- Litecoin seems to be a most well-liked mode of cost for BitPay customers.

- The studying of LTC’s MVRV ratio might put some stress on long-term holders.

In line with a latest update by Litecoin, it was revealed that LTC was probably the most most well-liked types of cost amongst different main cryptocurrencies.

Learn Litecoin’s Value Prediction 2023-2024

Reportedly, Litecoin transactions on BitPay (a cost processor) had elevated considerably. The variety of transactions represented 27.64% of the whole variety of transactions being made on the platform.

Litecoin managed to outperform different well-liked cryptocurrencies reminiscent of Ethereum, Doge, and XRP on this regard. Nevertheless, it couldn’t surpass Bitcoin because the king coin was liable for 41.62% of the general transactions being made on the platform.

That mentioned, by way of mining, Litecoin proved to be extraordinarily worthwhile for miners, because it supplied a profitability charge of 58%, in line with CryptoCompare.

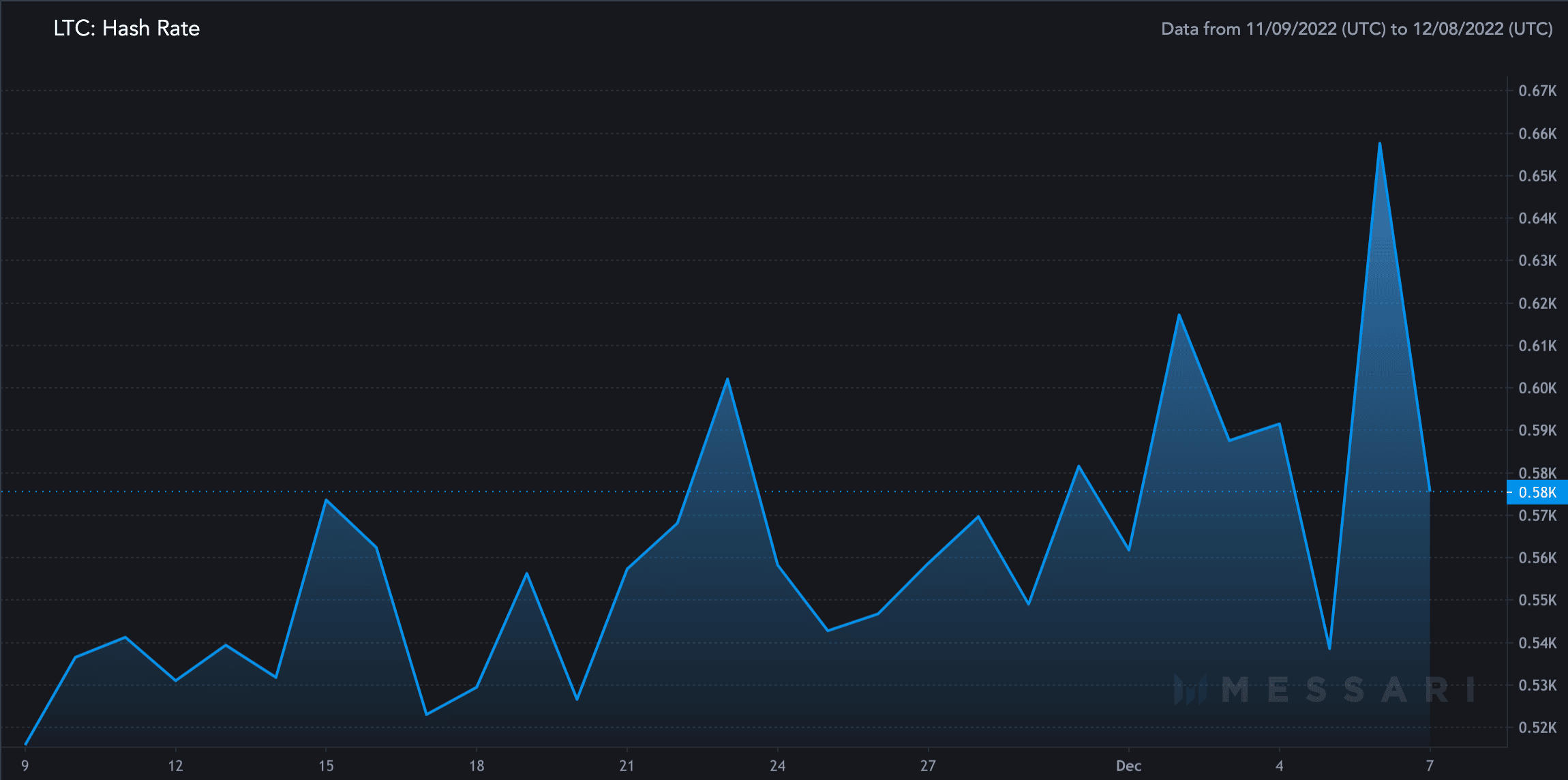

Its hash charge elevated over the previous month as will be seen from the picture beneath. During the last 30 days, Litecoin’s hashrate grew by 3.05%. An rising hash charge signifies that the safety and stability of the community have strengthened.

Nevertheless, it additionally means that extra vitality could be required to mine Litecoin.

Supply: Messari

These components might have performed a component in LTC’s progress within the ongoing bear market.

After 23 November, Litecoin witnessed a surge of 33.46% in its costs. Following that the altcoin was noticed to be buying and selling inside the vary of $83.63 and $70.60.

After testing the $84.45 resistance stage, Litecoin’s costs began to descend. Its RSI which was at 38.40, at press time, indicated that the momentum was with the sellers.

Its CMF was at -0.06, throughout press time which additionally instructed a bearish outlook for LTC. Thus, implying that there was a chance of the alt going to 70.40 but once more.

Supply: Buying and selling View

To promote or to not promote

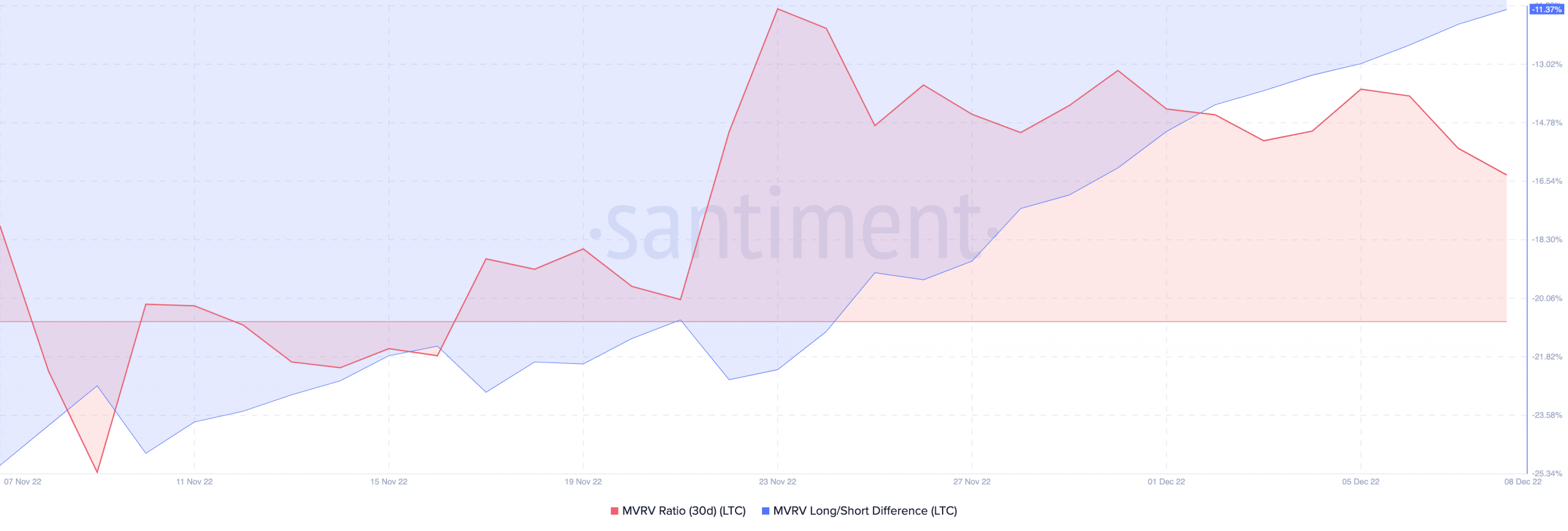

Litecoin’s MVRV ratio has grown considerably after 20 November. A excessive MVRV ratio instructed that the majority Litecoin holders would make a revenue in the event that they ended up promoting their LTC.

Nevertheless, the rising MVRV Lengthy/Brief distinction implied that it’s largely long-term Litecoin holders that will revenue from promoting their holdings.

Regardless that there may be an incentive for long-term LTC holders to promote their holdings for a revenue, they’re resorting to HODLing as an alternative. And, surprisingly, the sort of habits is being exhibited by short-term merchants.

Supply: Santiment

![Litecoin [LTC] outcompetes other major cryptocurrencies in this area](https://cryptonitenews.io/wp-content/uploads/2022/12/mario-dobelmann-RCU_nX9Qf8Y-unsplash-1000x600-768x461.jpg)