- Curve Finance introduced new additions to its liquidity swimming pools and safeguarded customers holding ren-based property

- Regardless of developments, quantity on its protocol and curiosity within the CRV token decreased

Curve Finance’s [CRV] new announcement on 18 December revealed that it will add WBTC, sBTC, and multiBTC liquidity swimming pools to its protocol. multiBTC is a Bitcoin [BTC] asset cross-chained from Bitcoin to Ethereum [ETH] via the cross-chain router protocol, Multichain.

Curve introduced the addition of a multiBTC/WBTC/sBTC pool, and launched a proposal vote for including liquidity incentives to the pool. multiBTC is a Bitcoin asset cross-chained from Bitcoin to Ethereum via Multichain.https://t.co/zG4iJ7kXKq

— Wu Blockchain (@WuBlockchain) December 18, 2022

Learn Curve Finance’s [CRV] Worth Prediction 2023-24

Curve Finance pronounces main replace

Including to those developments, Curve additionally introduced that renBTC holders may swap their property with wBTC for a 1.5% bonus. This was as a result of previous Bitcoin swimming pools on the Curve protocol, which contained renBTC, can be shutting down quickly. The explanation for that is the truth that Ren Protocol, the protocol behind renBTC, can be updating its community.

This replace was a results of Ren Protocol’s publicity to Almeda. After this replace happens and the Ren Community switches to Ren Community 2.0, the holders of ren-based property may doubtlessly lose all their holdings.

In the event you nonetheless have renBTC someplace, you possibly can swap it to wbtc as an alternative of redeeming and get a pleasant 1.5% bonus pic.twitter.com/vBuJ3isH1q

— Curve Finance (@CurveFinance) December 18, 2022

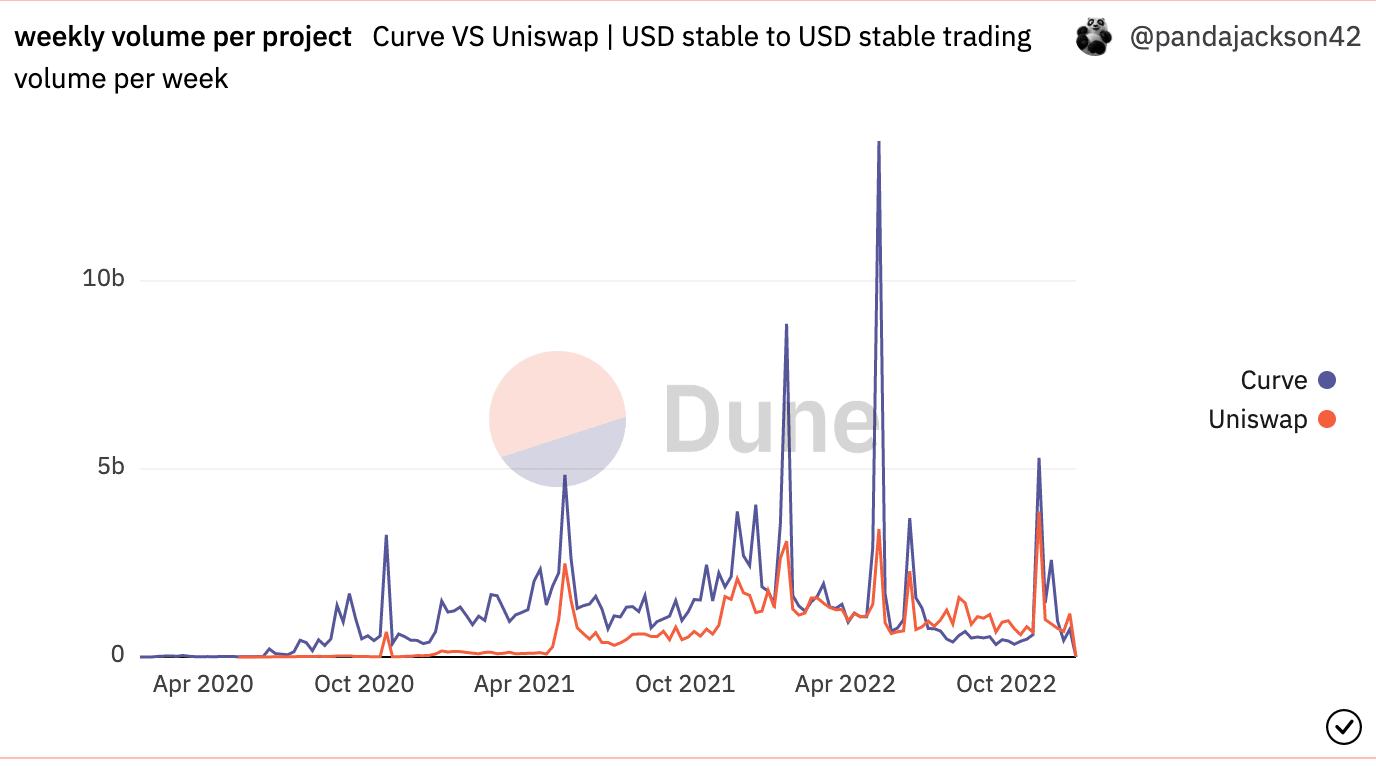

Regardless of Curve Finance’s growing user-centric developments and new additions, the protocol’s buying and selling quantity continued to say no, in comparison with different DEXes.

Based on knowledge offered by Dune Analytics, each Curve and Uniswap noticed their weekly quantity lower. On account of these declining buying and selling volumes, DEX’s similar to Uniswap [UNI] out-competed Curve by way of quantity.

On the time of writing, Curve Finance’s weekly quantity was 1.48 million, whereas Uniswap’s quantity amounted to eight.83 million.

Supply: Dune Analytics

Nonetheless, buying and selling quantity wasn’t the one space the place Curve Finance’s progress faltered. Its TVL was additionally impacted over the course of the previous few months.

Primarily based on the knowledge offered by DefiLlama, the TVL collected by Curve Finance was at $5.91 billion on 7 November, and plummeted to $3.69 billion at press time.

Supply: DefiLlama

State of the token

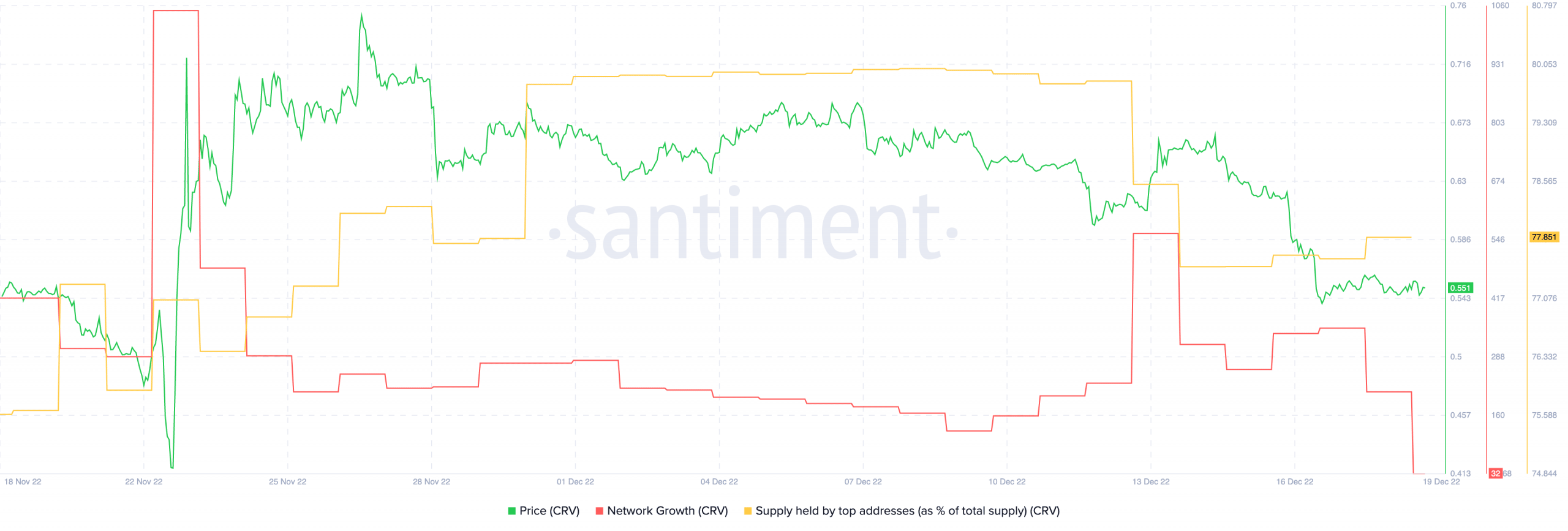

These developments had a adverse influence on the CRV token.

Based on knowledge offered by Santiment, CRV’s community progress decreased considerably over the previous week. This indicated that the variety of new addresses transferring CRV for the primary time had declined.

Coupled with that, massive addresses misplaced the CRV token as effectively. As evidenced by the chart beneath, the share of the variety of prime addresses holding CRV fell throughout this era.

Supply: Santiment

On the time of writing, CRV was buying and selling at $0.552. Its worth had fallen by 0.66% within the final 24 hours, based on CoinMarketCap.