- 1INCH’s proposal for the overall overhaul of 1INCH tokenomics and incentivized staking went stay

- 1INCH’s value motion may need a nudge from traders within the days to come back

1inch Community [1INCH] was within the limelight as soon as once more because it made it to the list of the highest 6 Optimism dApps in 2022. These dApps are measured by their variety of transactions and costs generated.

Not solely that, however a serious proposal for the overall overhaul of 1INCH tokenomics and incentivized staking went stay just lately.

1/ 📊 [1IP-11] #1inch Staking Pods

A serious proposal for the overall overhaul of $1INCH tokenomics and incentivized #staking is stay!

We invite you to solid your vote for the implementation of a brand new Staking Pod mechanic for the 🪙 1INCH token.

📃 https://t.co/u9aiOorpEh#DeFi pic.twitter.com/e2hSSHij1T

— 1inch Community (@1inch) December 19, 2022

Learn 1INCH’s Worth Prediction 2023-24

This was an optimistic announcement because it introduced a number of new options with it. As an example, with the Staking Pod system, customers can lock their 1INCH tokens in a staking contract to get st1INCH tokens.

Curiously, the longer the lock interval, the extra st1INCH tokens the consumer will get. Stakers can use st1INCH tokens for 1inch DAO governance, and the 1inch DAO can use these token balances for reward distribution.

The excellent news was that quickly after this, 1INCH additionally turned one of many prime gainers within the Avalanche ecosystem within the final 24-hours.

Prime Gainers in @Avalancheavax Ecosystem Final 24H 🚀🚀$CQT @covalent_hq $STG @StargateFinance$GMX @GMX_IO $SYN @SynapseProtocol $MULTI @MultichainOrg $SURE @InsureToken $AAVE @AaveAave $YFI @iearnfinance

$1INCH @1inch $CTSI @cartesiproject #avalanche $AVAX pic.twitter.com/Tvw3BpzCTP— AVAX Each day 🔺 (@AVAXDaily) December 20, 2022

Is every thing going effectively?

Although 1INCH was one of many prime gainers within the Avalanche ecosystem, its weekly value motion was not at par. In accordance with CoinMarketCap knowledge, the value of 1INCH has dropped practically 10% within the final week.

Moreover, on the time of writing, it was buying and selling at $0.3989 with a market capitalization of greater than $305 million. Let’s take a look at 1INCH’s on-chain metrics to seek out out what was really occurring.

What number of 1INCH’s are you able to get for $1?

In accordance with CryptoQuant’s data, 1INCH’s trade netflow was excessive as in comparison with the previous seven days. This may very well be thought of as a bearish sign because it indicated increased promoting stress. The full variety of transactions additionally registered a lower, reflecting a decrease variety of customers within the community.

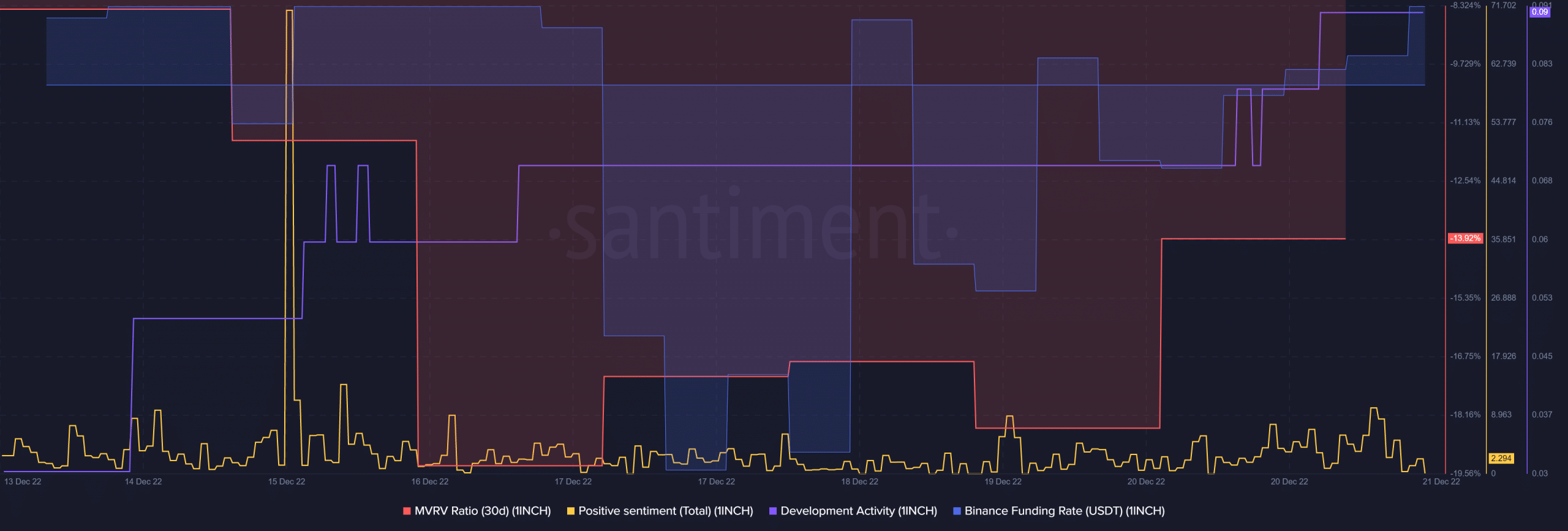

Other than that, the metrics seemed constructive for 1INCH because the community’s constructive sentiment spiked final week. Moreover, 1INCH’s Market Worth to Realized Worth (MVRV) Ratio additionally registered a slight spike.

The community’s growth exercise and Binance funding charge additionally went up just lately, which additional offered hope to the traders.

Supply: Santiment

The place’s the hazard?

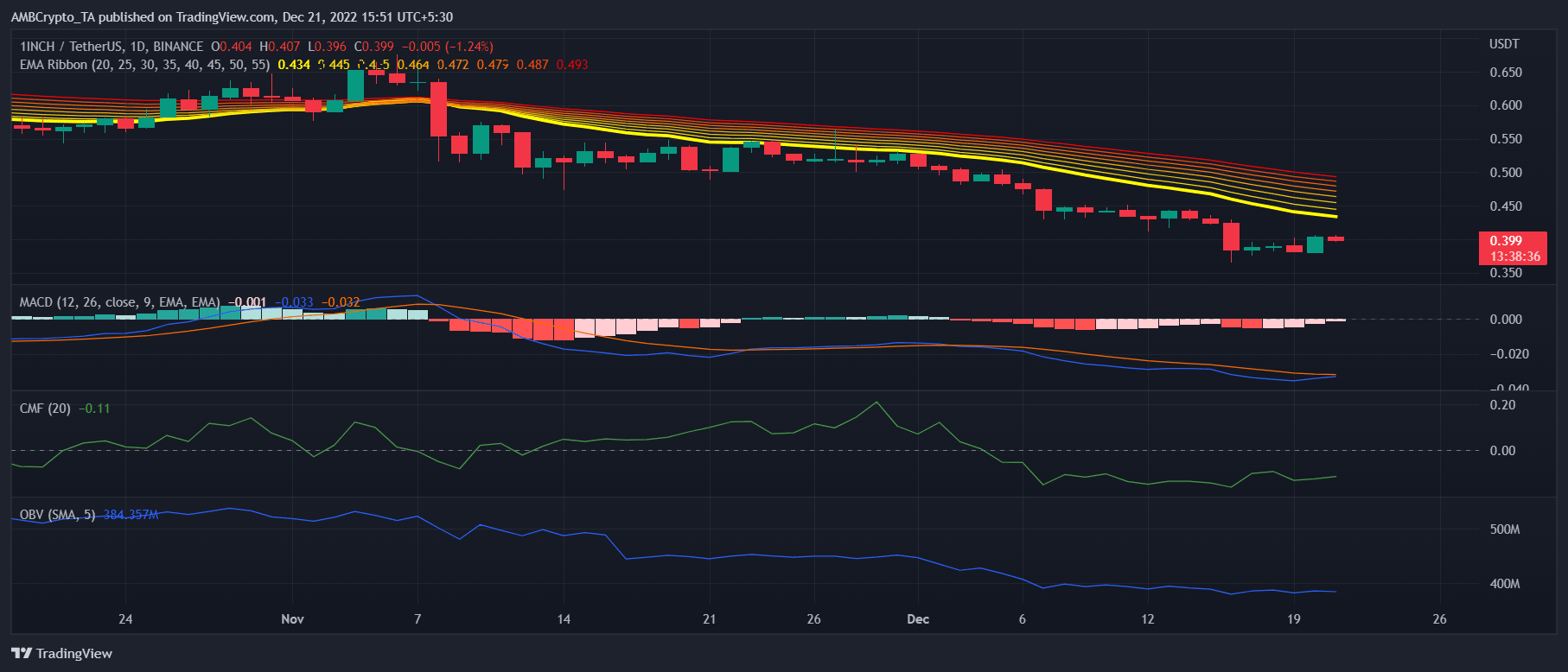

Fairly the opposite to most metrics, 1INCH’s day by day chart steered that the bears had been controlling the market. 1INCH’s Chaikin Cash Circulation (CMF) and On Steadiness Quantity (OBV) had been significantly low, proving a bearish benefit.

The Exponential Shifting Common (EMA) Ribbon additionally instructed an analogous story. The 20-day EMA was resting under the 55-day EMA. Nonetheless, the Shifting Common Convergence Divergence (MACD) offered the much-needed aid because it displayed the opportunity of a bullish crossover. Thus, this might assist 1INCH enhance its worth within the days to come back.

Supply: TradingView