Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- The upper timeframe market construction remained bearish.

- A bearish order block on the each day chart of Chiliz might pose a stern problem to bulls.

Chiliz has been within the grip of the bears since 21 November. It fell beneath the lows of a four-month vary in early December. From 1 December to the swing low late in the identical month, the asset had famous losses amounting to 41.8%.

Learn Chiliz Worth Prediction 2023-24

Bitcoin dithered in regards to the $16.7k space. The king of crypto has been unable to interrupt above $17k and was additionally not prepared for a plunge beneath $16.4k-$16.2k help. A transfer as much as $17.3k-$17.6k earlier than a drop was a possible situation, amongst many others.

Chiliz bulls should mood their enthusiasm with warning

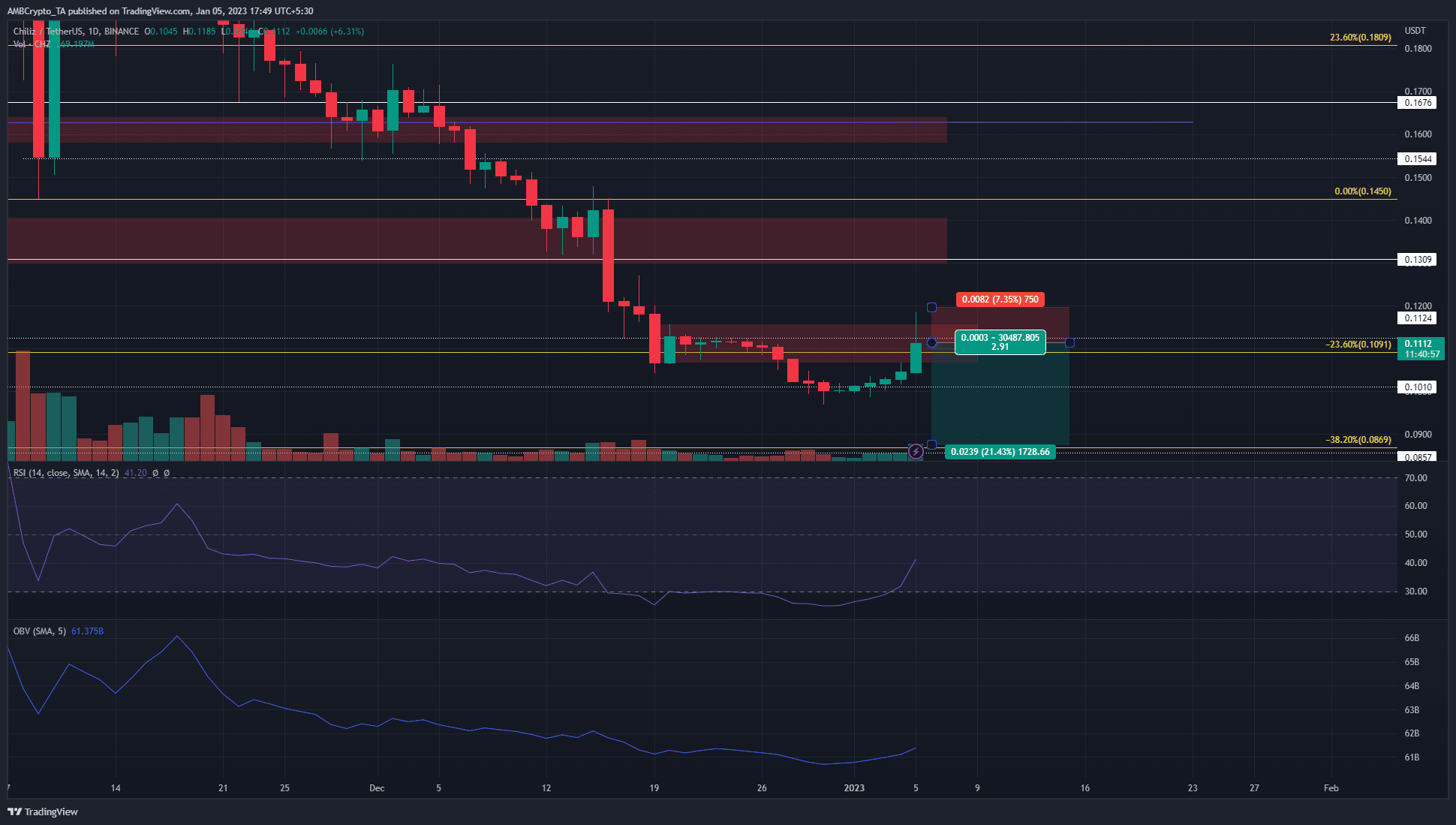

Supply: CHZ/USDT on TradingView

The development of CHZ on the upper timeframes was strongly bearish. This was evident on the charts primarily based on the collection of decrease highs and decrease lows the value has made in current months. On the newest drop, Chiliz shaped a bearish order block on the each day timeframe.

The transfer downward from $0.145 to $0.1 devastated the bulls, and in addition supplied areas of curiosity for the bears to search for shorting alternatives on a retest. One such space sat at $0.111. The transfer upward on 20 December signified an space the place the value consolidated earlier than the transfer downward.

Are your holdings in revenue? Examine the CHZ Revenue Calculator

Moreover, the previous few hours of buying and selling noticed CHZ enhance as excessive as $0.1185. In doing so, brief positions have been caught offside, and liquidity was collected. Primarily based in the marketplace construction and the bearish order block, it appeared seemingly that the short-term surge and reversal from $0.1185 was more likely to be adopted by extra losses.

Merchants can look to enter brief positions across the $0.111-$0.115 space, with a stop-loss above the swing excessive at $0.1135. To the south, bears can look to take revenue on the December low of $0.096. They’ll additionally goal the 38.2% Fibonacci extension stage at $0.086.

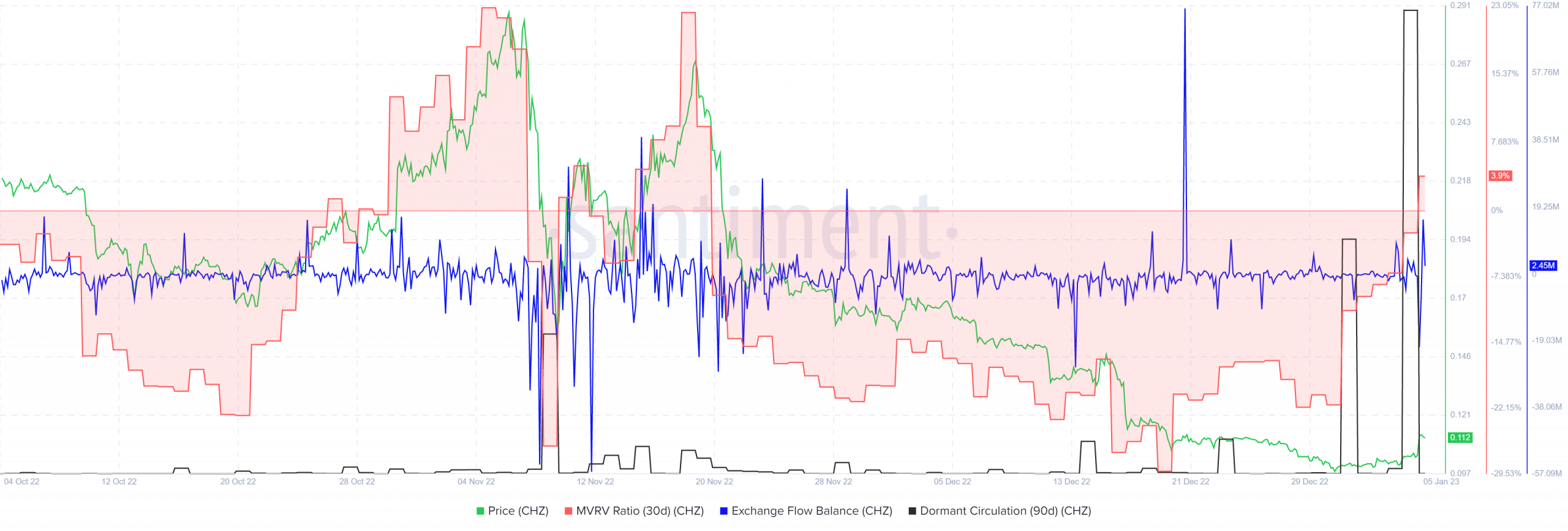

Dormant circulation wakes up after the transient upward surge, and the outcome may very well be strongly bearish

Supply: Santiment

The alternate circulate steadiness confirmed a considerable amount of CHZ withdrawals on 5 January in addition to circulate into exchanges. Total, the tokens withdrawn have been extra in quantity. On the similar time, the dormant circulation (90-day) noticed an enormous spike.

This indicated previously dormant tokens have been all of a sudden on the transfer. Contemplating the truth that we might have witnessed a liquidity hunt a number of hours earlier, the circulate of tokens into exchanges seemingly foreshadowed a big wave of promoting.

The 30-day MVRV ratio recovered above the zero mark and will climb greater. Nevertheless, it was additionally in a spot the place short-term holders will look to take income. This might add to the promoting strain.