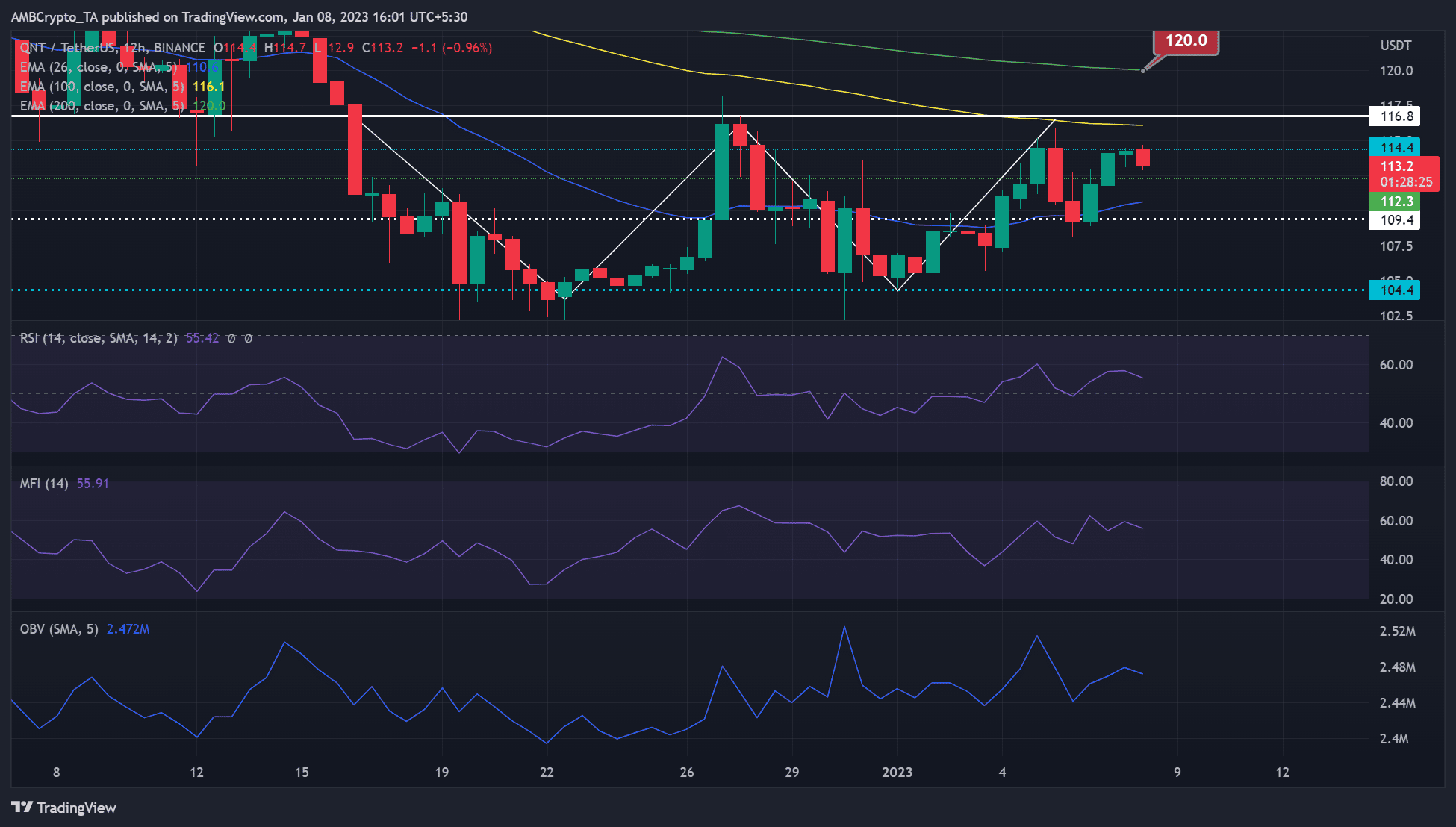

- The $114.4 hurdle might give QNT bears extra leverage.

- A break above the 100-period EMA of $116.1 would invalidate the bias.

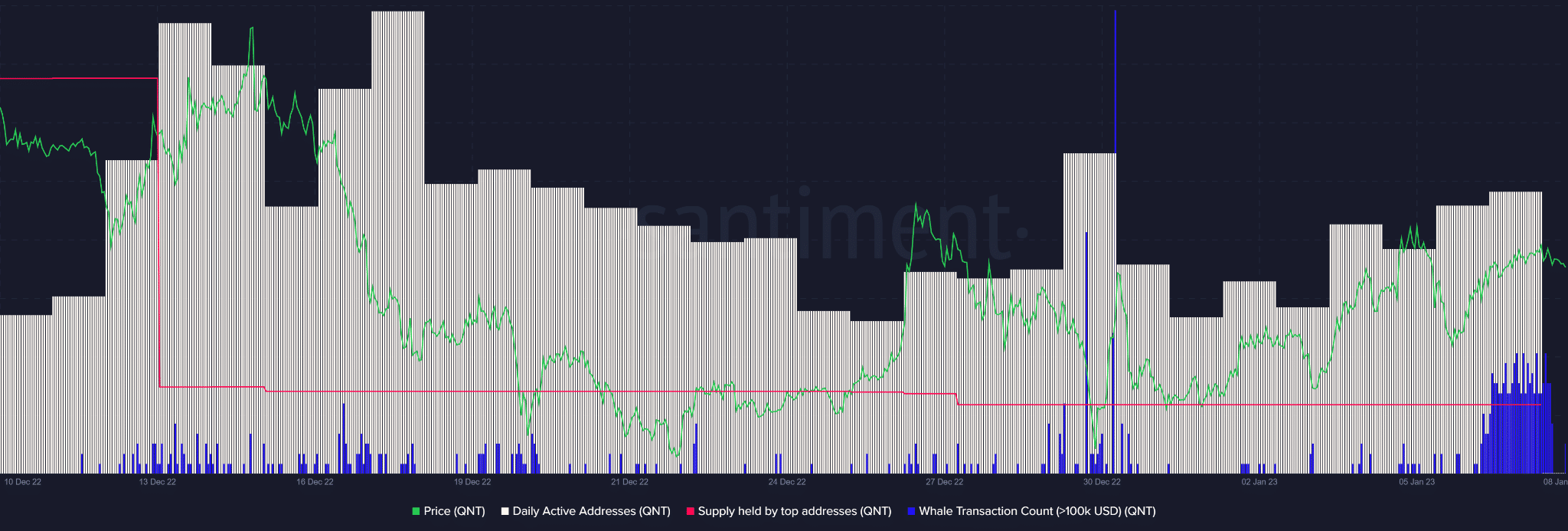

- Provide held by high addresses was unchanged regardless of a rise within the whale transaction depend.

Quant’s (QNT) value motion fashioned a double-bottom sample in latest weeks. This might have set QNT up for an uptrend, however a bearish order block at $114.4 persevered.

At press time, QNT was buying and selling at $113.2 and flashing crimson, suggesting that the bears might have already got a small maintain in the marketplace.

At press time, technical indicators urged {that a} correction may very well be probably if the bears acquire extra affect.

Learn Quant’s (QNT) Worth Prediction 2023-24

The bearish order block at $114.4: will the bears acquire extra affect, or can the bulls neutralize them?

Supply: QNT/USDT on TradingView

QNT’s late December downtrend discovered stable help at $104.4. The following rally hit a roadblock at $116.8 earlier than one other correction adopted, solely to bounce again from $104.4 once more.

The value motion fashioned a double backside sample, a typical sign of an uptrend when an asset breaks above the neckline. In QNT’s case, the neckline at $116.8 was not crossed as the value triggered a downtrend slightly below the neckline on the bearish order block at $114.4.

The RSI, OBV, and MFI confirmed downward developments, indicating a weakening shopping for strain and buying and selling quantity, reinforcing the impression {that a} distribution had taken place. This might give extra leverage to the bears and push QNT down.

QNT’s value might fall to $112.3, the 26-period EMA of 110.6, or instant help round $109.4. These can function targets for short-selling.

Alternatively, bulls might get a lift if BTC is bullish. In such a case, the bulls would induce a bearish order breaker and overcome the impediment at $114.4. Nevertheless, the bulls might solely acquire leverage if QNT breaks above the neckline of the double backside at $116.8.

Are your holdings flashing inexperienced or crimson? Examine with QNT Revenue Calculator

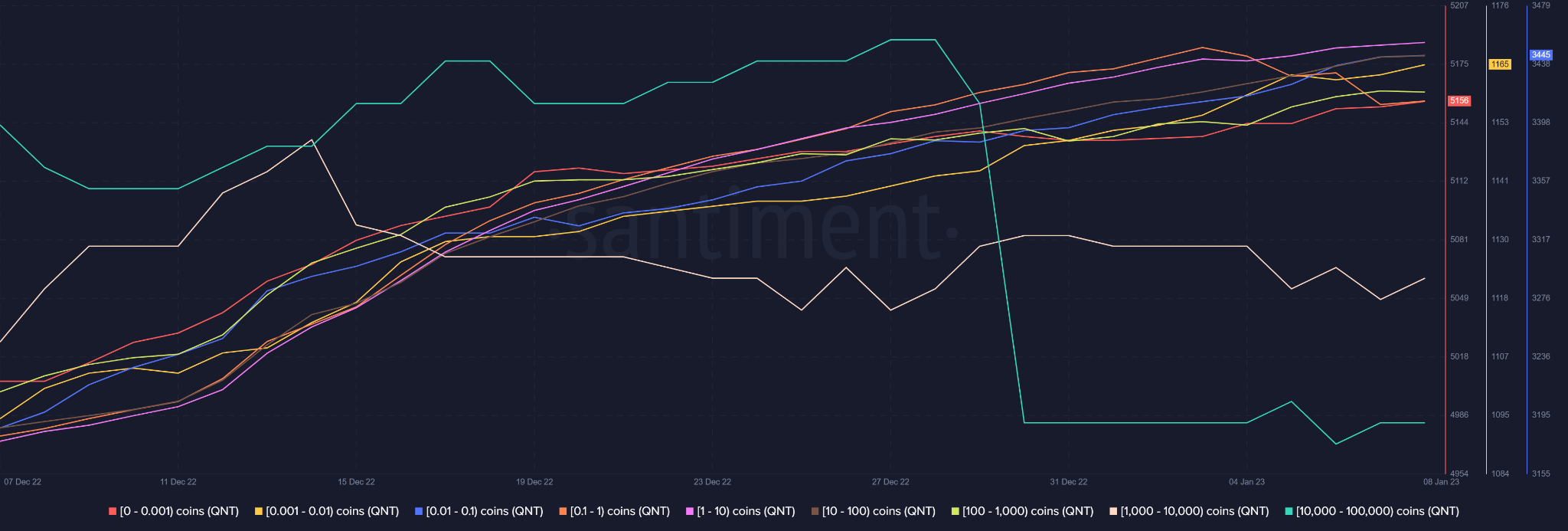

QNT noticed a rise within the variety of addresses holding 0-1000 cash, however the whale transaction depend induced a value rally

Supply: Santiment

In keeping with Santiment knowledge, QNT noticed a rise in addresses holding 0-1000 cash since mid-December final yr. Nevertheless, these having greater than 1000 cash gave up a few of their holdings.

Though the above development might point out retail investor confidence within the community, the QNT value solely rose on the finish of the yr after a pointy enhance within the whale transaction depend. After that, day by day lively addresses rose steadily, and the value elevated too.

Supply: Santiment

QNT additionally not too long ago skilled a handful of Whale transactions, which can have immediately influenced the latest value rally. As of press time, much more, Whale transaction counts had been recorded.

Nevertheless, the value of QNT has dropped barely regardless of the elevated variety of Whale transactions as of press time, which may very well be associated to a barely bearish BTC.

As well as, the provision held by high addresses has remained comparatively unchanged since late December 2022. Though this might undermine a bigger upside transfer, buyers ought to observe BTC actions earlier than taking motion on QNT.