- The PnL and NUPL metrics place steered a attainable additional decline for Bitcoin in 2023.

- Traders taking lengthy positions on BTC had been at the moment dominant.

A number of forecasts have been made about ‘when the bear market would finish,’ and normally, this coincided with a rally in Bitcoin’s [BTC] worth. A look at a number of essential measures may help level one within the appropriate method when attempting to make sense of the rumors and theories surrounding the king coin and its future transfer.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

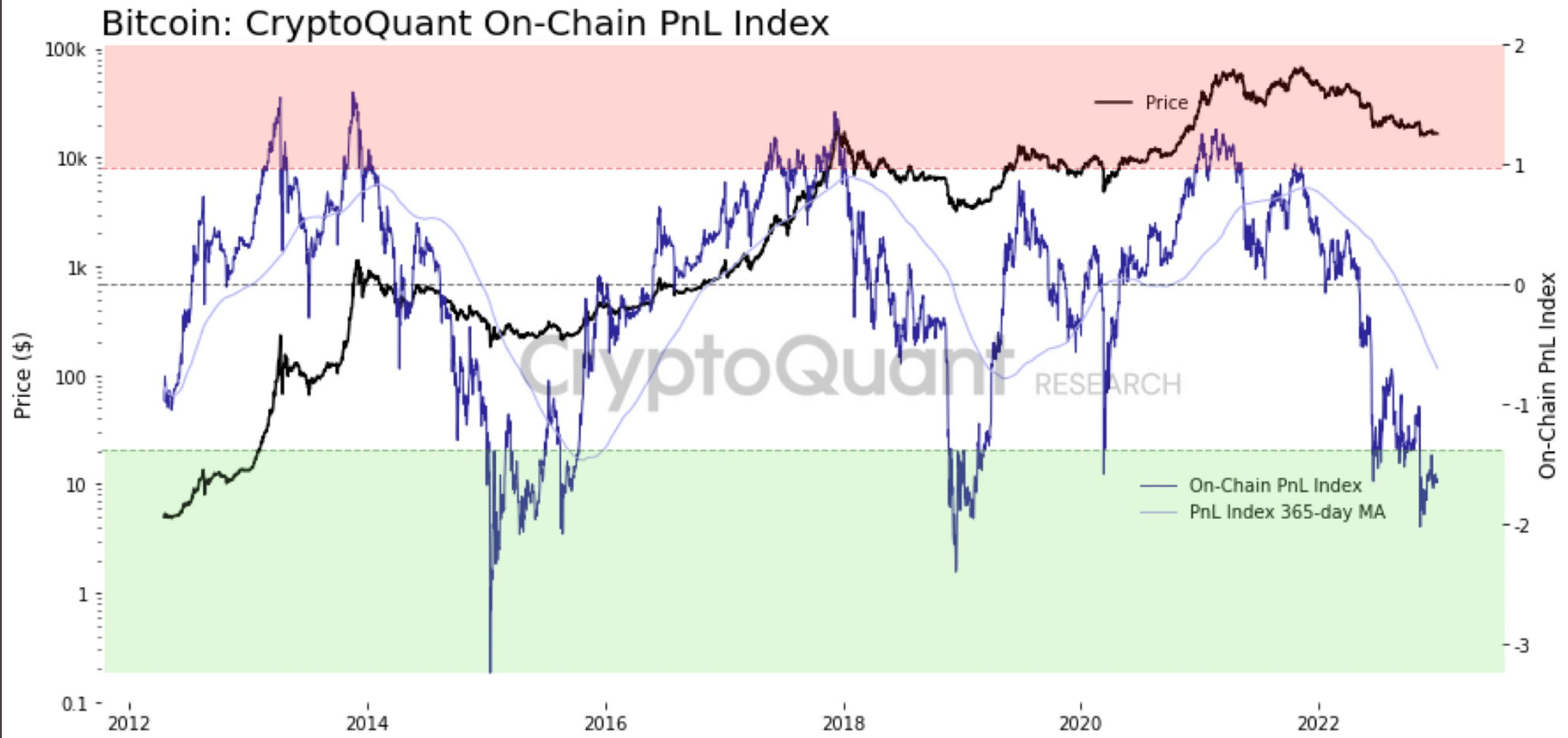

PnL Index suggests backside isn’t in

When discussing the habits of costs, the time period “backside” refers back to the level at which costs have dropped to their lowest earlier than starting to maneuver upwards once more.

There have been quite a lot of rumors and guesses about the place the underside of Bitcoin can be, and a latest post from CryptoQuant acknowledged that king coin’s backside is but to be reached.

Supply: CryptoQuant

Based on the chart of the Revenue and Loss Index (PnL), Bitcoin started the yr within the undervalued zone; nonetheless, it couldn’t cross above its 365-moving common. The position of the metrics steered that the worth of Bitcoin might proceed to say no much more.

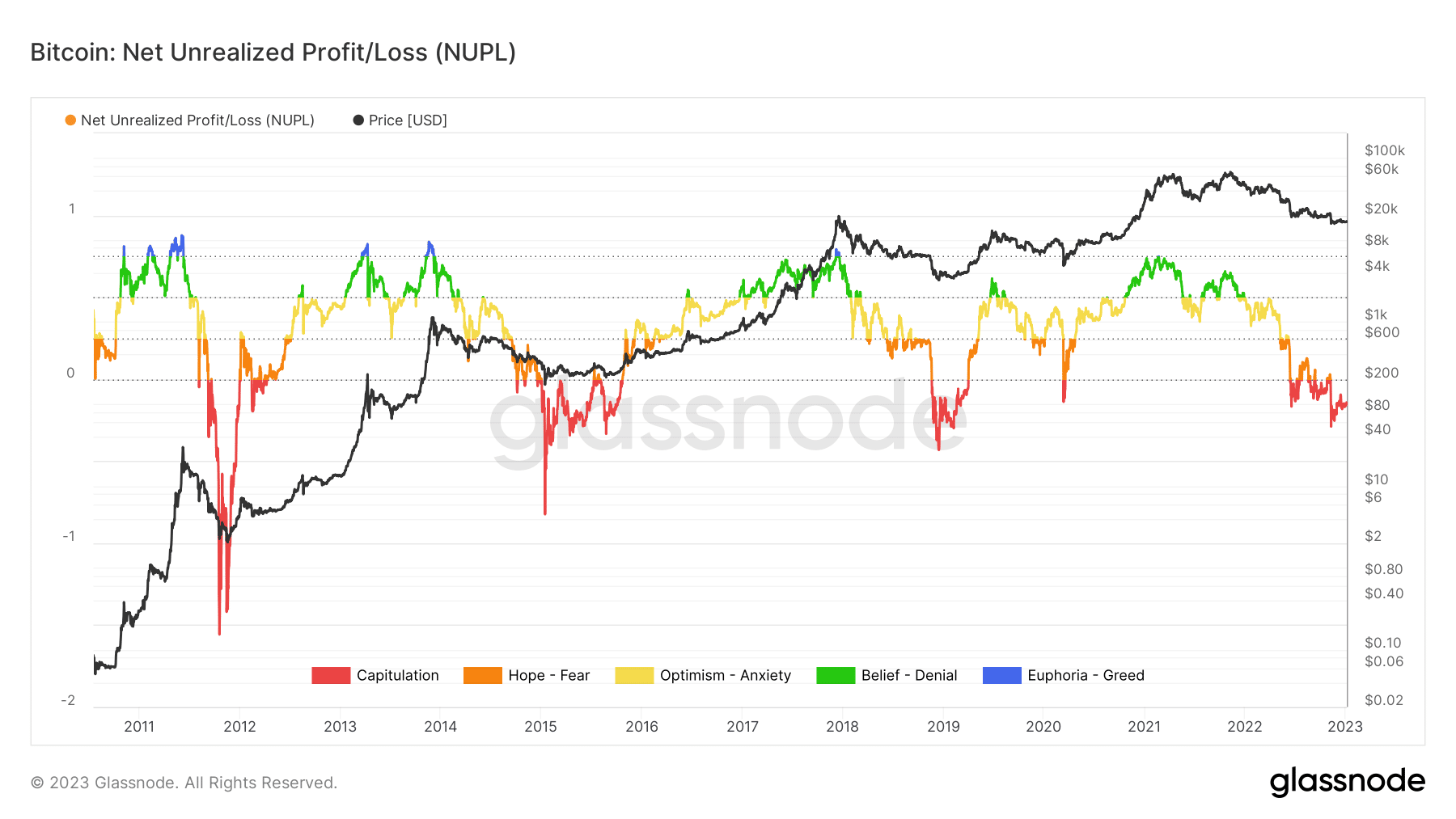

Optimistic NUPL however capitulation in play

Internet Unrealized Revenue or Loss (NUPL) is one other important indicator that is perhaps used to entry Bitcoin’s (BTC) real situation. It’s calculated by dividing the distinction between the respective unrealized good points and losses.

A damaging worth signifies a shedding market, whereas a optimistic one signifies a worthwhile one. Whether or not the market is worthwhile might be decided by wanting on the NUPL on-chain indicator.

Analyzing Glassnode’s NUPL metric revealed that the forex was beneath zero, signaling a loss in holdings.

Supply: Glassnode

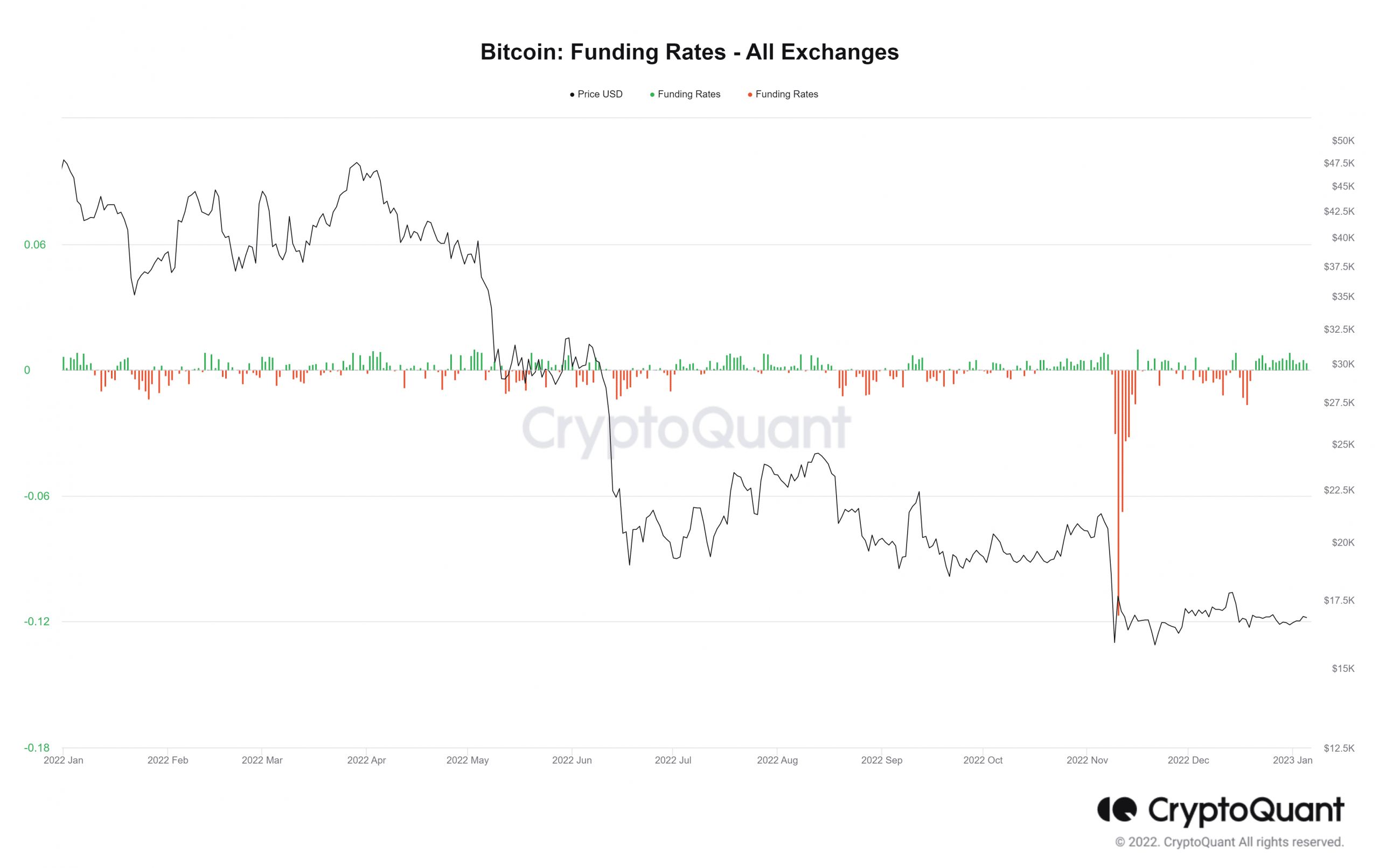

Lengthy-position buyers keep dominant

Regardless that the PnL and NUPL charts introduced what gave the impression to be a depressing view, buyers proceed to be optimistic a couple of worth improve for BTC.

The Funding fee chart on CryptoQuant indicated that the measure was optimistic. Given the place of the metrics, it was clear that buyers had been banking on a sustained improve within the worth of Bitcoin over the long term by establishing an extended place.

Supply: CryptoQuant

Are your holdings flashing inexperienced? Verify the BTC Revenue Calculator

In the case of BTC, it will seem from a look on the PnL and NUPL measures that the market is but to achieve its backside. As of this writing, the worth of the coin was hovering at about $16,000; it couldn’t stage a restoration that might enable it to return to the area round $20,000, the place it had been in prior months earlier than its decline.

However, buyers seem like optimistic a couple of worth rise sooner or later, which is all the time the case as soon as the bottoms have been established in a market.