation with BTC, layer one coin Cardano [ADA] and main meme coin Shiba Inu [SHIB] additionally logged value jumps of 4% and 6%, respectively, inside the identical timeframe.

Supply: Quantify Crypto

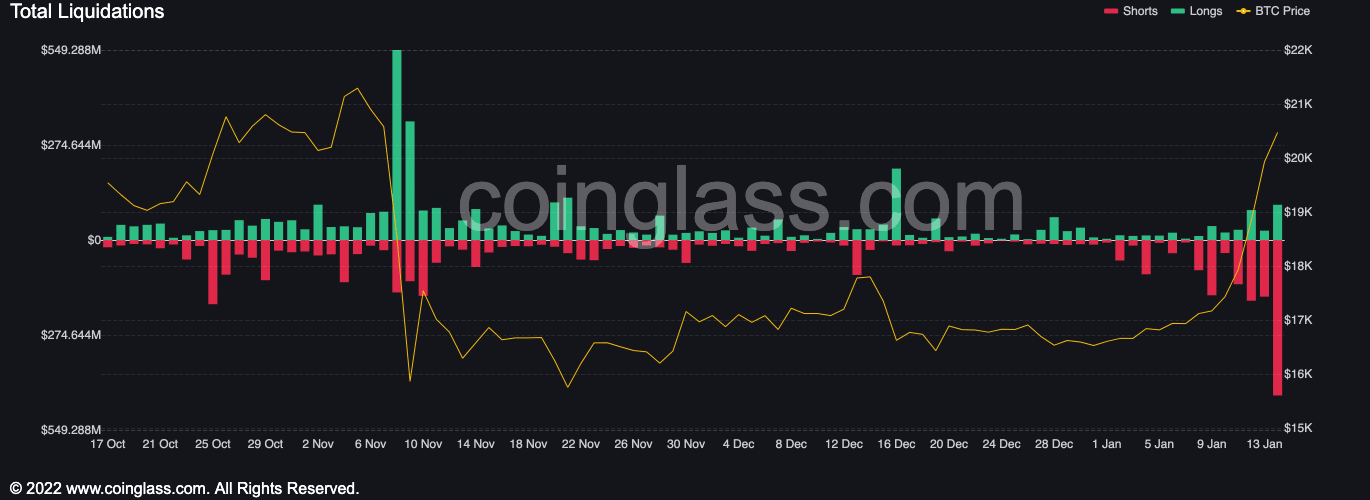

In response to knowledge from the crypto analytics platform Coinglass, liquidations throughout the cryptocurrency market within the final 24 hours totaled $719.05 million, with 131,575 merchants liquidated.

Nonetheless, the latest rally has had a very unfavorable influence on brief merchants. Within the final 24 hours, liquidated brief positions represented 62% of whole market liquidations, knowledge from Coinglass confirmed.

Supply: Coinglass

Why the greens?

There’s no denying that the crypto and conventional finance markets share a detailed correlation. The latest rally within the crypto market might be attributable to the truth that all main indexes closed the just-concluded buying and selling week on a constructive word for the primary time since November.

On 13 January, after beginning the day by reserving important losses, all main indexes managed to get better and shut within the inexperienced. The Dow Jones Industrial Common elevated by 0.33%. The S&P 500 additionally rose by 0.40% to three,999.09, and the Nasdaq Composite gained 0.71% to succeed in 11,079.16.

In response to CNBC, the latest rally resulted within the S&P and Nasdaq each having their second consecutive constructive week and greatest weekly efficiency since November. The Nasdaq had the very best weekly improve at 4.82%. The S&P and Dow additionally noticed positive aspects of two.67% and a pair of%, respectively.

A bull entice or nay?

A pseudonymous crypto analyst on Twitter CryptoCapo opined that whereas the market may need logged unprecedented positive aspects within the final 24 hours, the potential for registering new lows was not fully invalidated.

Good morning.

Market is bouncing greater than anticipated, that could be a certainty. Now… is the bearish situation invalidated?

I will clarify why I feel new lows are nonetheless possible.

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

In response to CryptoCapo, an evaluation of BTC, ETH, and different altcoins on a excessive time revealed that the leap in value within the final 24 hours prompted these crypto property to check main resistance ranges. Nonetheless, “there’s no bullish affirmation but,” CryptoCapo stated.

He assessed BTC on a decrease timeframe and stated:

“$BTC is in a ltf (decrease timeframe) parabolic transfer. However there’s an issue for bulls. This transfer is already overextended. The bottom of the parabola was weak, and when this ltf development breaks it typically leads to sharp declines and full reversals.”

2) Decrease timeframe.$BTC is in a ltf parabolic transfer. However there’s an issue for bulls. This transfer is already overextended. The bottom of the parabola was weak, and when this ltf development breaks it typically leads to sharp declines and full reversals. pic.twitter.com/edq7tM25PI

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

On market sentiment, the analyst believed that:

“Bulls usually are not solely euphoric, they’re being very conceited once more. The necessity to always have fun a victory by mocking others reveals a weak spot of their arguments. And it’s as a result of one of the best bullish argument is that market has dumped rather a lot already”