- Ethereum’s Shanghai replace may drive progress for staking protocol Lido.

- Lido confronted challenges as APR declined, and exercise on the community additionally decreased.

Ethereum’s [ETH] Shanghai replace, set to go stay within the first quarter of 2023, will introduce staking to the ETH protocol. The replace has the potential to be a key progress catalyst for staking protocols comparable to Lido [LDO].

As of now, when Ethereum is being staked, there is no such thing as a method to unstake or retrieve it.

Are your LDO holdings flashing inexperienced? Test the revenue calculator

Nonetheless, with the upcoming Shanghai replace, the power to withdraw staked Ethereum will probably be given high precedence. This could decrease the potential danger for long-term holders who had staked their Ethereum because the Beacon Chain went stay in December 2020.

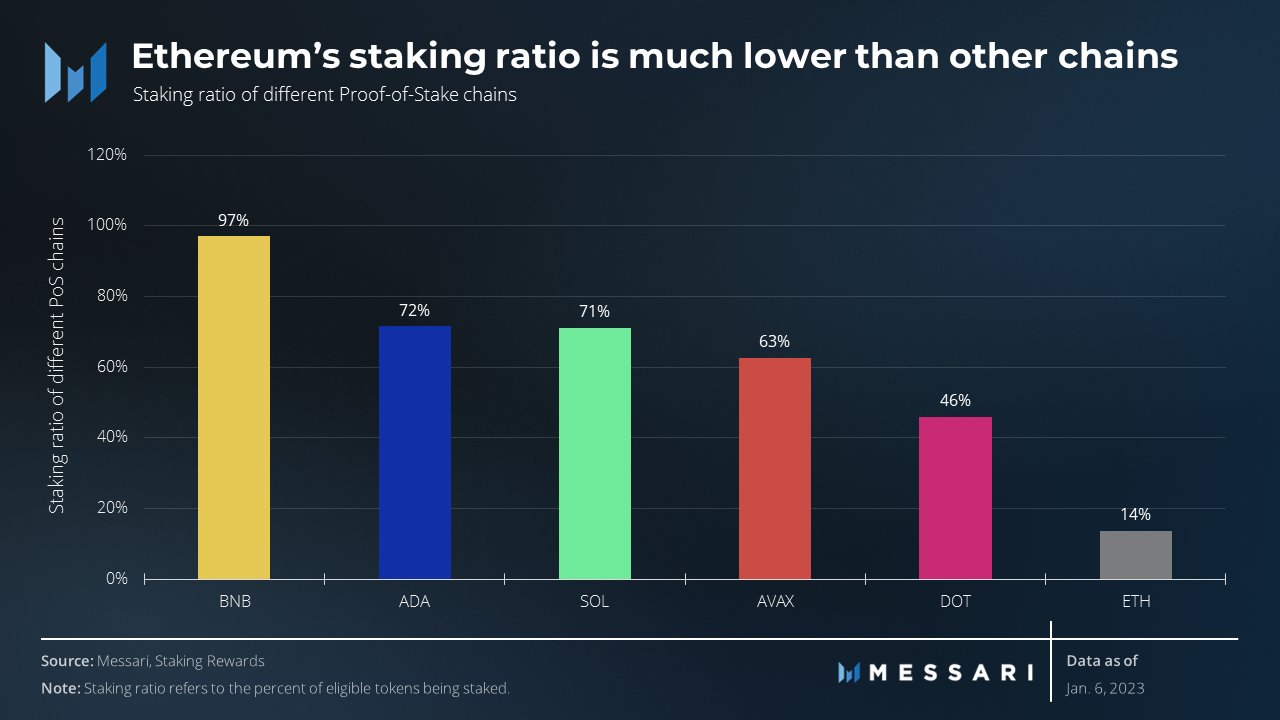

At press time, the staking ratio of ETH was presently decrease in comparison with different protocols, comparable to Binance Coin [BNB], Cardano [ADA] and Solana SOL.

Supply: Messari

Stake it up

Nonetheless, the introduction of staking within the Shanghai replace may assist enhance the staking ratio of ETH. This might be a constructive growth for Lido and different staking protocols.

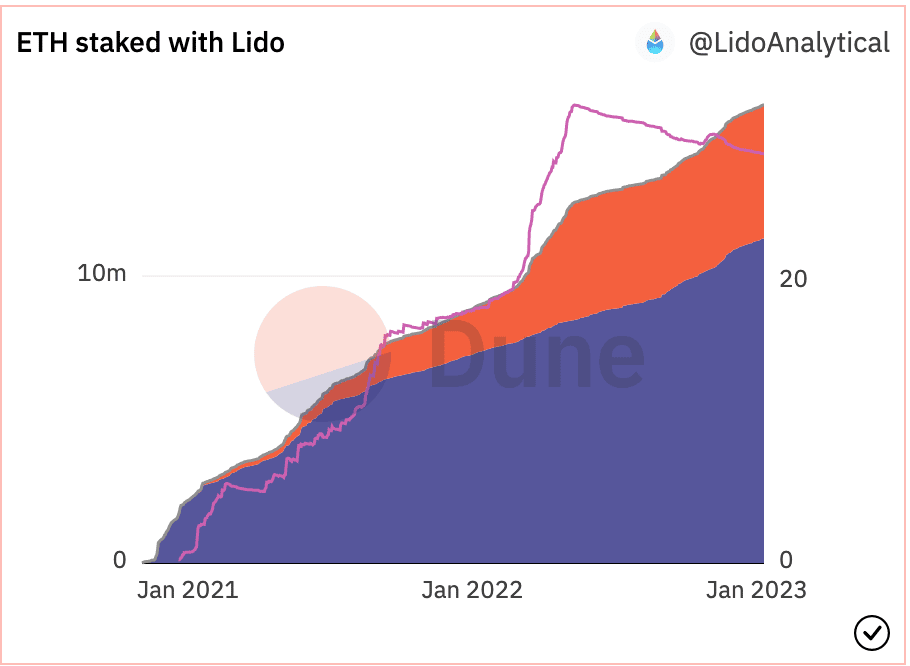

The rising variety of ETH staked on Lido advised that extra customers have been making the most of the staking alternatives supplied by the protocol till press time.

Supply: Dune Analytics

Nonetheless, Lido noticed a decline within the annual proportion price (APR). This might probably have an effect on the attractiveness of the protocol for customers trying to earn staking rewards.

Coupled with that, Lido noticed a drop in each complete income (-18.80%) and distinctive customers (-24.17%) over the previous interval, in line with Messari. The overall income collected was $25.39 million and the variety of distinctive customers was 11,017 at press time.

Supply: Dune Analytics

What’s going to Lido HODLers do?

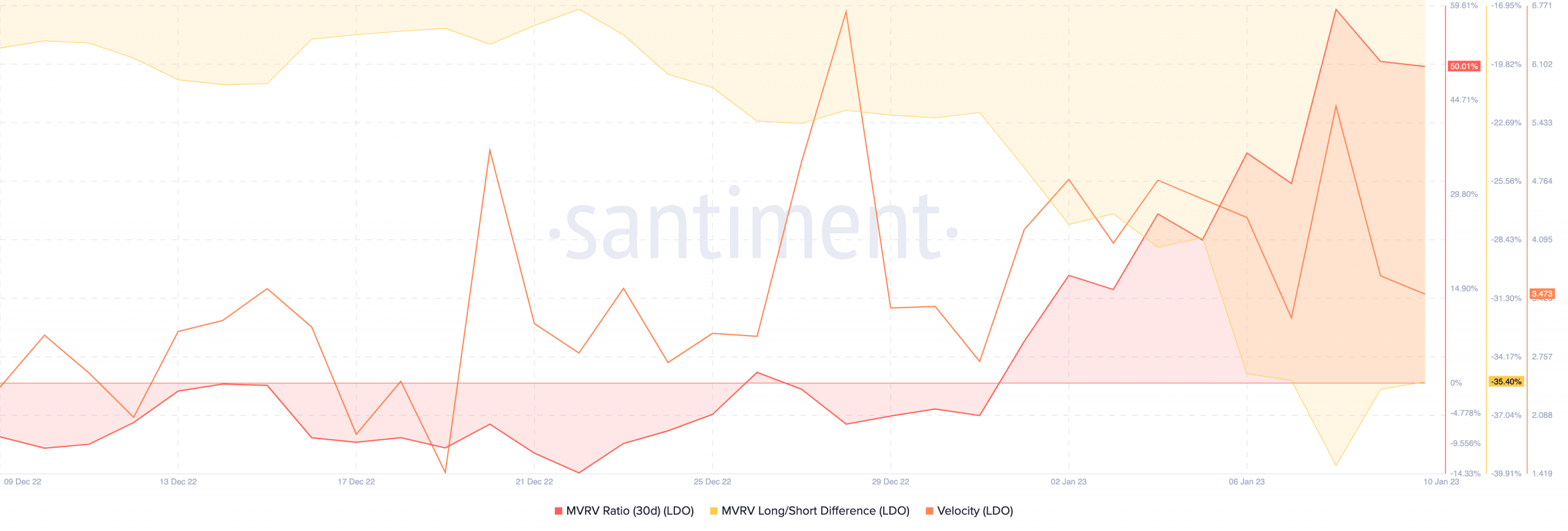

Regardless of these unfavorable developments, curiosity within the LDO token grew. This was indicated by the MVRV ratio for LDO, which elevated, indicating that holders of the token may take a revenue in the event that they bought at press time.

What number of LDOs are you able to get for $1?

Nonetheless, the lengthy/brief distinction indicated that many short-term holders noticed revenue, which meant that the promoting strain was larger.

The exercise of the LDO token additionally decreased, as was showcased by the declining velocity of LDO. Thus, the frequency with which LDO was being exchanged decreased.

Supply: Santiment

General, the Shanghai replace may have a constructive impression on Lido by growing the staking ratio of ETH and attracting extra customers to the protocol. Nonetheless, the declining APR and exercise on the community are areas of concern that Lido might want to tackle with a purpose to keep its place out there.

On the time of writing, the worth of LDO was $2.04. It grew by 6.11% within the final 24 hours, as per CoinMarketCap.