- 1INCH finds favor with ETH whales in keeping with WhaleStats.

- Evaluating the potential for a bounce from the oversold zone.

Crypto buyers are wanting into potential alternatives now that 2022 is sort of at its conclusion. 1INCH matches the invoice as one of many tokens which are at the moment displaying promise for a bullish restoration.

Learn 1INCH’s worth prediction 2023-2024

To this point there are a number of indicators indicating that 1INCH bulls may be about to regain management. Amongst these is a latest WhaleStats alert revealing that 1INCH was among the many prime 10 tokens by buying and selling quantity among the many 1000 greatest ETH whales. That is based mostly on its efficiency within the final 24 hours on the time of the statement.

JUST IN: #1INCH @1inch now on prime 10 by buying and selling quantity amongst 1000 greatest #ETH whales within the final 24hrs 🐳

Peep the highest 100 whales right here: https://t.co/jFn1zIOq03

(and hodl $BBW to see information for the highest 1000!)#1INCH #whalestats #babywhale #BBW pic.twitter.com/PqoHeCQ273

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 22, 2022

Are your 1INCH holdings flashing inexperienced? Verify the revenue calculator

1INCH sees a gradual return of shopping for stress

The WhaleStats statement urged that 1INCH may be about to expertise extra volatility. Increased volumes fueled by ETH whales could set off larger worth actions. The timing of those observations may additionally decide the next worth route of the token.

Supply: TradingView

The surge in whale volumes occurred proper across the similar time when 1INCH was recovering from the oversold zone. This was additionally accompanied by an upsurge within the Cash Move indicator, which urged that there was important accumulation in the previous few days.

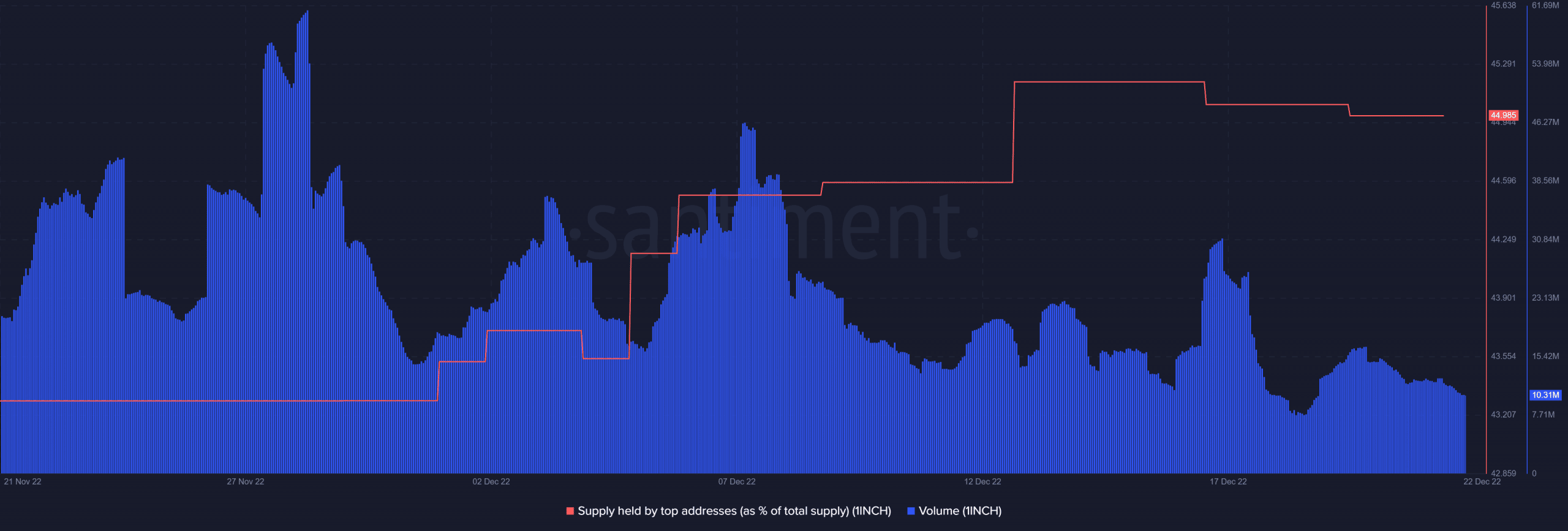

Regardless of these observations and the WhaleStats report, the ETH whale quantity has thus far not been sufficient to set off a major rise in on-chain quantity. This implies there won’t sufficient purchase stress for a serious uptick.

Supply: Santiment

One other contradicting metric is the availability held by prime addresses which has been declining since mid-month. It is a signal that the highest addresses have been contributing to promoting stress for greater than per week.

However, the identical metric confirmed sturdy accumulation between the final week of November and the primary week of December.

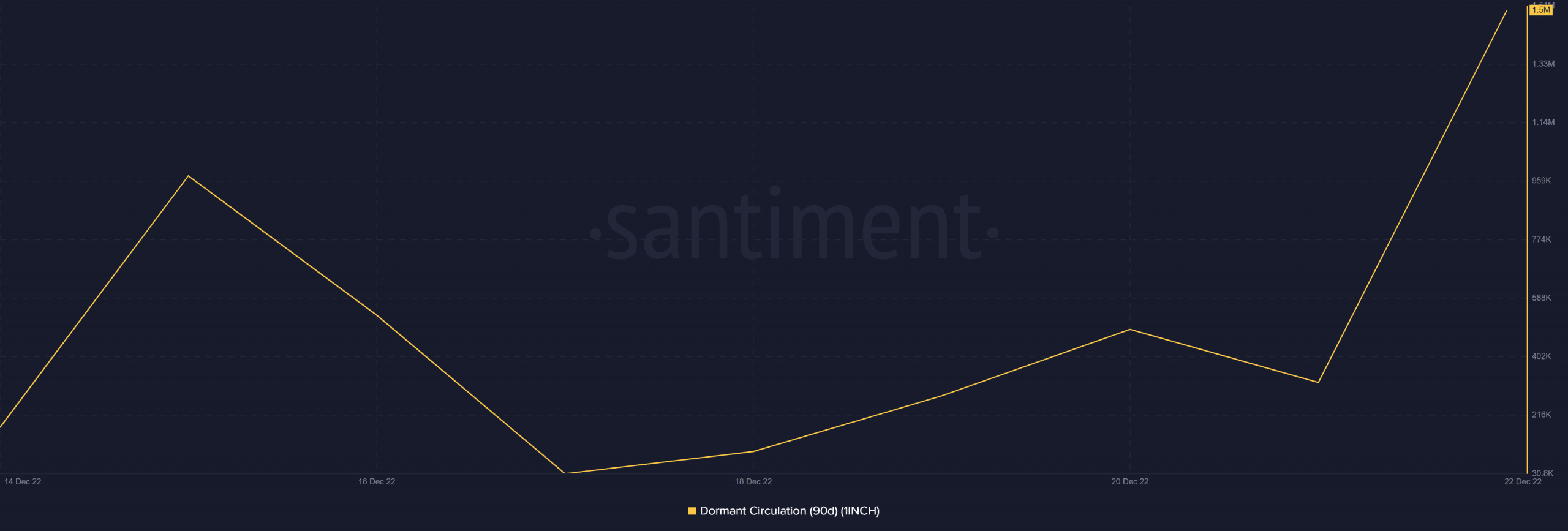

Alternatively, there are observations that affirm that there’s wholesome accumulation. For instance, the dormant circulation metric is up considerably, particularly within the final seven days.

Supply: Santiment

That mentioned, there may be nonetheless some promoting stress out there. Particularly from addresses holding between 10,000 and 100,000 tokens.

A lot of the above metrics overwhelmingly lean on the bullish aspect. This strengthens the bullish expectations as 1INCH recovers from oversold circumstances.